Security, Funded by Return on Security, is a weekly analysis of economic activity in the cybersecurity market. This week’s issue is brought to you by Prophet Security and Cydea.

Hey there,

Summer is officially upon us now in the northern hemisphere, and I don't think anyone had it coinciding with WWIII on their bingo card for 2025.

Every so many months or years, some physical (kinetic) skirmish takes place, and as a result, there is a doubling down on both national security and cybersecurity across the globe. It’s not just in the news and in conversations, but in the markets as well. And as we’ve seen with various conflicts these past 2-3 years, any physical actions now get coupled with cyber actions from various government-sponsored and affiliated groups.

Even in times of general economic uncertainty, the cyber industry (along with much of big tech) is seen as a near hedge. This perspective makes a lot of sense when you take a step back. Cyber isn’t recession-resistant per se, but people tend to flock to “safety” during market turmoil. Cyber has experienced a long trend of growth. It’s been a hot field to work in for these past 15+ years, and cyber issues impact all of our lives through an ever-increasing number of touchpoints.

While the cyber industry is thriving (pacing well ahead of 2024), leaders in nearly every sector are under pressure to justify spending amid economic uncertainty, including in cyber. These factors, combined with an already fragile economic climate, further restrict an already tight cyber hiring and purchasing market.

Make sure to keep your head on a swivel out there. 👀

PARTNER

Smarter alert triage. Faster investigations. Powered by Prophet Security.

Cuts the noise. Surfaces what matters. Explains every decision.

SOC teams face the same inefficiencies: endless alert backlogs, hours spent on manual triage, investigation bottlenecks, and too much noise obscuring real threats.

Prophet Security delivers an Agentic AI SOC Analyst that acts as a force multiplier for security operations. It autonomously triages and investigates every alert in seconds, and delivers clear, explainable findings so your team can focus on real threats.

Table of Contents

😎 Vibe Check

Click the options below to vote on whether you are a practitioner, founder, or investor. Feel free to leave a comment, and I'll feature the best takes in next week’s write-up!

What’s the most underused input in security decision-making today?

Last issue’s vibe check:

What’s the most misleading “security win” teams still celebrate?

🟩🟩🟩🟩🟩🟩 Passed compliance audit (47)

🟨🟨⬜️⬜️⬜️⬜️ Closed all high CVEs (17)

🟨🟨🟨🟨⬜️⬜️ No "alerts" in the SIEM (32)

🟨🟨🟨🟨🟨⬜️ Zero findings on pentest (44)

⬜️⬜️⬜️⬜️⬜️⬜️ Other (leave comment) (4)

144 Votes

The security industry has no shortage of "wins" that feel good in the moment but fall apart under scrutiny. Last week’s results showed that the industry is fed up with check-the-box victories that hide reality rather than shine a light on it. It was nearly a tie between passing a compliance audit and having zero findings on a pentest. These are, ironically, two of the things that most third-party risk management programs seek out the most and push their suppliers to have. 🙄

Across the board, people agreed that these wins often reflect process completion, not security improvement, and that they’re too often used to deflect scrutiny or calm leadership at the expense of truth. 🫠

Some of the top comments from last week’s vibe check:

💬 Other - “We got our colleague’s password in a phishing test.”

💬 Passed compliance audit - “Passing a compliance audit does reduce risk -- of a fine.”

💬 Zero findings in pentest - “Zero findings on a pentest never feels good. Are they skilled enough? Did they get mis-scoped? What didn't they find? Guess we'll wait a year and see.”

💬 No “alerts” in the SIEM - “No alerts is only a good thing if you don't have an "assume breach" mentality... "no news is bad news", since there's always news -- it's just that you might not hear the metaphorical oncoming train.”

💰 Market Summary

Private Markets

7 companies from 4 countries raised $80.4M across 7 unique product categories

69% of funding went to product-based cybersecurity companies

8 companies were acquired or had a merger event across 3 unique product categories

Public Markets

No public cyber companies had an earnings report

As of market close on June 20, 2025.

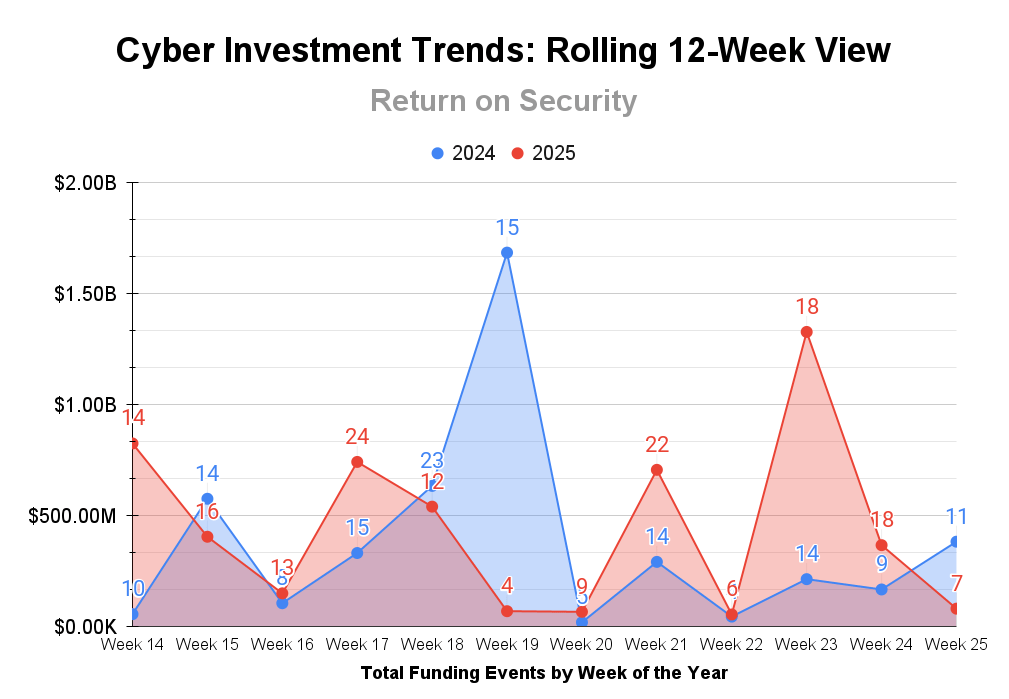

📸 YoY Snapshot

Rolling 12-week charts that compare funding and acquisitions weekly in a year-over-year (YoY) view between 2024 and 2025.

A quieter week on the funding front compared to the last few, but still one more week left to wrap up Q2.

M&A activity will not be contained! It’s crazy to think about it, but after last week’s run of activity, Q2 2025 is now tied with Q2 2022, which was at the peak of the ZIRP market before the crash. This time is different, though, because it was a slow crawl back to this point.

PARTNER

🎙️ Communicating Cyber – New Episode is here!

How do you communicate cyber when the pressure’s on, and the board’s watching?

Robin Oldham is joined by Phil Clayson to explore how cyber leaders can cut through noise, build credibility, and keep their seat at the table when it matters most.

You’ll learn how to:

Navigate complex board dynamics

Communicate clearly in a crisis

Shift cyber from afterthought to agenda item

If you’ve ever had to fight for cyber to be heard, this episode is your next move.

☎️ Earnings Reports

Earnings reports from last week: None until Q3.

Earning reports to watch this coming week: None until Q3

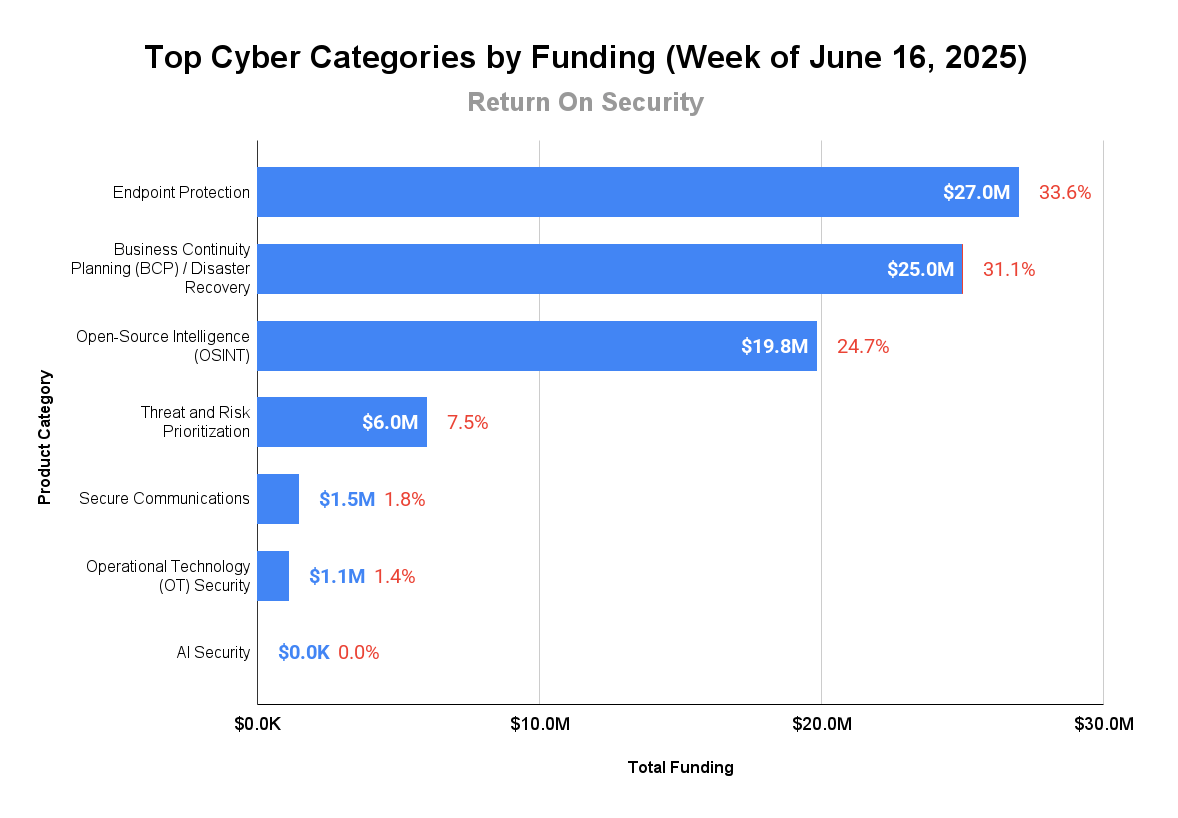

🧩 Funding By Product Category

$27.0M for Endpoint Protection across 1 deal

$25.0M for Business Continuity Planning (BCP) / Disaster Recovery across 1 deal

$19.8M for Open-Source Intelligence (OSINT) across 1 deal

$6.0M for Threat and Risk Prioritization across 1 deal

$1.5M for Secure Communications across 1 deal

$1.1M for Operational Technology (OT) Security across 1 deal

An undisclosed amount for AI Security across 1 deal

🏢 Funding By Company

Product Companies:

Fleet Device Management, a United States-based mobile device management (MDM) platform for employee laptops and cloud servers, raised a $27.0M Series B from Ten Eleven Ventures. (more)

TaDaweb, a Luxembourg-based open-source intelligence and investigation platform, raised a $19.8M Venture Round from Arsenal Growth Equity and Forgepoint Capital International. (more)

Circumvent, a United States-based cloud security threat and risk prioritization platform, raised a $6.0M Seed from Paladin Capital Group. (more)

Sekur Private Data, a United States-based secure communication and collaboration suite, raised a $1.5M Post-IPO Equity round. (more)

Steryon, a Spain-based IoT/OT security platform, raised a $1.1M Seed from 4Founders Capital and Abac Nest. (more)

Nestria AI, a Singapore-based security platform for AI and agentic applications, raised an undisclosed Pre-Seed round.

Service Companies:

Slide, a United States-based business continuity and disaster recovery platform for managed IT service providers, raised a $25.0M Series A from Base10 Partners. (more)

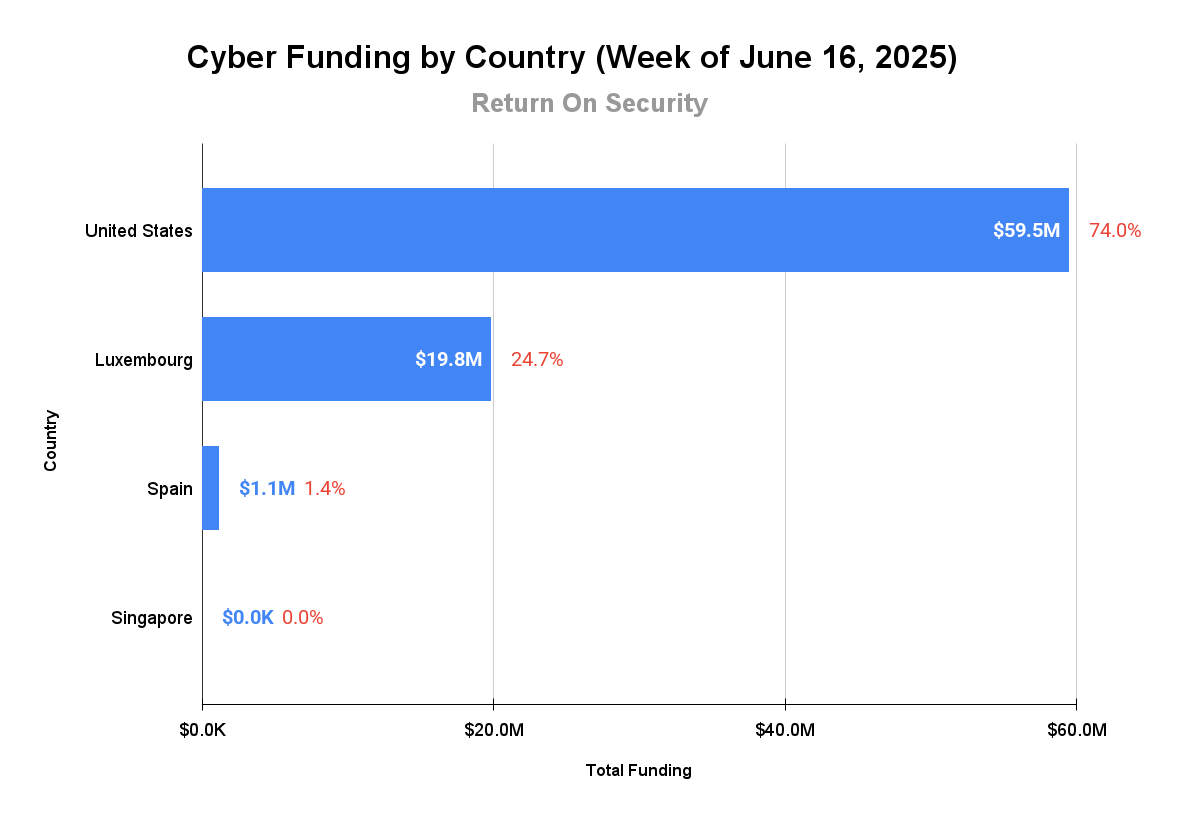

🌎 Funding By Country

$59.5M for the United States across 4 deals

$19.8M for Luxembourg across 1 deal

$1.1M for Spain across 1 deal

An undisclosed amount for Singapore across 1 deal

🤝 Mergers & Acquisitions

Product Companies:

Mesh, an Ireland-based email security platform, was acquired by Bitdefender for an undisclosed amount. Mesh had previously raised $1.7M in funding. (more)

Service Companies:

1nteger Security, a United States-based managed security services provider (MSSP), was acquired by Integris for an undisclosed amount. 1nteger Security has not previously disclosed any funding events. (more)

Entara, a United States-based managed security services provider (MSSP), was acquired by Abacus Group for an undisclosed amount. Entara has not previously disclosed any funding events. (more)

Gray Tier Technologies, a United States-based professional services firm focused on cybersecurity for mission-critical systems for the US military, was acquired by TDI (Tetrad Digital Integrity LLC) for an undisclosed amount. Gray Tier Technologies has not previously disclosed any funding events. (more)

Oktacron, a Serbia-based professional services firm focused on security operations and AI, was acquired by MDS Informatički inženjering for an undisclosed amount. Oktacron has not previously disclosed any funding events. (more)

📚 Great Reads

What sort of Security is in System Prompts? - My friend Rami McCarthy breaks down the built-in security context of popular AI models and AI coding assistants.

Trust Engineering: Building Security Leadership at Early-Stage Startups - Now in short blog post format! How to lead security at early-stage startups by building trust, driving growth, and aligning security with business priorities.

*A message from our partner

🧪 Labs

Security ROI > Coffee ROI

Get value every week? Back the mission.

Or forward this to someone smart.

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using the Return on Security system.

Sometimes deal details, like who led the round, how much was raised, or the deal stage, may be updated after publication.

Let us know if you spot any errors, and we’ll fix them.