Have you ever wondered how public cybersecurity companies are performing in real time? Well, wonder no more!

Here is a dynamic market tracker with the latest updates on the market performance and funding data of public cybersecurity firms. It is updated automatically every two hours with publicly available market data, and I always add more context to it.

While I have personally spent many hours and much of my own money collecting, refining, and validating this data, I am making it a free resource. This database view shares detailed information on publicly available funding and market data from public cybersecurity companies, combined with Return on Security’s own product categories and designations between “Hybrid” and “Pure Play” companies.

My goal?

Transparency and utility for everyone in the cybersecurity field.

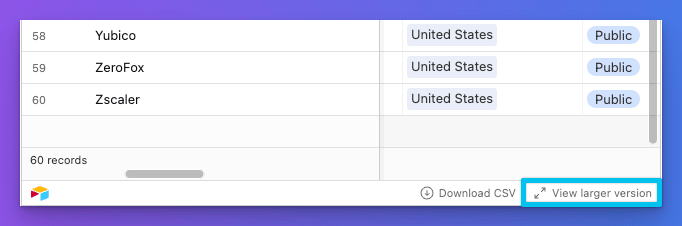

This interactive list includes up-to-date information on current public companies, those delisted or shut down, and firms taken private via M&A. You can easily play around with the data in Airtable with or without an account!

To make this table wider, click “View larger version” at the bottom of the embedded table

This pops you out to the direct Airtable link

Pure Play vs. Hybrid

For reference, here is how I am defining “pure play” vs. “hybrid” cybersecurity companies

Pure Play - A “pure play” cybersecurity company is a specialist company that dedicates everything it does to cybersecurity. It does not dabble in things outside of this space, and its whole business revolves around creating and providing cybersecurity products, services, and solutions. Companies with this designation are easy to tell apart from others. CrowdStrike is a great example here.

Hybrid - A “hybrid” company offers a broader range of products and services, not just cybersecurity ones. It might also provide technology solutions that are closely aligned with cybersecurity. Cloudflare is a great example. Companies with this designation are the subject of much debate.

For the sake of this list, I am excluding hyper-scale cloud companies like Microsoft, AWS, Google, IBM, etc. While they all have thriving cybersecurity businesses, cybersecurity is not their main focus, and “the line” has to be drawn somewhere.

Tech Eras Over Time

Here is a key to help understand the different technology eras over time and how they are commonly referred to:

| Year Range | Period Description |

|---|---|

| Before 1991 | Pre-Internet Era |

| 1991 - 1994 | Early Internet Era |

| 1995 - 2002 | Dotcom Bubble |

| 2003 - 2009 | Post-Dotcom Bubble to Great Recession |

| 2010 - 2011 | Recovery and Digital Expansion |

| 2012 - 2020 | High-Burn / High-Growth |

| 2021 - 2022 | High-Burn / Slowing-Growth |

| 2023 - 2024 | Expense Management |

| 2025 - ??? | The Uncertainty Era |

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our own system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who's in, how much they're giving, or the deal stage, might get updated after we first share the news.

If you spot any errors, let us know, and we’ll fix them.