Security, Funded provides a weekly analysis of economic activity in the cybersecurity market. This week’s issue is presented together with Material Security.

Hey there,

I hope you had a great weekend!

I spent a lot of time outside this past weekend touching real grass. Highly rated, would recommend, A+++!

It’s a short intro this week, so you can get to the money, and we can all get this bread 🥖 😤 👊

TOGETHER WITH

Simplify and Automate Your Cloud Office Security

Security teams are constantly battling phishing attacks, misconfigurations, data leaks, and identity threats, often juggling multiple tools that are time-consuming and ineffective.

Material Security offers a unified platform that secures your Google Workspace or Microsoft O365, eliminating the complexity and gaps of managing multiple security tools. More importantly, Material automates remediations, eliminating tedious manual tasks and freeing your team to focus on strategic work.

Table of Contents

😎 Vibe Check

Whether you’re a security leader, product builder, or investor, if AI isn’t the game-changer for security yet, what is?

Last issue’s vibe check:

Whether you’re a security leader, product builder, or investor, what’s holding back AI in cybersecurity?

🟨🟨⬜️⬜️⬜️⬜️ 💰 Buyers hesitate to spend on AI security tools (7)

🟨🟨🟨🟨⬜️⬜️ ⚖️ Security leaders & practitioners don’t fully trust AI decisions (13)

🟩🟩🟩🟩🟩🟩 🔌 Vendors struggle to make AI fit into real workflows (17)

🟨🟨🟨🟨⬜️⬜️ 🤯 Buyers aren’t convinced AI actually helps (13)

50 Votes

The people have spoken and the hearts and minds are yet to be won.

88% of the responses last week showed hesitation around the value proposition of AI in cybersecurity. It’s not just about AI capabilities but how well it actually integrates into existing security operations. Many security teams simply don’t have time to completely change workflows for AI, which creates friction in adoption.

Last week’s poll shows that, once again, money isn’t the biggest roadblock to adopting something new in cyber. The roadblocks are workflow integration and trust.

Some of the top comments from last week’s vibe check:

Buyers not convinced - “AI is extremely overhyped rn”

Vendors struggle - “You're not my real dad, you're just an LLM!” 😂

💰 Market Summary

Private Markets

8 companies from 4 countries raised $198.3M across 7 unique product categories

4 companies were acquired or had a merger event for $335.0M across 4 unique product categories

100% of funding went to product-based cybersecurity companies

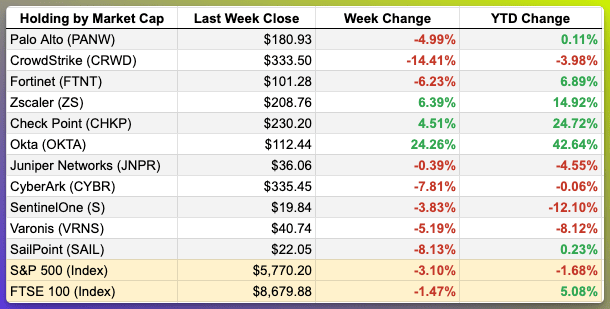

Public Markets

3 public cyber companies had an earnings report

Cyber market moves last week (mostly down bad)

As of markets close on March 7, 2025

📸 YoY Snapshot

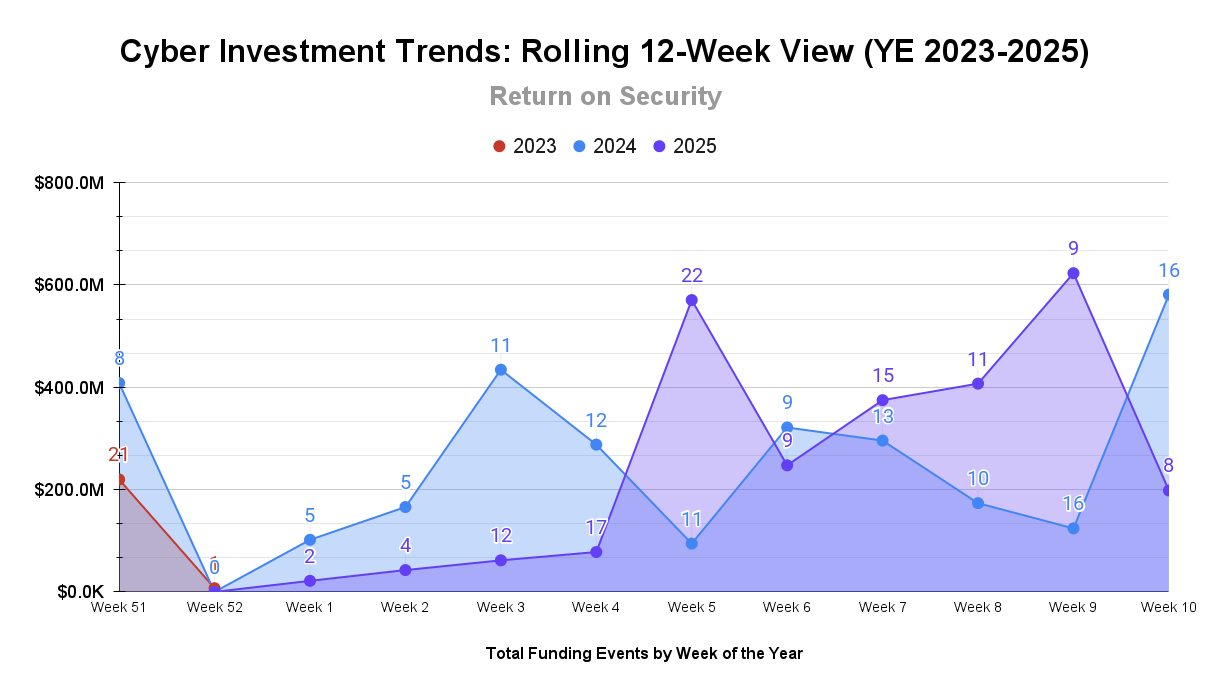

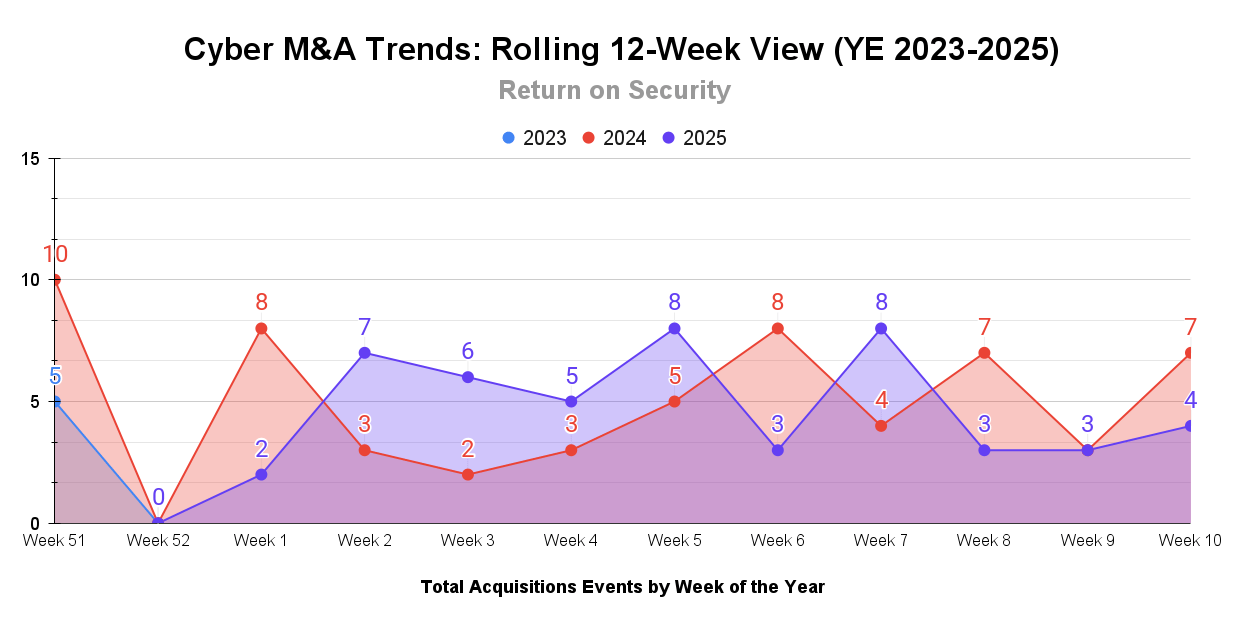

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between the end of 2023 and the start of 2024 and 2025.

Looks like this is a cyclical pattern between last year and this year. Companies love announcing within this three to four-week timeframe for some reason. My guess is that it’s just far enough away from the RSA Conference not to get too lost in the PR sauce.

Another low-volume but high-dollar figure week on the M&A front. 2025 is dead even with 2024 during the same timeframe regarding M&A volume. Dollars, on the other hand, are a very different story. The first three months of 2024 saw some mega deals and accounted for 42% of the total dollars in 2024 alone! 🤯

☎️ Earnings Reports

Earnings reports from last week: CrowdStrike, Okta, Zscaler

CrowdStrike (CRWD)

CrowdStrike delivered another strong fourth quarter, with revenue growing 25% to reach $1.1 billion. This success was driven by the strong adoption of its Falcon platform (most likely from this brilliant marketing campaign) and increased demand for cloud security solutions. CrowdStrike cited over $1 billion in sales on AWS Marketplace (which is mind-blowing alone), and 60% of new business came from channel partners.

While all of that sounds great, nothing is worse for investors than being told the future might not be as good as it is now. CrowdStrike mentioned weak forward-looking guidance and higher-than-expected expenses (from the massive outage last year), and the stock has been down 18% since last week.

Okta (OKTA)

Okta delivered a strong fourth quarter, with significant achievements in product and growth with workforce and customer identity products. Okta launched new products, Okta Identity Governance and Auth0 for GenAI, and a focus on securing the identity space of agentic AI contributed to this success and accounted for over 20% of Q4 bookings.

The strategic focus on the channel and the AWS Marketplace partner ecosystem drove a ton of growth. Okta was optimistic about its forward-looking guidance, expecting 9%-10% revenue growth and continued strong operating margins. Analysts and the market responded positively to Okta’s results.

It’s worth noting that this strong quarter report comes on the heels of a ~300-person layoff announced back in January. 🤔

Zscaler (ZS)

Zscaler delivered a strong second quarter, with revenue growing 23% to reach $648 million. This success was driven by demand for their Zero Trust solution, especially in the Americas region, which saw a 23% year-over-year increase. Zscaler's ARR grew by 23% to over $2.7 billion, and the net revenue retention rate (NRR) improved to 115%, showing best-in-class upsell strategies.

The focus on Zero Trust and partnerships with global system integrators (GSIs) propelled much of the success. Immediately after the call, the market reacted positively to Zscaler's execution and strategic direction but then tanked along with the rest of the tech market.

Earning reports to watch this coming week: SecureWorks, SentinelOne

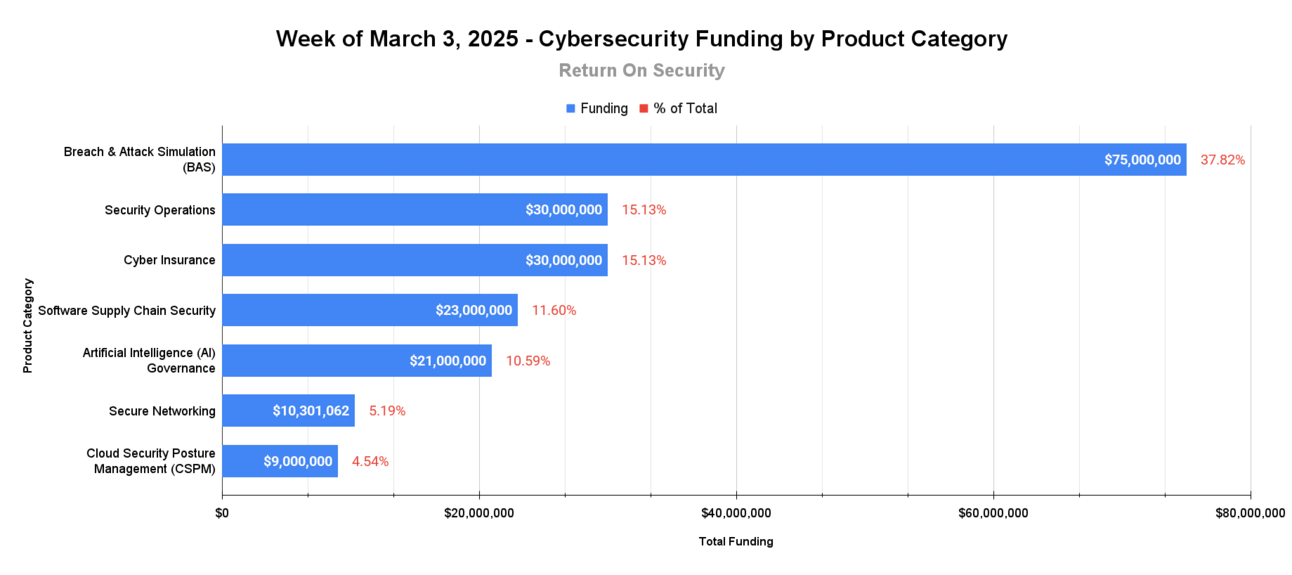

🧩 Funding By Product Category

$75.0M for Breach & Attack Simulation (BAS) across 1 deal

$30.0M for Security Operations across 2 deals

$30.0M for Cyber Insurance across 1 deal

$23.0M for Software Supply Chain Security across 1 deal

$21.0M for Artificial Intelligence (AI) Governance across 2 deals

$10.3M for Secure Networking across 1 deal

$9.0Mfor Cloud Security Posture Management (CSPM) across 1 deal

🏢 Funding By Company

Product Companies:

SpecterOps, a United States-based breach and attack path management platform, raised a $75.0M Series B from Insight Partners. (more)

Coalition, a United States-based cyber risk insurance company, raised a $30.0M Private Equity Round from Mitsui Sumitomo Insurance Company. (more)

Crogl, a United States-based AI-agent-enabled security operations platform, raised a $25.0M Series A from Menlo Ventures and a $5.0M Seed from Tola Capital. (more)

Cloudsmith, a Nothern Ireland-based application security observability and supply chain management platform, raised a $23.0M Series B from TCV. (more)

Knostic, an Israel-based identity and access management (IAM) platform for using GenAI applications and LLMs, raised a $11.0M Series A from Bright Pixel Capital. (more)

Quantum Industries, an Austria-based quantum-secure network security platform, raised a $10.3M Seed from Findus Venture and Sparring Capital Partners. (more)

AIceberg, a United States-based secure web gateway and firewall for AI usage and AI applications, raised a $10.0M Seed from SYN Ventures and Sprout & Oak. (more)

Aryon Security, an Israel-based cloud security platform focused on cloud security guardrails and preventing cloud misconfigurations, raised a $9.0M Seed from Viola Ventures and Blumberg Capital. (more)

Service Companies:

None

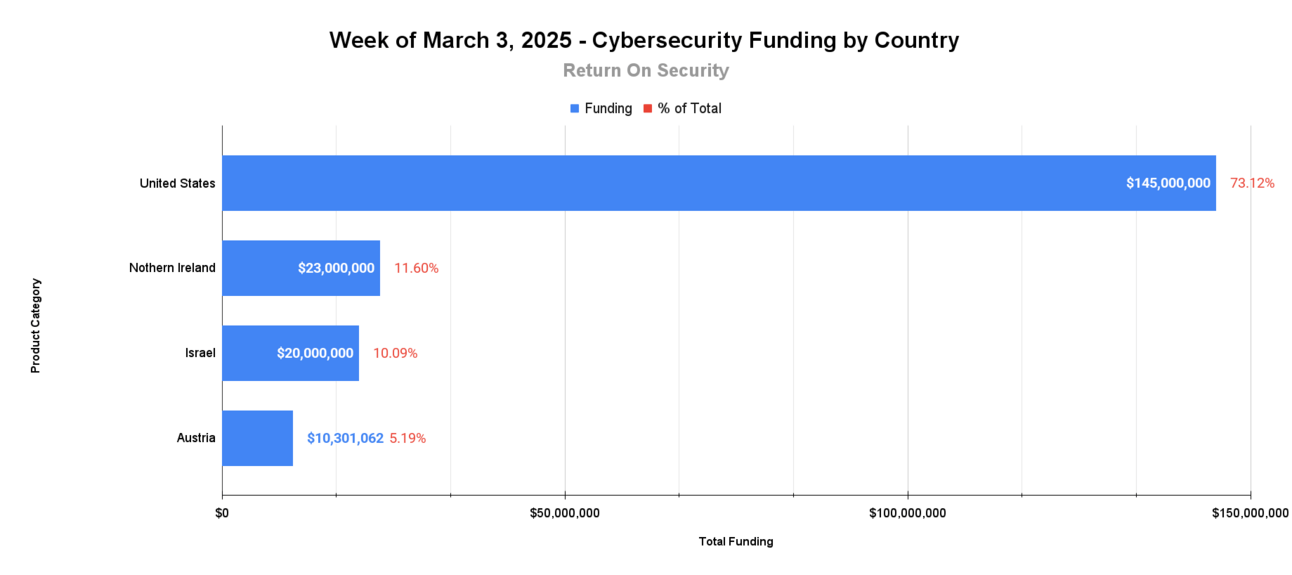

🌎 Funding By Country

$145.0M for the United States across 5 deals

$23.0M for Nothern Ireland across 1 deal

$20.0M for Israel across 2 deals

$10.3M for Austria across 1 deal

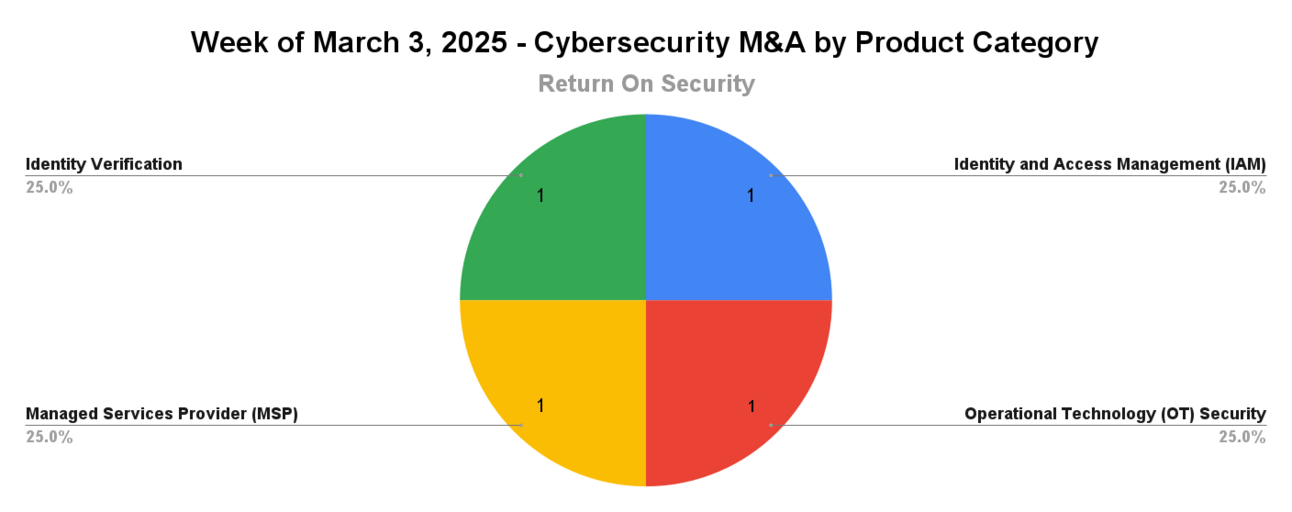

🤝 Mergers & Acquisitions

Product Companies:

Identity Automation, a United States-based authentication and identity lifecycle management platform, was acquired by Jamf for $215.0M. Identity Automation has not publicly disclosed any funding events. (more)

OTORIO, an Israel-based operational technology (OT) security platform, was acquired by Armis Security for $120.0M. OTORIO has not publicly disclosed any funding events. (more)

IDnow, a Germany-based identity verification platform, was acquired by Corsair Capital for an undisclosed amount. IDnow had previously raised $61.2M in funding. (more)

Service Companies:

Apogee IT Services, a United States-based managed services provider (MSP), was acquired by Supra Canada Technologies Ltd. for an undisclosed amount. Apogee IT Services has not publicly disclosed any funding events. (more)

📚 Great Reads

America's Cyber Surrender - The U.S. just hit pause on cyber operations against Russia while gutting its own cybersecurity defenses. Is America walking away from cyber deterrence? This could be the most dangerous shift in U.S. cyber policy yet.

The Phony Comforts of Useful Idiots - The debate on AI skepticism is limited by shallow dichotomies and obscures nuanced discussions on AI's complexities, implications, and realities.

*A message from our sponsor

🧪 Labs

You can never be too careful these days 😮💨

can't even do a romantic gesture anymore

— laura 🔥 (@freezydorito.lol) 2025-02-28T12:35:10.651Z

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.

Follow me on LinkedIn to never miss any updates!