Hey there,

Happy Monday, and I hope you had a great weekend. In this week’s issue, we’ve got:

🏀 Funding Bounces Back

🍦 Life Can Come At You Fast

🎉 A Surge in M&A Acquisitions

📘 From SEC Filing Tactics to AI Challenges

Growth stage rounds, which often take shape in the form of Series B or Series C rounds, have been notably absent from the cyber funding landscape in 2023. What had, in large part, driven massive funding dollars in 2022 and 2021 to cyber companies has barely made a dent in 2023. That’s starting to change though, with some late Q4 growth round deals entering in with the force of the Wu-Tang Clan coming up from the 36 Chambers.

To me, this is a sign of rebounding for the cyber industry. Maybe not all the way up to “we are so back” levels yet, but definitely on the right trajectory.

Also, life can come at you fast.

One day you're a fast-growing IT and cyber managed service business killing it in the mid-west, and then the next day you get bought out by a booze and ice cream company (not a bad combo 👀). As you’ll see below, more companies outside of the cyber realm are getting into the cyber arena.

(if you understand the subject line reference, we are now legally best friends)

Onward to this week's issue.

🗣Sponsor

Low-code workflow automation platform for SecOps

Tired of time-consuming SOAR and TIP processes?

Try n8n and save tens of hours every week. Empower your analysts to focus on genuine threats, reduce operational costs, and join security teams globally enjoying the benefits of n8n.

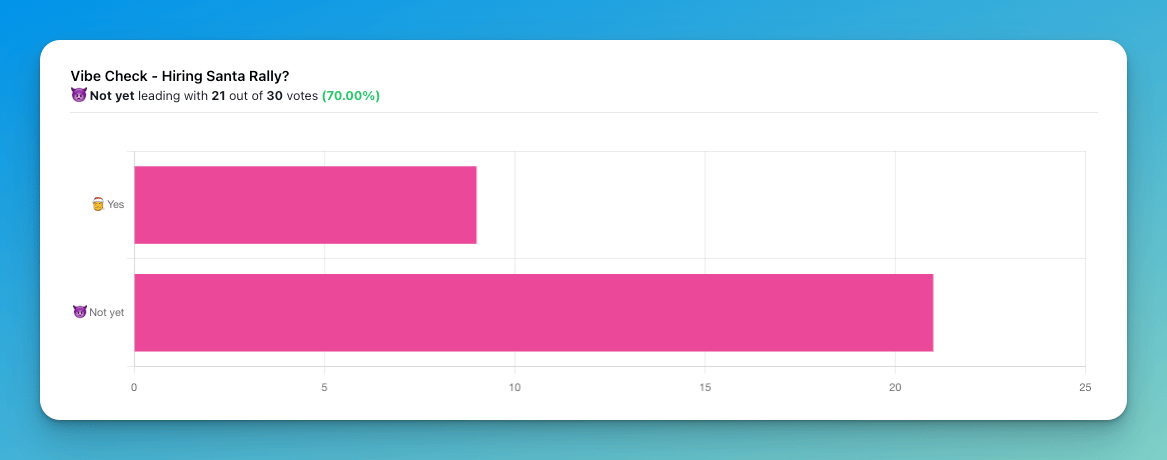

Vibe Check - OpenAI Shuffle

Last week’s vibe check:

Has hiring for cybersecurity talent rebounded for your company yet?

Cyber has always been a tale of the “haves” and the “have-nots.” While an overwhelming majority say they are not seeing the talent pipeline floodgates being opened yet, some still managed to catch a wave and bring talent in. One commenter saw a boon, stating they “hired six appsec people in the last two months.” 😲

🔮 Earnings Reports

A section for notable earnings reports from public cybersecurity companies, be they “pure play” or hybrid companies.

Click the link to read the full issue on the website.

Palo Alto Networks ($PANW) - Palo Alto had a mixed reception from investors following its recent earnings call. Despite beating revenue expectations and boasting its highest cash collection quarter ever, the company wasn’t immune to the broader economic challenges.

Customers have been opting for shorter-duration deals and looking for ways to defer payments, indicating caution in spending due to macroeconomic concerns and high-interest rates. This trend was reflected in some variability in total billings, even with various financing options offered by Palo Alto.

Still, the company remains confident, and not overly concerned about customer churn, which is a testament to its strong market position. Maintaining its aggressive strategy, Palo Alto plans to continue its significant M&A activities, budgeting around $1.0B per year.

📸 YTD Snapshot

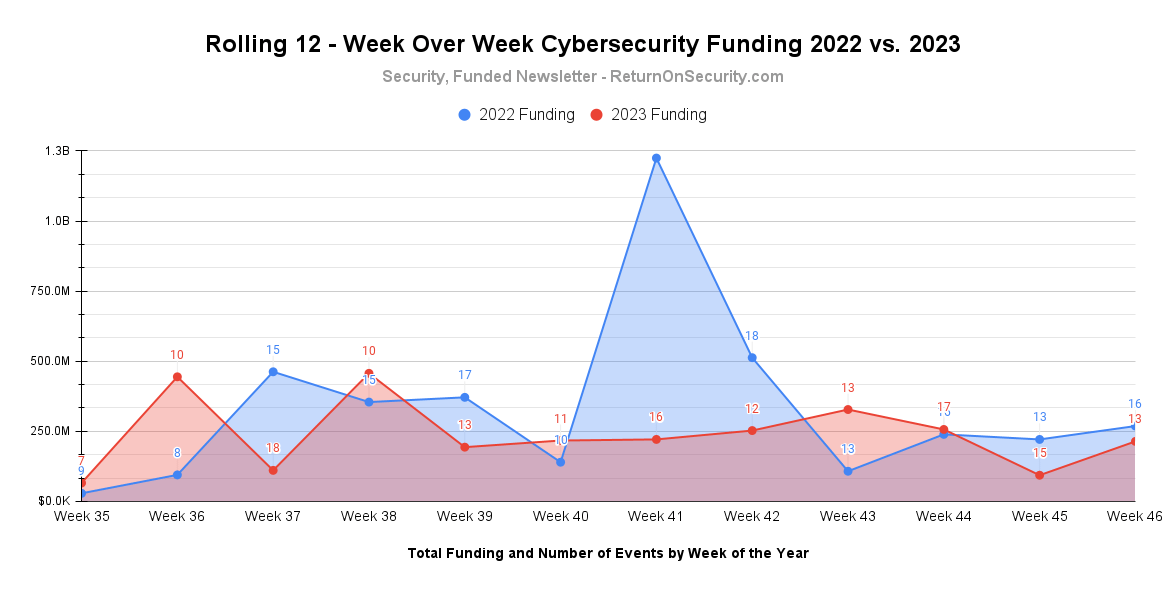

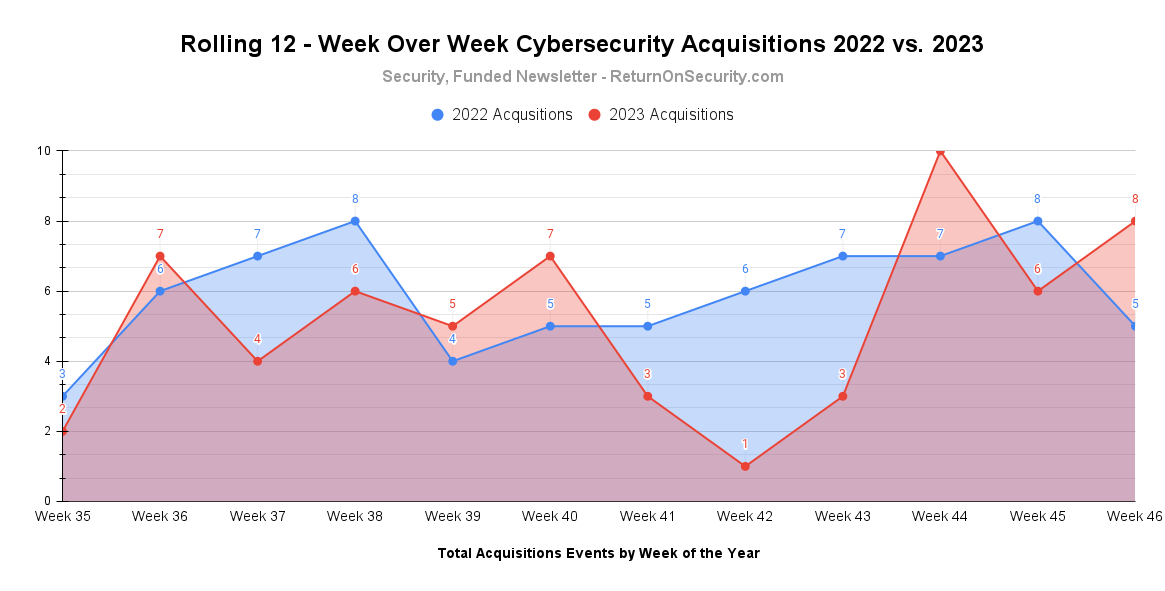

A rolling 12-week chart to compare funding and acquisitions each week between 2022 and 2023.

A healthy week of rebounding on the funding scene last week after a much smaller-than-normal funding total the week prior. And with last week, cybersecurity deals have hit nearly $12.0B for the year or down ~38% YoY.

The party continues on the acquisition front with more and more details zipping in at the end of the year. Acquisitions for 2023 are currently just shy ~11% YoY.

💰 Funding Summary

13 companies raised $214.2M across 11 unique product categories

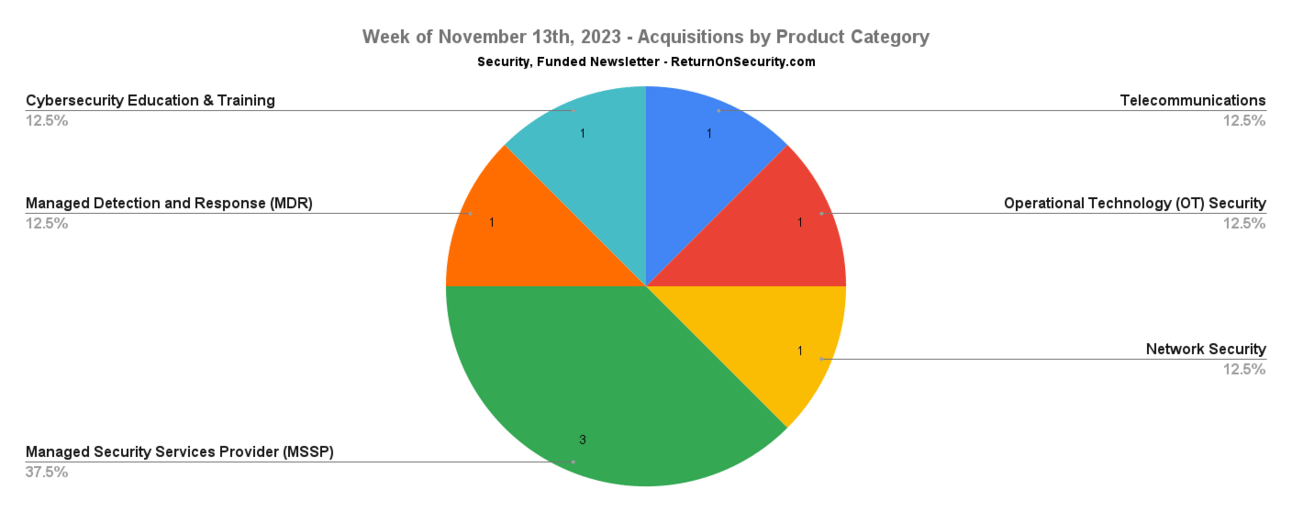

8 companies were acquired or had a merger event across 6 unique product categories

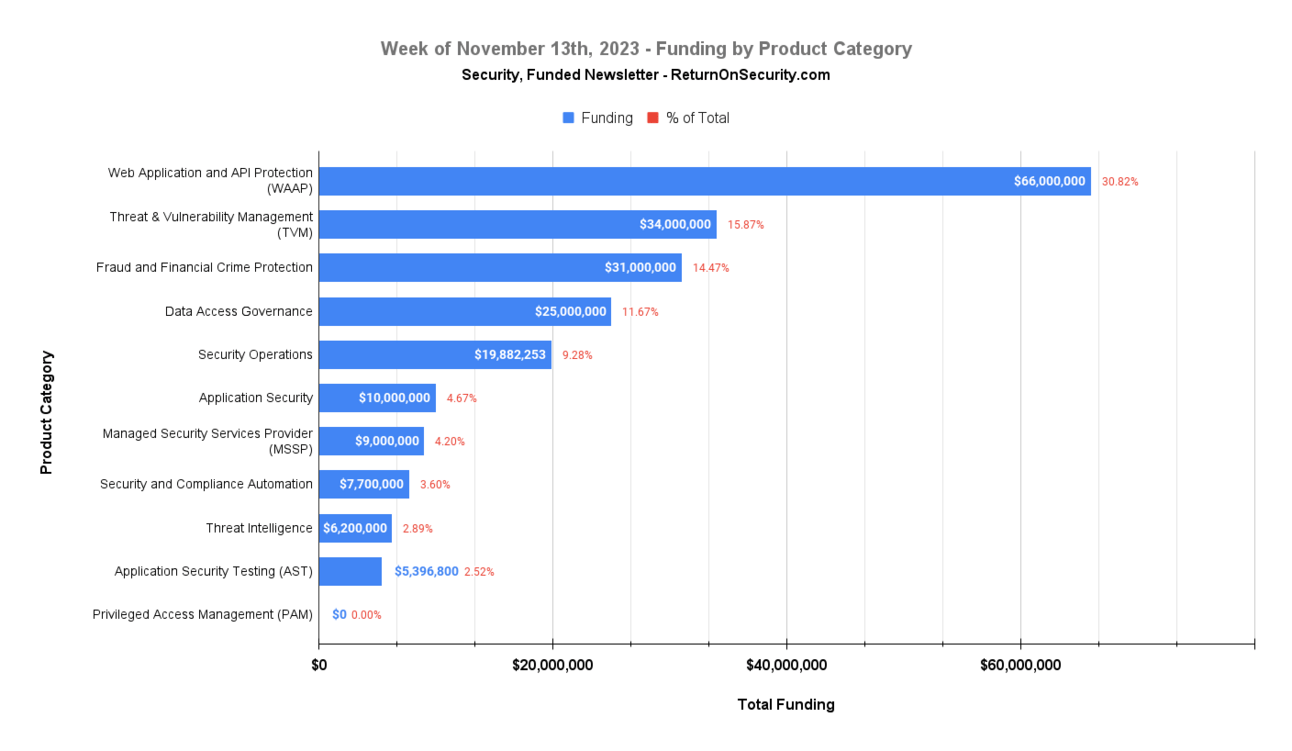

🧩 Funding By Product Category

$66.0M for Web Application and API Protection (WAAP) across 1 deal

$34.0M for Threat & Vulnerability Management (TVM) across 1 deal

$31.0M for Fraud and Financial Crime Protection across 2 deals

$25.0M for Data Access Governance across 1 deal

$19.9M for Security Operations across 2 deals

$10.0M for Application Security across 1 deal

$9.0M for Managed Security Services Provider (MSSP) across 1 deal

$7.7M for Security and Compliance Automation across 1 deal

$6.2M for Threat Intelligence across 1 deal

$5.4M for Application Security Testing (AST) across 1 deal

An undisclosed amount for Privileged Access Management (PAM) across 1 deal

🏢 Funding By Company

Edgio, a United States-based web application and API protection (WAAP) platform, raised $66.0M in post-IPO debt from Lynrock Lake LP. (more)

Vulcan Cyber, an Israel-based vulnerability remediation and risk management platform, raised a $34.0M Series B from Maor Investments and Ten Eleven Ventures. (more)

Lynx, a United Kingdom-based AI and ML-driven fraud and financial crime protection platform, raised an $18.0M Series A from Forgepoint Capital and Banco Santander. (more)

Radiant Security, a United States-based AI-agent-enabled security operations center support platform, raised a $15.0M Series A from Next47. (more)

Refine Intelligence, an Israel-based AI and ML-driven fraud and financial crime protection platform, raised a $13.0M Seed from Fin Capital. (more)

AppMap, a United States-based run-time code security and observability platform, raised a $10.0M Venture Round from Work Bench Ventures, Forgepoint Capital, and Venture Guides. (more)

RADICL Defense, a United States-based managed security services provider (MSSP) for small to medium businesses (SMB), raised a $9.0M Seed from Paladin Capital Group. (more)

Zip Security, a United States-based security and compliance automation platform for small businesses, raised a $7.7M Venture Round from General Catalyst and Human Capital. (more)

Cyble, a United States-based AI-powered platform for darkweb and cybercrime monitoring, raised a $6.2M Series B from Summit Peak Investments. (more)

Aikido Security, a Belgium-based application security testing platform, raised a $5.4M Seed from Connect Ventures and Notion Capital. (more)

Qevlar AI, a France-based AI-agent-enabled security operations center support platform, raised a $4.9M Seed from EQT Ventures. (more)

SGNL, a United States-based privileged access management (PAM) platform focused on just-in-time (JIT) access, raised an undisclosed Venture Round from Costanoa Ventures, Fika Ventures, Moonshots Capital, Resolute Ventures, and Cisco Investments. (more)

🗣Sponsor

Say goodbye to countless spreadsheets and endless email threads when you automate compliance with Vanta.

Automate up to 90% of the work for SOC 2, ISO 27001, HIPAA, and more

Get audit-ready in weeks instead of months

Save over 300 hours of manual work and up to 85% of associated costs.

Easily monitor and secure the tools your business relies on with Vanta’s 200+ integrations.

Join 5,000 fast-growing companies like Chili Piper, Quora, Autodesk, and Patch that leverage Vanta to manage risk and prove security in real time. Vanta scales with your business, helping you successfully enter new markets, land bigger deals, and earn customer trust.

As a special offer, Security, Funded readers get $1,000 off. Claim your discount here.

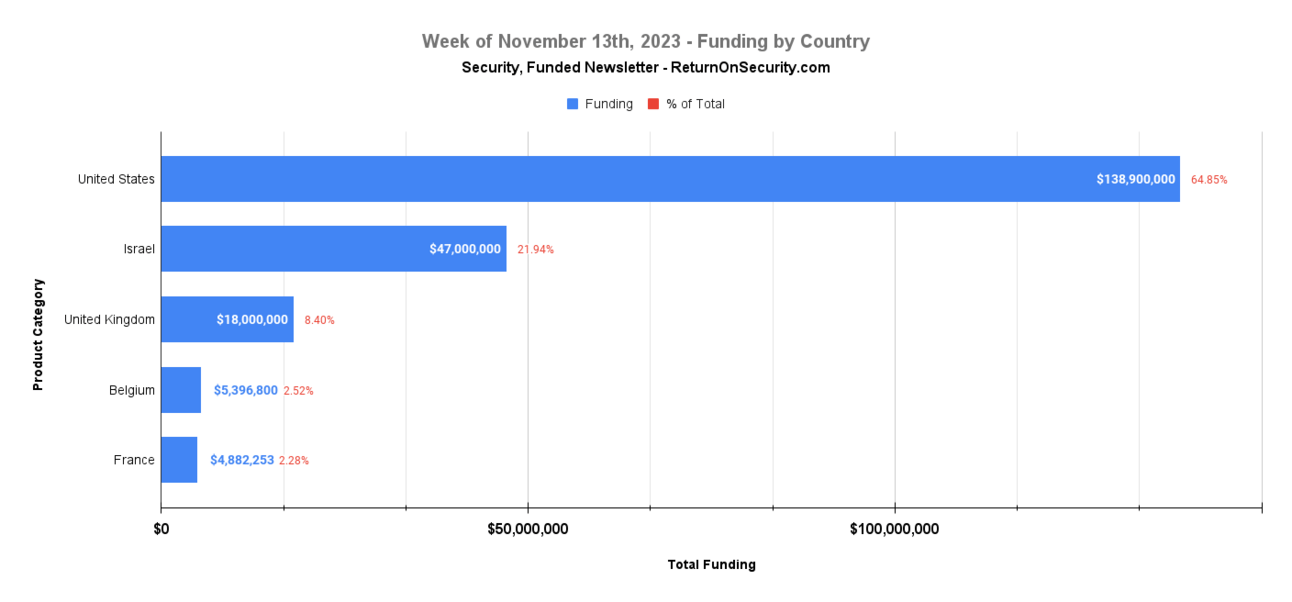

🌎 Funding By Country

$138.9M for United States across 8 deals

$47.0M for Israel across 2 deals

$18.0M for United Kingdom across 1 deal

$5.4M for Belgium across 1 deal

$4.9M for France across 1 deal

🤝 Mergers & Acquisitions

Caleycom, a United Kingdom-based telecommunications provider, was acquired by Converged Communication Solutions for an undisclosed amount. (more)

GO Concepts, a United States-based managed security services provider (MSSP) focused on the defense sector, was acquired by VC3 for an undisclosed amount. (more)

Increase Your Skills, a Germany-based cybersecurity education and training platform, was acquired by MetaCompliance for an undisclosed amount. (more)

Ingalls Information Security, a United States-based managed security services provider (MSSP) focused on the defense sector, was acquired by C3 Integrated Solutions for an undisclosed amount. (more)

ReachOut Technology, a United States-based managed security services provider (MSSP) for small businesses, was acquired by Yuengling's Ice Cream Corp for an undisclosed amount. (more)

SIXGEN, a United States-based offensive and defensive network security platform for defense operations, was acquired by Washington Harbour Partners for an undisclosed amount. (more)

Solutions Granted, a United States-based managed detection and response (MDR) platform for managed security services providers (MSSPs), was acquired by SonicWALL for an undisclosed amount. (more)

📚 Great Reads

It’d Be a Shame If Someone Filed this Breach with the SEC - Insert Dr. Evil pinky meme - Matt Jay covers how a ransomware gang stepped up their name and shame tactics by filing a breach notification on a company THEY breached. 🤯

*Leverage AI to reduce the burden of security questionnaires - learn how AI, backed by a robust Trust Center, can help your team say goodbye to the manual effort of responding to security questionnaires

OpenAI Accidentally Created a Black Market for ChatGPT Plus - And this happened before all of the drama with OpenAI over the weekend! With OpenAI's future hanging in the balance, and with the company coming off of a fresh DDoS attack, the last thing they need is bootleg accounts.

InfoSec Black Friday Deals - "Friday Hack Fest" 2023 Edition - It’s the time of year again for the world-famous InfoSec Black Friday GitHub repo! This has been a huge hit running over 5 years now and has just about everything a cybersecurity person would want.

*Sponsored content and/or affiliate link.

🧪 Labs

It ain’t much, but it’s honest work