Security, Funded by Return on Security, is a weekly analysis of economic activity in the cybersecurity market. This week’s issue is brought to you by Palo Alto Networks, Intruder, and Tines.

Hey there,

I hope you had a great weekend, and Hoppy Easter. 🐰 🥚

Twas the week before the RSA Conference, so I’ll keep this intro short. The newsletter this week comes from Paris, France, where I’ve just visited for the first time. It's a very cool city, and I'm looking forward to visiting more.

Something I leanred while I was there? It’s only considered “Vibe Security” if it comes from the LA’Region de Sécurité of France. Otherwise, it’s just Sparkling Risk Management.

It’s also time to double and triple book in those RSA parties to make sure you’re thoroughly getting all the free food and drinks maximizing your return on conference experience (RoCE). I’m co-hosting parties on Monday and Wednesday this year, and I hope to see many of you there!

And a quick reminder, you can now submit anonymous questions for me here

→ https://forms.gle/vHTQsr2RKMquNjcq7

Vive le Return on Security! 🇫🇷

PARTNER

Is Posture Security A Match for the Modern Threat Landscape?

In the race between cloud attackers and defenders, time is the critical factor — and time increasingly favors the attackers.

Security teams take approximately 145 hours to resolve a single alert — far too late to prevent a breach. Meanwhile, attackers are now exfiltrating data nearly twice as fast as they did just 12 months ago.

The widening gap between attack speed and response time exposes a fundamental truth: traditional peace-time cloud security approaches are no longer sufficient in today's threat landscape.

Table of Contents

😎 Vibe Check

Make sure to click on the options below to vote in this week’s poll, whether you’re a practitioner, founder, or investor!

What’s the biggest thing that undermines a security leader’s influence?

Last issue’s vibe check:

What’s the most effective way a security leader can build influence internally?

🟨🟨🟨🟨⬜️⬜️ Tie security to revenue (30)

🟨🟨⬜️⬜️⬜️⬜️ Bring metrics every time (9)

🟨⬜️⬜️⬜️⬜️⬜️ Manage up to leadership (5)

🟩🟩🟩🟩🟩🟩 Cross-team relationships (45)

⬜️⬜️⬜️⬜️⬜️⬜️ Other (leave comment) (1)

90 Votes

Cross-team relationships was the clear winner from last week, which makes a lot of sense when you zoom out. This poll reinforces the importance of influence in security, and how it comes from being embedded with teams, not just reporting upwards. More collaboration, less convincing. Trust, buy-in, and alignment are often more important than the actual problems being solved.

The takeaway is something I’ve always said in my career - security is more like diplomacy than defense.

Some of the top comments from last week’s vibe check:

Cross-team - “Help get things done. Eradicate classes of problems, not instances of them.”

Other - “By learning what internal stakeholders value the most, not by what they say, but by how they act. And then appeal to those values.”

Manage up - “I just don't see tying security to revenue working in a lot of cases. In a product company where customers care about security, sure. Most other places, it's still loss avoidance. In-house insurance.”

💰 Market Summary

Private Markets

12 companies from 4 countries raised $149.3M across 10 unique product categories

4 companies were acquired or had a merger eventacross 2 unique product categories

100% of funding went to product-based cybersecurity companies

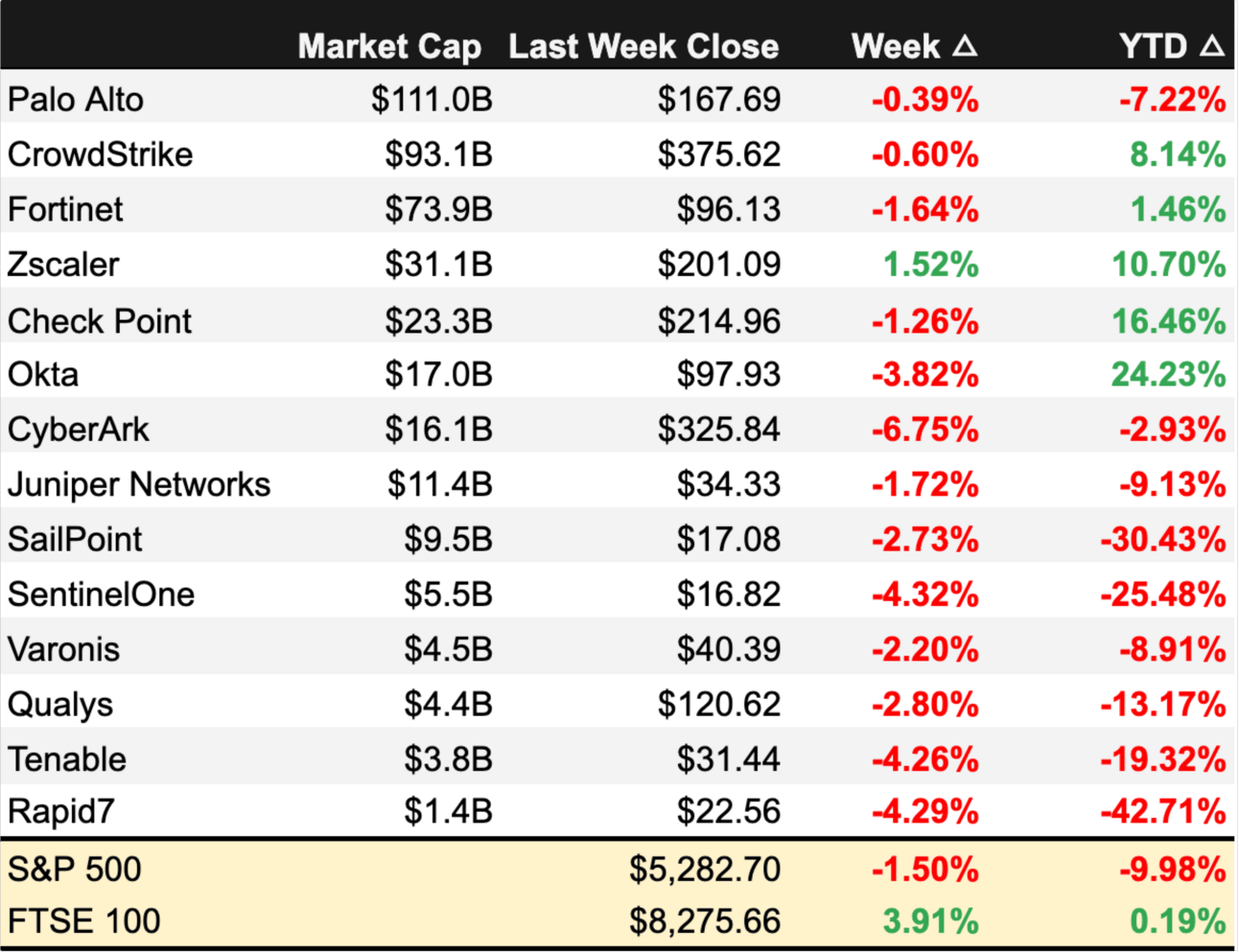

Public Markets

No public cyber companies had an earnings report

Public market moves last week

As of market close on April 17, 2025.

📸 YoY Snapshot

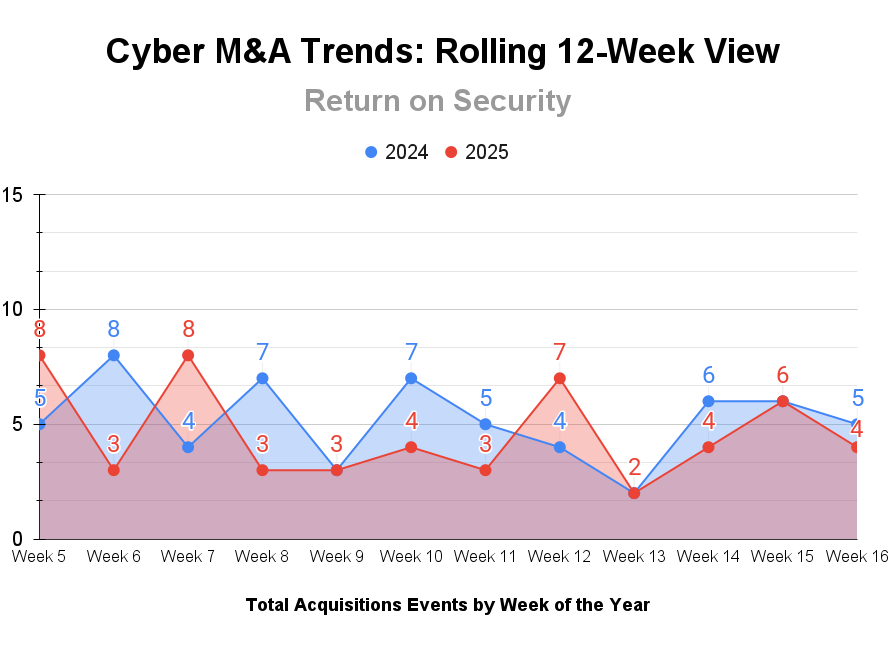

Rolling 12-week charts that compare funding and acquisitions weekly in a year-over-year (YoY) view between 2024 and 2025.

Not a huge week compared to the last few weeks, but still a strong one. This is a seasonal downtick ahead of the RSA Conference, where (many) more companies will try to make a splash with their news. As of last week, the cyber industry has raised over $5 billion in funding.

Another moderate week for M&A activity, but I expect the same to be true ahead of RSA Conference week. As of last week, M&A activity is only sightly behind the same period last year with a total of 75 announcements to date.

PARTNER

Another Cloud Security Tool? Not Quite

Intruder launched Cloud Security - and immediately turned down a $32 billion offer from Google!

Alright, half true. But we’re still excited - and this isn’t just another cloud security tool. We know that security teams face too many tools, tight budgets, and not enough time to handle all the alerts.

So we’ve combined Cloud Security with VM, ASM, and our signature simplicity and noise reduction - all in one powerful platform. No alert fatigue. No hefty price tags. Only what you need to stay secure.

☎️ Earnings Reports

Earnings reports from last week: None

Macro Context:

More down bad news for the major US stock markets with continued tariff and policy uncertainties.

Piling onto this, the US Fed Chair, Jerome Powell (my boy JPow) is under pressure from the Trump administration to lower interest rates, something the Fed is not in a good position to do.

The US dollar dropped to its lowest level in over three years compared against six foreign currencies.

Earning reports to watch this coming week: Check Point Software

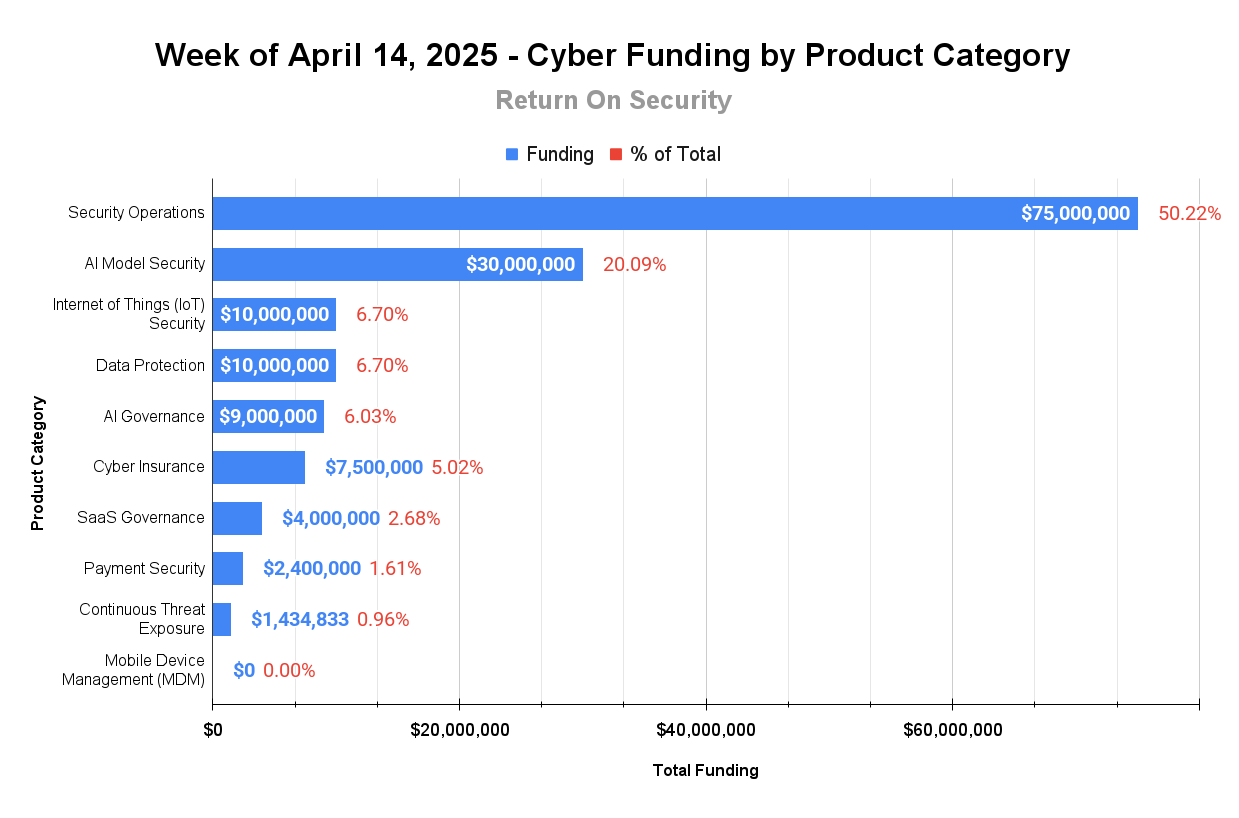

🧩 Funding By Product Category

$75.0M for Security Operations across 1 deal

$30.0M for AI Model Security across 3 deals

$10.0M for Internet of Things (IoT) Security across 1 deal

$10.0M for Data Protection across 1 deal

$9.0M for AI Governance across 1 deal

$7.5M for Cyber Insurance across 1 deal

$4.0M for SaaS Governance across 1 deal

$2.4M for Payment Security across 1 deal

$1.4M for Continuous Threat Exposure Management (CTEM) across 2 deals

An undisclosed amount for Mobile Device Management (MDM) across 1 deal

🏢 Funding By Company

Product Companies:

ExaForce, a United States-based multi-modal AI agent security operations platform, raised a $75.0M Series A from Khosla Ventures and Mayfield Fund. (more)

Virtue AI, a United States-based AI model security platform, raised a $23.0M Series A from Lightspeed Venture Partners and Walden Catalyst Ventures and a $7.0M Seed from Factory. (more)

Cy4Data Labs, a United States-based encrypted data-in-use platform, raised a $10.0M Seed from Pelion Venture Partners. (more)

NetRise, a United States-based Internet of Things (IoT) security monitoring platform, raised a $10.0M Series A from DNX Ventures. (more)

Pillar Security, an Israel-based platform for monitoring and mitigating risks across the AI development and deployment lifecycle, raised a $9.0M Seed from Shield Capital. (more)

1Fort, a United States-based cyber insurance and manged security company for SMBs, raised a $7.5M Seed from Bonfire Ventures. (more)

Quilr, a United States-based AI agent-based SaaS governance platform, raised a $4.0M Seed from Crew Capital. (more)

Ideem APA, a United States-based payment step-up authentication platform, raised a $2.4M Seed from Everywhere Ventures and Hustle Fund. (more)

GlitchSecure, a Canada-based continuous security testing and validation platform, raised a $1.4M Seed from the Business Development Bank of Canada. (more)

Actualization.AI, a United States-based AI agent vulnerability testing and monitoring platform, raised an undisclosed Pre-Seed round.

BreachBits, a United States-based continuous threat exposure management (CTEM) platform, raised an undisclosed Venture Round from Lloyd's. (more)

Devicie, a Australia-based mobile device management (MDM) and endpoint security platform, raised a undisclosed Venture Round from Insight Partners. (more)

Service Companies:

None

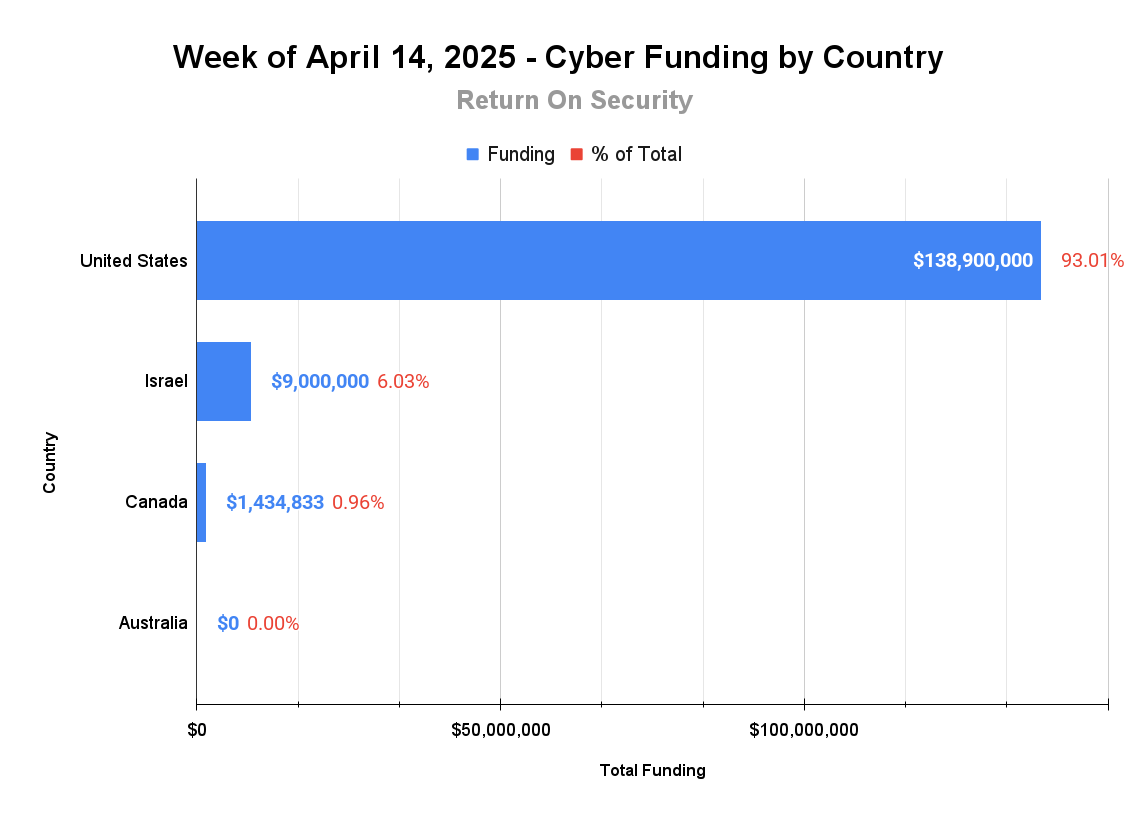

🌎 Funding By Country

$138.9M for United States across 10 deals

$9.0M for Israel across 1 deal

$1.4M for Canada across 1 deal

An undisclosed amount for Australia across 1 deal

🤝 Mergers & Acquisitions

Product Companies:

None

Service Companies:

Omnipotech, a United States-based managed security services provider (MSSP), was acquired by Netsurit for an undisclosed amount. Omnipotech has not publicly disclosed any funding events. (more)

Oxford Computer Group, a United States-based professional services firm focused on identity and access management consulting, was acquired by MajorKey Technologies for an undisclosed amount. Oxford Computer Group has not publicly disclosed any funding events. (more)

Secher Security, a Denmark-based managed security and remote access provider, was acquired by Momentum for an undisclosed amount. Secher Security has not publicly disclosed any funding events. (more)

The Missing Link, a Australia-based managed security services provider (MSSP), was acquired by Infosys for an undisclosed amount. The Missing Link has not publicly disclosed any funding events. (more)

📚 Great Reads

Trump vs Krebs and the Sound of Silence - The Seriously Risky Business podcast covers President Trump's new Executive Order targeting Chris Krebs, the former head of CISA, and the firm he worked for, SentinelOne. The podcast discusses the new precedent and how the cybersecurity industry has responded to it.

*Voice of Security 2025 - Curious what 900+ security leaders say about AI, tech debt & team priorities? New IDC research, sponsored by Tines and AWS, reveals what’s top of mind. Get insights from global leaders on how AI is reshaping security, top challenges and blockers, tooling pain points, and more.

Reimagining Democracy - Bruce Schneier examines how modern technology and societal changes necessitate rethinking traditional democratic systems and how AI's role in governance could redefine legislative processes within the next decade.

*Sponsored

🧪 Labs

Security ROI > Coffee ROI

Get value every week? Back the mission.

Or forward this to someone smart.

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security.

Sometimes, deal details- such as who led the round, how much was raised, or the deal stage- may be updated after publication.

Let us know if you spot any errors, and we’ll fix them.