Security, Funded by Return on Security, is a weekly analysis of economic activity in the cybersecurity market. This week’s issue is brought to you by Tines, Dropzone AI, and Hyperproof.

Hey there,

I hope you had a great weekend!

Cyber Earnings Season™ continued on this past week, with three more heavyweights reporting in with mixed results. The macro pressure and uncertainty in the US markets and economy are still very real, and we’re seeing a pattern play out in the public markets for many companies.

Some of the other public companies are absolutely ripping it and going on an acquisition spree. Consolidation and platformization are still very much alive and well, and we’re watching this play out with the Security for AI and AI for Security markets.

Also, I’ll be at Infosecurity Europe this week, literally just vibing. Please stop me and say hello if you’re there! 🤝

PARTNER

Why teams are ditching manual patch management

Patch management is still a major challenge for many technical teams. But when done right, it can greatly improve security, efficiency, and employee experience.

So what does “right” look like?

Join Kandji and Tines on June 4th to find out. We’ll explore why traditional approaches fall short and share real-world examples of how automation helps modern IT teams scale patching, reduce manual effort, and stay compliant, with no complex scripting required.

Table of Contents

😎 Vibe Check

Click the options below to vote on whether you are a practitioner, founder, or investor. Feel free to leave a comment, and I'll feature the best takes in next week’s write-up!

What’s the most overrated security KPI?

Last issue’s vibe check:

How is AI changing cybersecurity hiring?

🟨🟨🟨🟨⬜️⬜️ Fewer junior roles (31)

🟨🟨⬜️⬜️⬜️⬜️ Replacing niche contractor work (15)

🟩🟩🟩🟩🟩🟩 Too early to tell (52)

🟨⬜️⬜️⬜️⬜️⬜️ No different than before AI (11)

⬜️⬜️⬜️⬜️⬜️⬜️ Other (leave a comment) (1)

110 Votes

Some interesting results from the vibe check last week. On the one hand, I expected a lot of votes to go towards “Fewer junior roles.” After all, it’s what we keep hearing and reading about in the news (and I think we will be there eventually), but having fewer “junior” roles is not new to cyber. Some even argue that it’s impossible to have junior roles in cyber, but I think that’s a bit overkill.

“Too early to tell” got a lot more votes than I expected since people seem to have very strong opinions on this topic with either a hard yes or no. I’m going to need to ask this question again in 6-12 months and see how it compares.

Some of the top comments from last week’s vibe check:

Fewer junior roles - “AI may amplify existing senior engineers but won't supercharge juniors that lack the knowledge to see where AI is going wrong. As a result, AI will eat Tier 1 SOC roles, which were always a poor solution to the alert triage problem.”

Too early to tell - “AI isn't taking security jobs yet, but it's on the path too. Too early to understand what that impact really is.”

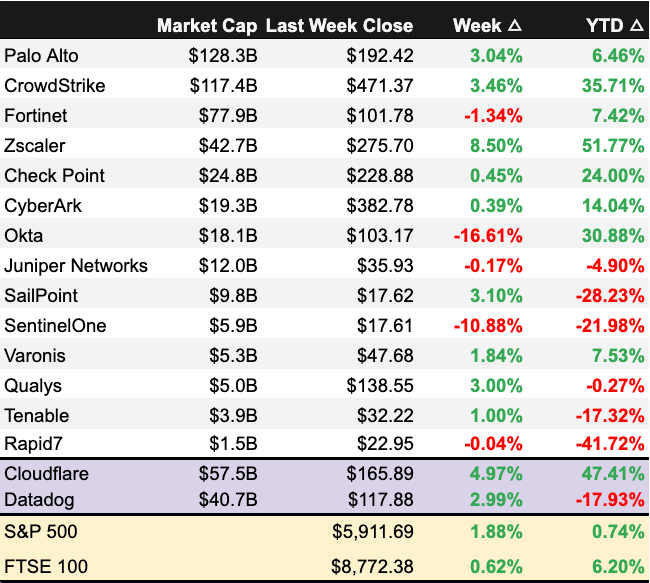

💰 Market Summary

Private Markets

6 companies from 2 countries raised $54.2M across 6 unique product categories

100% of funding went to product-based cybersecurity companies

6 companies were acquired or had a merger event for $975.0M across 5 unique product categories

Public Markets

3 public cyber companies had an earnings report

As of markets close on May 30, 2025.

📸 YoY Snapshot

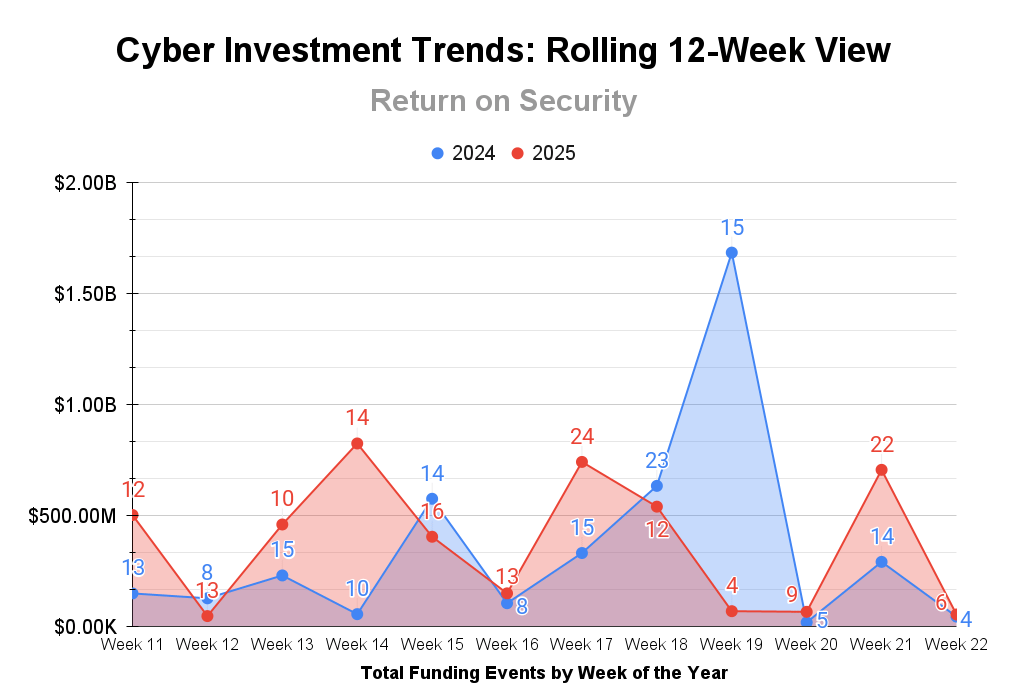

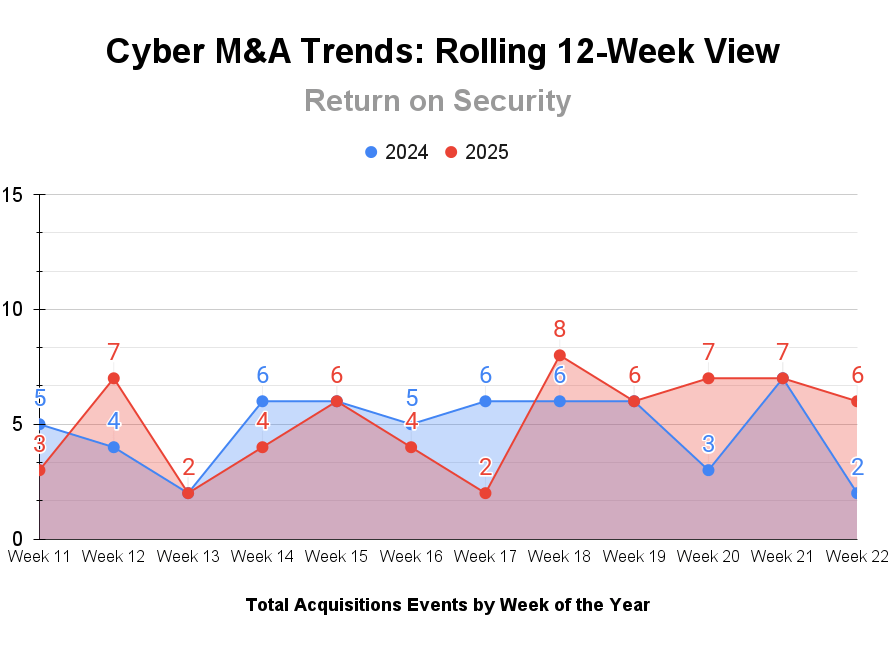

Rolling 12-week charts that compare funding and acquisitions weekly in a year-over-year (YoY) view between 2024 and 2025.

A seasonally quiet week for funding last week. All things “data” was the name of the game last week and continues to be a tear this year.

M&A, on the other hand, will not be contained! A big week for product and service acquisitions from some of the big public cyber players.

PARTNER

Your Best Analyst Spends 40 Minutes Per Alert. AI Does It in 5.

Intelligent investigation that scales with you

Give your team their time back. Dropzone AI races through every security alert - gathering evidence, analyzing patterns, and delivering investigation reports you can trust. With <0.1% false negatives, you'll confidently dismiss the noise and zero in on real threats.

It's like cloning your elite analysts and giving them superhuman speed. Watch alert backlogs disappear while your team focuses on strategic defense, not repetitive triage.

☎️ Earnings Reports

Earnings reports from last week: $OKTA ( ▼ 9.18% ), $S ( ▼ 4.35% ) , $ZS ( ▼ 5.47% )

Okta - $OKTA ( ▼ 9.18% )

Okta delivered a strong start to its 2026 fiscal year, focusing on large customer growth and new product contributions. Okta’s Auth0 platform and the new Identity Governance offering brought in $400 million alone. The company hit a new record profitability, with an operating margin of 26% and a free cash flow margin of 19%.

Despite the overall positive quarter, there were a few dark spots that made investors respond sharply. Okta saw a reduction in Net Revenue Retention (NRR), or the measure of how well they are retaining existing customers and expanding revenue from them, cited macroeconomic uncertainties and potential risks in the U.S. federal vertical, and muted its forward-looking guidance.

Combine this with increasing competition from the likes of CyberArk and SailPoint, and Okta’s stock has been down ~15% post-earnings call. 🥶

SentinelOne - $S ( ▼ 4.35% )

SentinelOne delivered a solid first quarter, relatively speaking. Revenue climbed 23% to hit $229 million, powered by the “Singularity” platform, and ARR grew by 24% to $948 million. Sounds great if you look at these numbers only, but there’s more to the story.

SenitenlOne’s operating margin decreased 2% from last quarter, and that ARR number? It’s a higher number than last quarter, but it was a 21% reduction in growth from last quarter (ouch!). That downward ARR growth, combined with macro volatility, deal slippage (meaning potential customers pushed out buying decisions), and competing against CrowdSrike (which is 5x the size of SentinelOne), is a bad combo.

CrowdStrike aside, the rest are scenarios that many companies will experience as we live through these uncertain economic times. SentienlOne’s stock has been down ~10% post-earnings call as investors are not reassured of its ability to bounce back.

Zscaler - $ZS ( ▼ 5.47% )

Zscaler delivered a very strong earnings call this quarter. Revenue climbed 23% YoY to $678 million, driven by strong demand for its Zero Trust Exchange platform, and ARR grew by 23% YoY to $2.9 billion. However, Zscaler also acknowledged ongoing economic uncertainty affecting IT and cyber budgets. Cyber was still an easier sell than IT, but it noticed some pipeline drag.

Zscaler also highlighted its huge acquisition of Red Canary, a leading managed detection and response (MDR) platform, to further enhance its security operations capabilities. This was a huge move in creating new channels for sales and creating a more sticky experience for customers of both companies.

Zscaler’s stock has been up about 10% since the earnings call.

Earning reports to watch this coming week: $CRWD ( ▼ 7.95% )

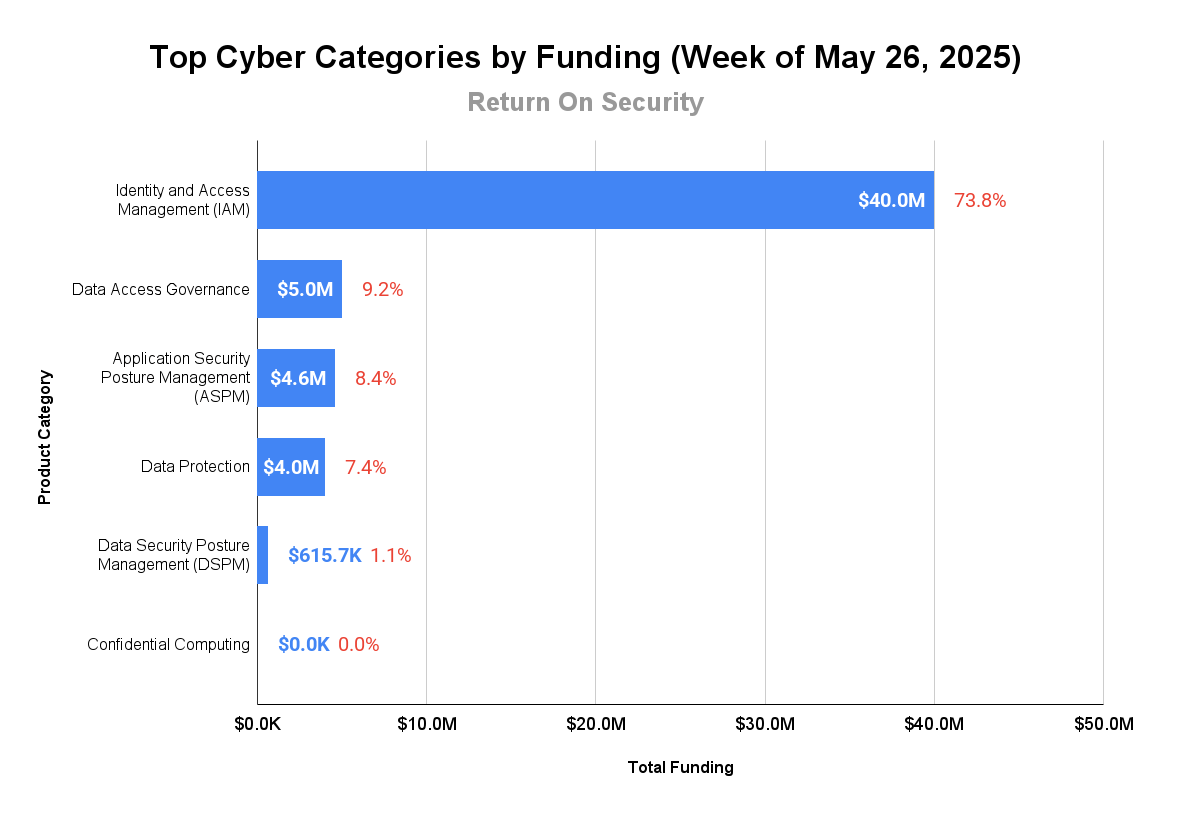

🧩 Funding By Product Category

$40.0M for Identity and Access Management (IAM) across 1 deal

$5.0M for Data Access Governance across 1 deal

$4.6M for Application Security Posture Management (ASPM) across 1 deal

$4.0M for Data Protection across 1 deal

$615.7K for Data Security Posture Management (DSPM) across 1 deal

An undisclosed amount for Confidential Computing across 1 deal

🏢 Funding By Company

Product Companies:

Congruity360, a United States-based data security and access governance platform, raised a $5.0M Debt Financing from Flow Capital. (more)

Dedge Security, a Spain-based application security posture management (ASPM) platform for Web3 applications, raised a $4.6M Seed from Tritemius. (more)

Unbound Security, a United States-based cryptographic keys and digital credential protection platform, raised a $4.0M Seed from Race Capital. (more)

Cyborg, a United States-based confidential computing and database platform for AI applications, raised an undisclosed Venture Round from iGan Partners. (more)

Service Companies:

None

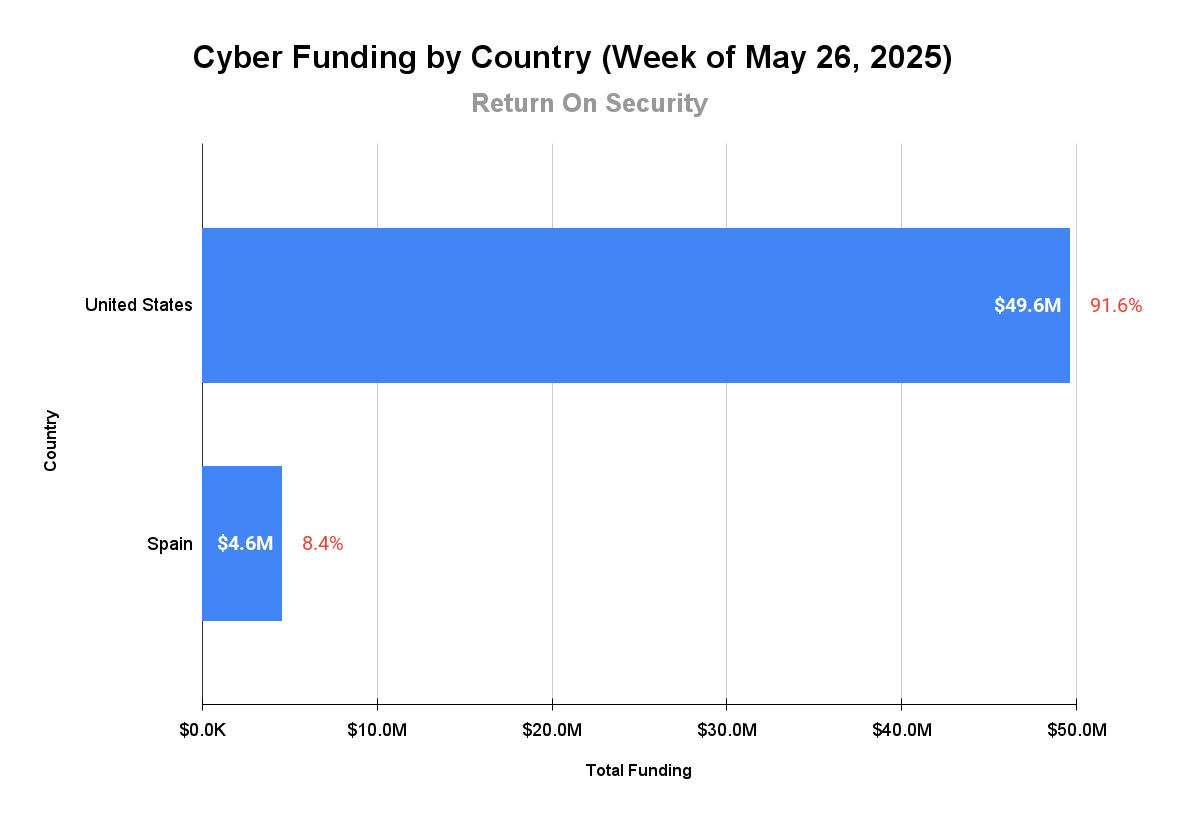

🌎 Funding By Country

$49.6M for the United States across 5 deals

$4.6M for Spain across 1 deal

🤝 Mergers & Acquisitions

Product Companies:

Red Canary, a United States-based managed detection and response (MDR) platform, was acquired by Zscaler for $675.0M. Red Canary had previously raised $129.9M in funding. (more)

Veriti, an Israel-based attack surface management (ASM) platform, was acquired by Check Point Software Technologies for an undisclosed amount. Veriti had previously raised $18.5M in funding. (more)

Service Companies:

Kudu Dynamics, a United States-based professional services firm focused on security for AI and network security, was acquired by Leidos Cyber for $300.0M. Kudu Dynamics has not publicly disclosed any funding events. (more)

Cybercrowd, a United Kingdom-based professional services firm focused on security risk assessments, was acquired by Limerston Capital for an undisclosed amount. Cybercrowd has not publicly disclosed any funding events. (more)

📚 Great Reads

Everyday Americans Help North Korea Infiltrates U.S. Remote Jobs - A LinkedIn message drew a former waitress in Minnesota into a type of intricate scam involving illegal paychecks and stolen data.

*The 2025 Summer GRC Report - Each year, Hyperproof’s report takes a deep dive into market trends in the GRC space. A new version just released that compares their data against reports from Accenture, BDO, PWC, and more so that security pros have the best data available.

Security Is Just Engineering Tech Debt (And That's a Good Thing) - Breaking the Illusion That Security Is Anything But Software Quality.

*A message from our partner

🧪 Labs

She’s disappointed in your last prompt.

Security ROI > Coffee ROI

Get value every week? Back the mission.

Or forward this to someone smart.

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using the Return on Security system.

Sometimes deal details, like who led the round, how much was raised, or the deal stage, may be updated after publication.

Let us know if you spot any errors, and we’ll fix them.