Security, Funded by Return on Security, is a weekly analysis of the public and private economic activity in the cybersecurity market. This week’s issue is brought to you by Specops and Permiso Security.

Hey -

Hope you had a great and long weekend if you’re tuning in from the US!

Summer is officially over here in the UK, as in many other places in the Northern Hemisphere. I hope that you’ve had the chance to take a break this summer and do some fun and interesting things.

One of the coolest things for me is that I get to write this newsletter from just about anywhere in the world, and boy, did I test those boundaries this summer!

For my European homies (and those who like to travel) - if you’re considering attending Cybersec Netherlands 2025 next week, I’ll be giving one of the keynote talks on the state of the Cybersecurity Economy in Europe. You can register here if you’re interested.

A little over one quarter left in the year. It’s time to lock in. 😤👊

PARTNER

Your AD passwords are an open secret

Free tool to expose weak credentials

Attackers don’t guess... they use stolen passwords. And odds are, some of yours are already exposed. With Specops Password Auditor, IT can instantly uncover weak, shared, and breached credentials in Active Directory. Stop flying blind, run your free AD password audit today

Table of Contents

😎 Vibe Check

Click the options below to vote on whether you are a practitioner, founder, or investor. Feel free to leave a comment, and I'll feature the best takes in next week’s write-up!

How do you really use industry analyst reports?

Last issue’s vibe check:

Which compliance requirement makes the least actual security sense?

🟨🟨⬜️⬜️⬜️⬜️ 📝 Annual security training videos

🟩🟩🟩🟩🟩🟩 🔐 Password rotation every 90 days

🟨🟨🟨⬜️⬜️⬜️ 📋 Documenting the documentation

🟨🟨⬜️⬜️⬜️⬜️ ✅ All of the above (and more!)

Password rotations stole the show far and away here. I thought the annual security training would have seen more hate love, documenting the documentation (for compliance documents in the document repository, of course) came in a distant second. Even NIST no longer recommends forced password rotations for users unless there is evidence of a password compromise or breach.

When will the compliance world catch up?

Some of the top comments from last week’s vibe check:

💬 “Password rotation just ends up confusing people and being decorative. It should be implemented only if it can be done completely automatically without human interference. Password rotation for service accounts that are never logged into by a human? Yes please. Password rotation for a human? Fusty crusty policy. Better to use a password manager, or even passkeys stored in a password manager, accompanied with a separate authentication factor.”

💰 Market Summary

Private Markets

8 companies from 5 countries raised $31.0M across 8 unique product categories

Average deal size was $6.2M (median: $4.6M)

100% of funding went to product companies

5 companies from 5 countries were acquired for $390.0M

60% of M&A activity went to product companies

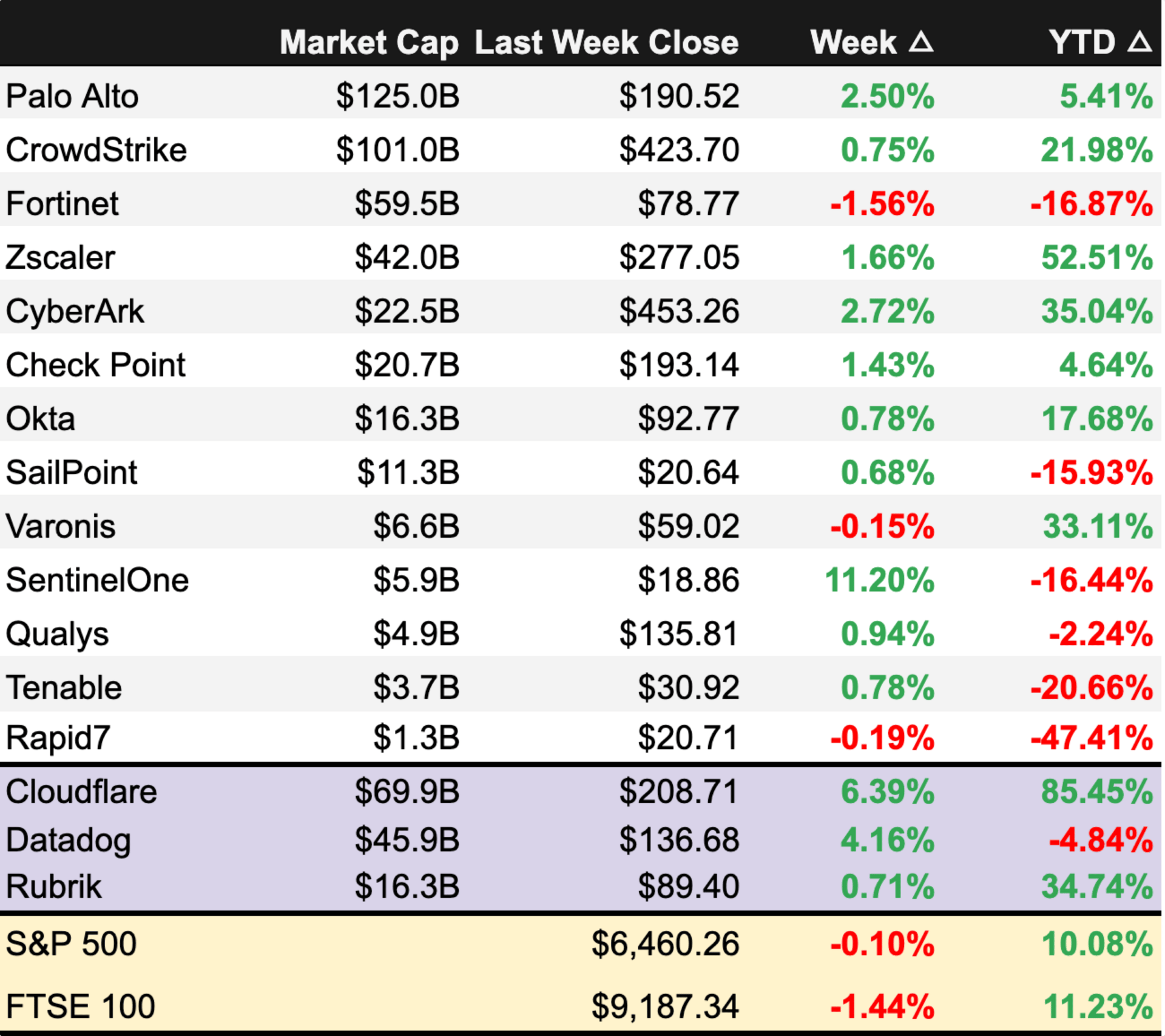

Public Markets

3 public cyber companies had an earnings report

As of market close on August 29, 2025.

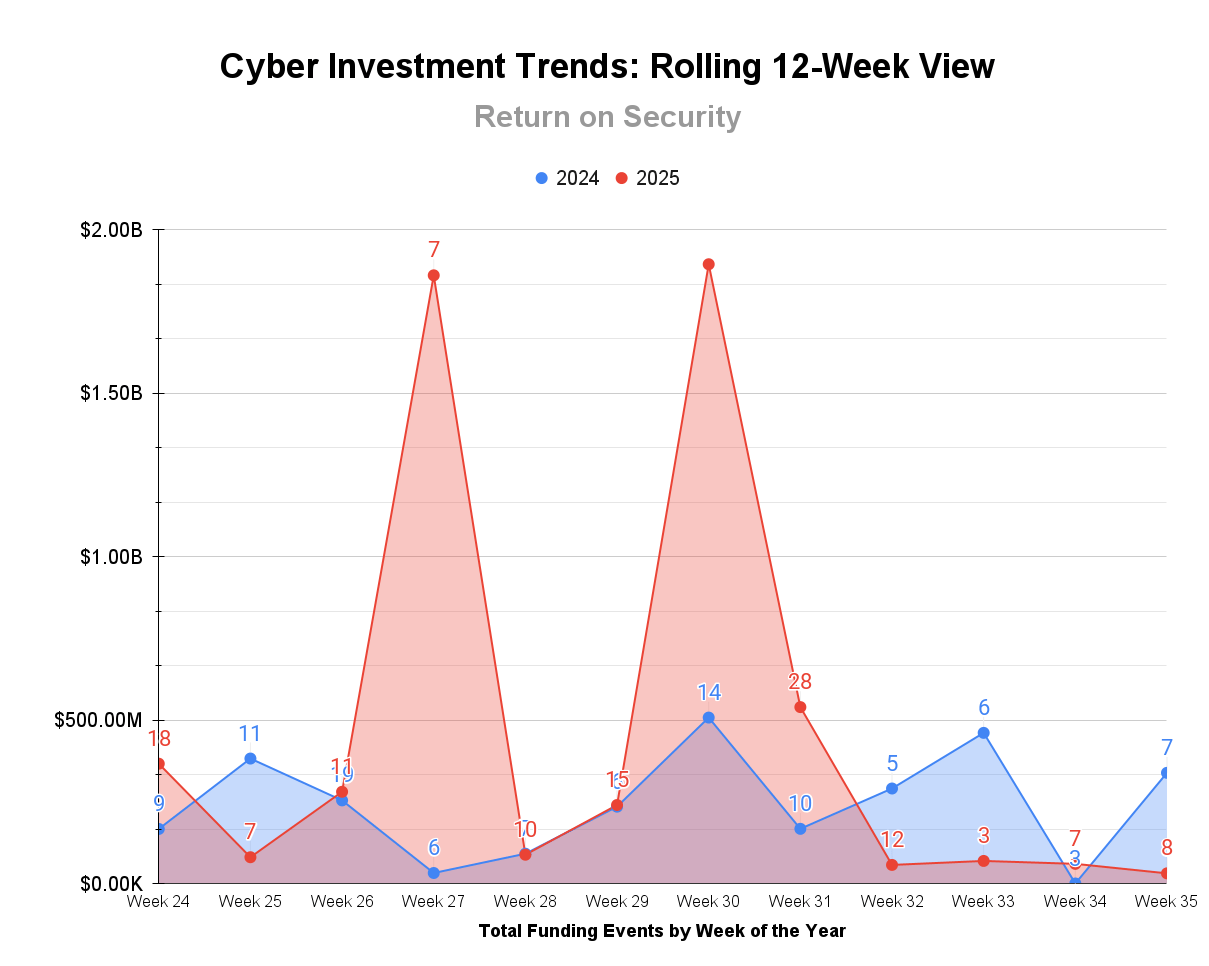

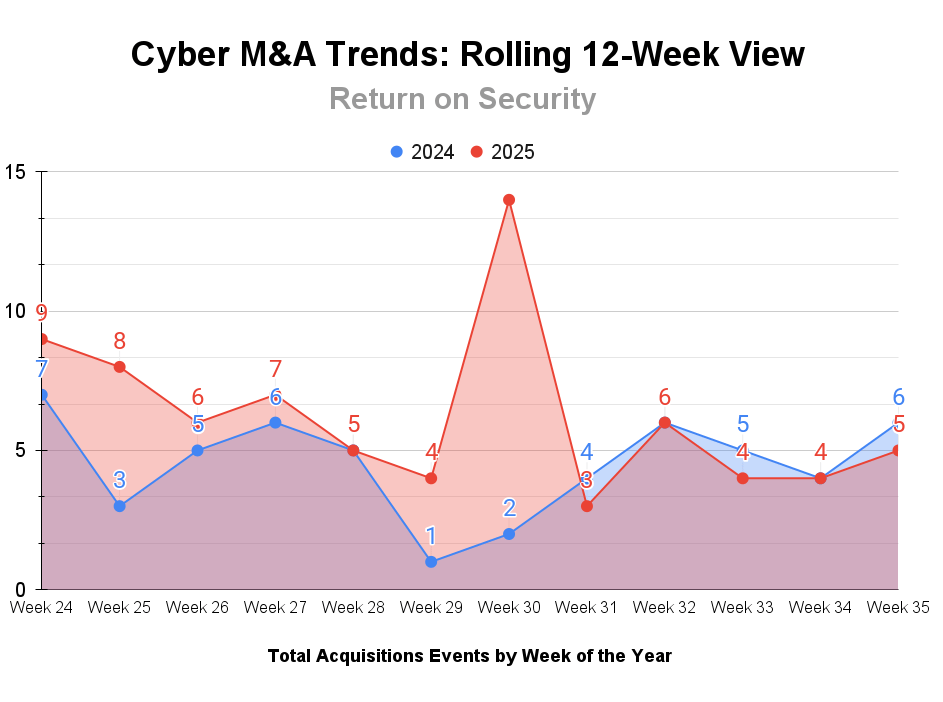

📸 YoY Snapshot

Rolling 12-week charts that compare funding and acquisitions weekly in a year-over-year (YoY) view between 2024 and 2025.

Funding activity over the past 12 weeks totaled $5.2B across 122 deals (mean: $50.0M, median: $6.9M), representing a 40% increase compared to the same period last year when $3.7B was invested across 130 deals.

M&A activity remained strong with 71 acquisitions completed over the trailing 12 weeks (averaging 5.9 per week). This represents a 15% increase from the 62 acquisitions during the same period in the previous year.

PARTNER

Discover Every Identity. Protect Against Exposures. Defend With Speed.

Clarity and speed for identity and security teams

Permiso's platform unifies all identities (human, NHI, and AI) across all environments. Powered by a universal identity graph, we track activity, risk, and threats in real time, cutting investigations from hours to minutes by correlating logs and building timelines automatically. This way, your team can focus on stopping threats instead of chasing data.

☎️ Earnings Reports

You’ll need to be a subscriber to view this section.

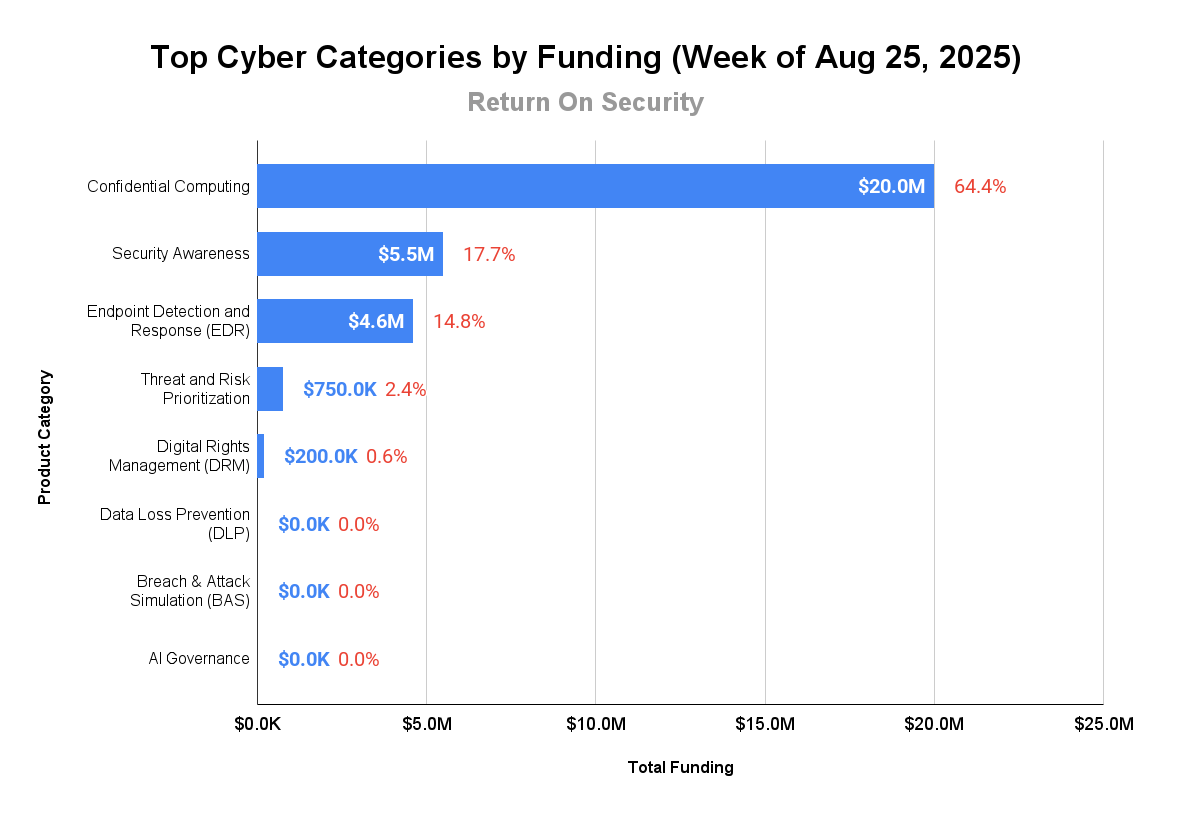

🧩 Funding By Product Category

$20.0M for Confidential Computing across 1 deal

$5.5M for Security Awareness across 1 deal

$4.6M for Endpoint Detection and Response (EDR) across 1 deal

$750.0K for Threat and Risk Prioritization across 1 deal

$200.0K for Digital Rights Management (DRM) across 1 deal

An undisclosed amount for Breach & Attack Simulation (BAS) across 1 deal

An undisclosed amount for AI Governance across 1 deal

An undisclosed amount for Data Loss Prevention (DLP) across 1 deal

🏢 Funding By Company

Product Companies:

HUB Security, an Israel-based confidential computing platform, raised a $20.0M Post-IPO Equity. (more)

Moxso, a Denmark-based security awareness training and phishing simulation platform, raised a $5.5M Seed from Seed Capital Partners. (more)

Vali Cyber, a United States-based endpoint detection and response (EDR) platform focused on Linux, raised a $4.6M Venture Round. (more)

ThreatCaptain, a United States-based threat and risk prioritization platform for MSSPs, raised a $750.0K Pre-Seed from Founderville.VC.

Honeycake, a United States-based secure file sharing and rights management platform, raised a $200.0K Angel from SilverCircle and various angels.

RedMimicry, a Germany-based breach and attack simulation platform, raised an undisclosed Seed from HTGF (High-Tech Gruenderfonds). (more)

TrustWorks, a Spain-based AI data governance and privacy platform, raised an undisclosed Seed from Elkstone Ventures. (more)

InnerActiv, a United States-based insider risk and data loss prevention platform, raised an undisclosed Venture Round from Blu Ventures Investors and North Coast Ventures. (more)

Service Companies:

None

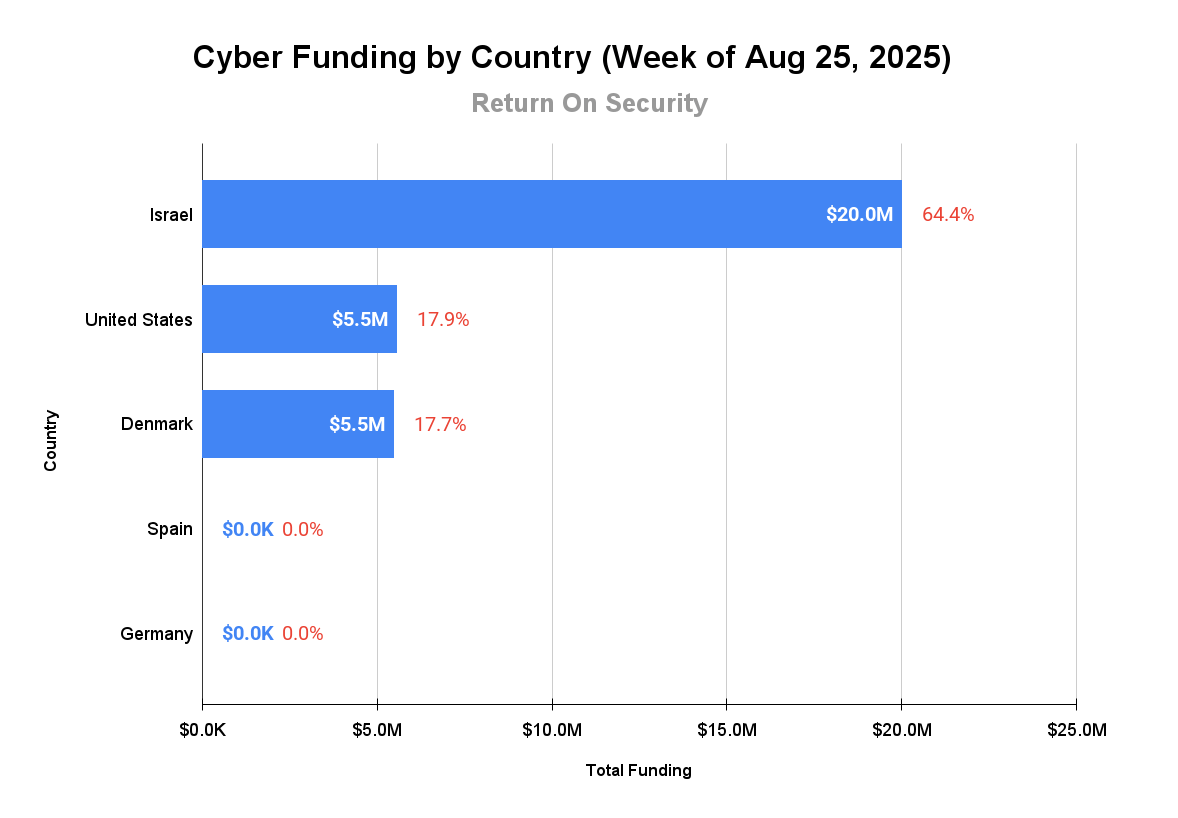

🌎 Funding By Country

$20.0M for Israel across 1 deal

$5.5M for the United States across 4 deals

$5.5M for Denmark across 1 deal

An undisclosed amount for Germany across 1 deal

An undisclosed amount for Spain across 1 deal

🤝 Mergers & Acquisitions

Product Companies:

ONUM, a Spain-based security analytics and data observability platform, was acquired by CrowdStrike for $290.0M. ONUM had previously raised $28.0M in funding. (more)

Zorse Cyber, a United States-based email security and anti-phishing platform, was acquired by ImageSource for an undisclosed amount. Zorse Cyber has not previously disclosed any funding events. (more)

Service Companies:

Trifork Security, a Denmark-based professional services firm focused on security and observability data consulting, was acquired by Wingmen Solutions for an undisclosed amount. Trifork Security has not previously disclosed any funding events. (more)

📚 Great Reads

Intent Over Tactics: A CISO's Guide to Protecting Your Crown Jewels - Caleb Sima writes a practical guide to protecting your most critical assets when budget, headcount, and political capital are tight.

Phishing Emails Are Now Aimed at Users and AI Defenses - Phishing has always been about deceiving people, but a threat researcher discovered that attacker approaches are changing. Not only are they targeting users, but they are also acknowledging the presence of AI in the defensive stack and trying to attack it.

*A message from our partner

🧪 Labs

Security ROI > Coffee ROI

Get value every week? Back the mission.

Or send your smart friends a referral.

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. Dollars (USD) at the current spot rate at the time of collection.

Company country locations are pulled from publicly available sources.

Companies are categorized using the Return on Security system.

Sometimes the deal details, such as who led the round, how much was raised, or the deal stage, may be updated after publication.

Let us know if you spot any errors, and we’ll fix them.