Security, Funded by Return on Security, is a weekly analysis of the public and private economic activity in the cybersecurity market. This week’s issue is brought to you by Palo Alto Networks and Permiso Security.

Hey -

I hope you had a great weekend!

Look, ma, new charts! 📊

I’ve been working on creating higher-quality visuals for the newsletter, so while I’m in Build Mode, please let me know if there is any new data or charts you’d like to see. Making these charts has reminded me of one of my favorite quotes:

“What’s in a chart? That which we call unstructured data by any other name would be transformed into actionable insights to align stakeholders.”

Gotta love the classics

Also, an open call - if you’re at a VC or PE firm and you’ve raised a new fund this year to invest (mostly) in cyber, I want to hear about it and will start tracking these as I capture more of what runs the cybersecurity economy.

PARTNER

Are Self-Managed AI Models Putting You at Risk?

Discover and secure blind spots in AI infrastructure

Self-managed AI models offer control—but also introduce hidden risks. From shadow AI deployments to malicious model supply chains, discover why self-hosted models can become major blind spots.

Learn how Cortex Cloud provides visibility and protection for AI models you run yourself.

Table of Contents

😎 Vibe Check

Click the options below to vote on whether you are a practitioner, founder, or investor. Feel free to leave a comment, and I'll feature the best takes in next week’s write-up!

How would you describe the structure of your organization's AI governance committee?

Last issue’s vibe check:

How would you honestly describe your AI governance right now?

🟩🟩🟩🟩🟩🟩 📋 Basic guidelines that hopefully someone follows

🟨🟨🟨⬜️⬜️⬜️ 🤞 "Use your best judgment" approach

🟨🟨🟨⬜️⬜️⬜️ 📊 Comprehensive policies with regular reviews

🟨🟨🟨🟨⬜️⬜️ 🆘 What governance? We're just trying to keep up!

Well, it seems that the future is here, it’s just not evenly distributed. Not when it comes to the matter of AI Governance, at least. I think a “basic guidelines” approach is a great place to start, so long as you work to find and understand what people are actually using. Otherwise, you’re just wishing things would go the right way.

I know this is a fast-moving space, and over the next few weeks, we’re going to explore it further and collectively gain a better understanding of AI Governance. Let’s get this bread together, family. 🥐 😤 👊

Some of the top comments from last week’s vibe check:

💬 "Too busy firefighting to do fire prevention.”

💰 Market Summary

Private Markets

10 companies from 3 countries raised $94.6M across 10 unique product categories

Average deal size was $9.5M (median: $6.5M)

78% of funding went to product companies

6 companies from 4 countries were acquired for $450.0M

67% of M&A activity went to product companies

Public Markets

No public cyber companies had an earnings report

As of market close on September 26, 2025.

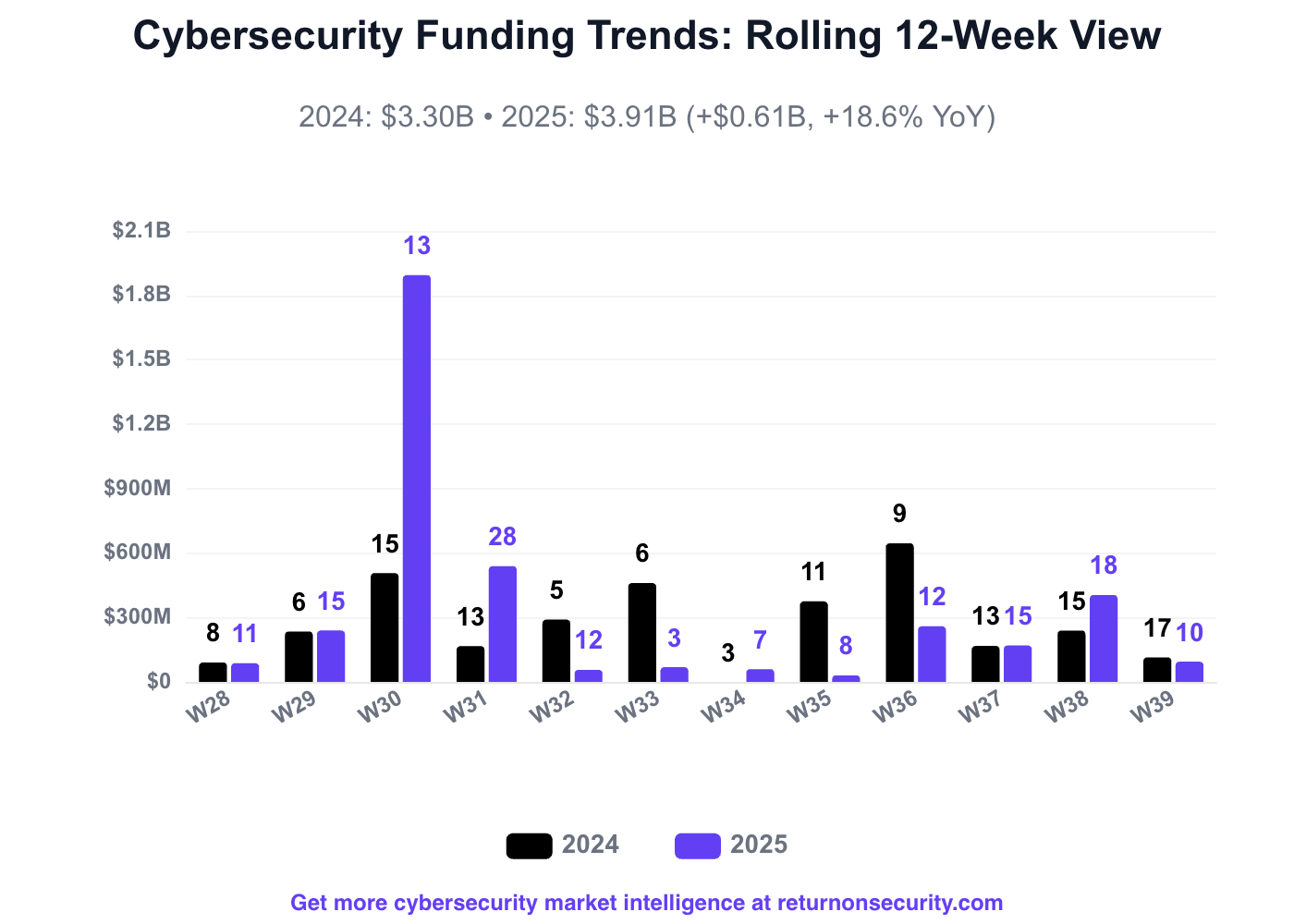

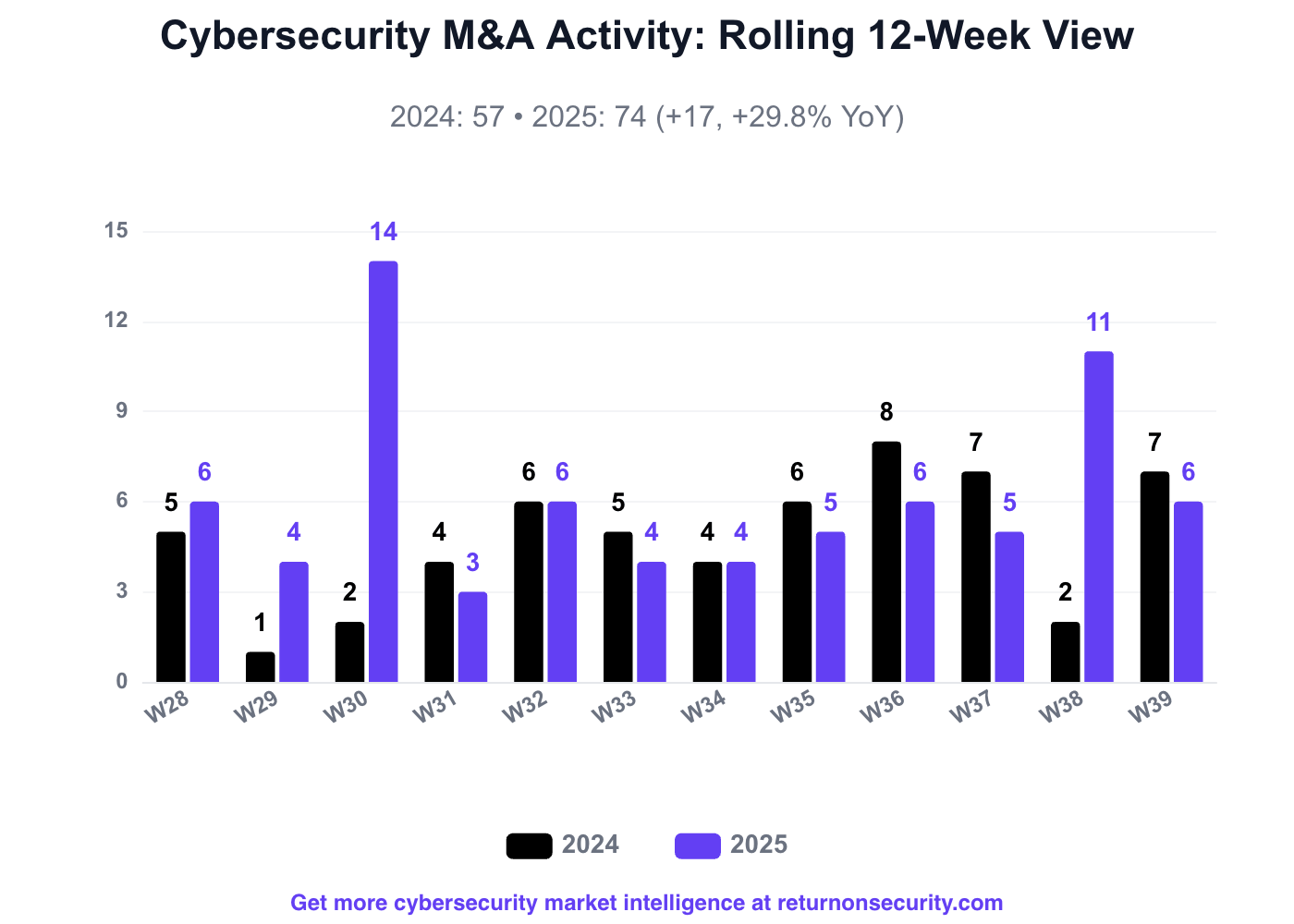

📸 YoY Snapshot

Rolling 12-week charts that compare funding and acquisitions weekly in a year-over-year (YoY) view between 2024 and 2025.

Funding activity over the past 12 weeks totaled $3.9B across 153 deals (mean: $29.2M, median: $7.0M), representing a 19% increase compared to the same period last year, when $3.3B was invested across 121 deals.

M&A activity remained strong with 75 acquisitions completed over the trailing 12 weeks (averaging 6.2 per week), a 32% increase from the 57 acquisitions during the same period in the previous year.

PARTNER

Rethinking AI Security Through the Lens of Identity

Stronger Governance & Reduced Risk

AI is reshaping the enterprise threat landscape, but traditional controls fall short. The real risk? Identity. Every interaction with AI, from human prompts to autonomous agents, is an identity transaction. Learn how reframing AI security around identity helps executives govern access, mitigate risk, and protect critical assets.

☎️ Earnings Reports

This analysis is personal research and opinions only. This is not financial or investing advice. Do your own due diligence before making investment decisions.

Earnings reports from last week: None

Earning reports to watch this coming week: None

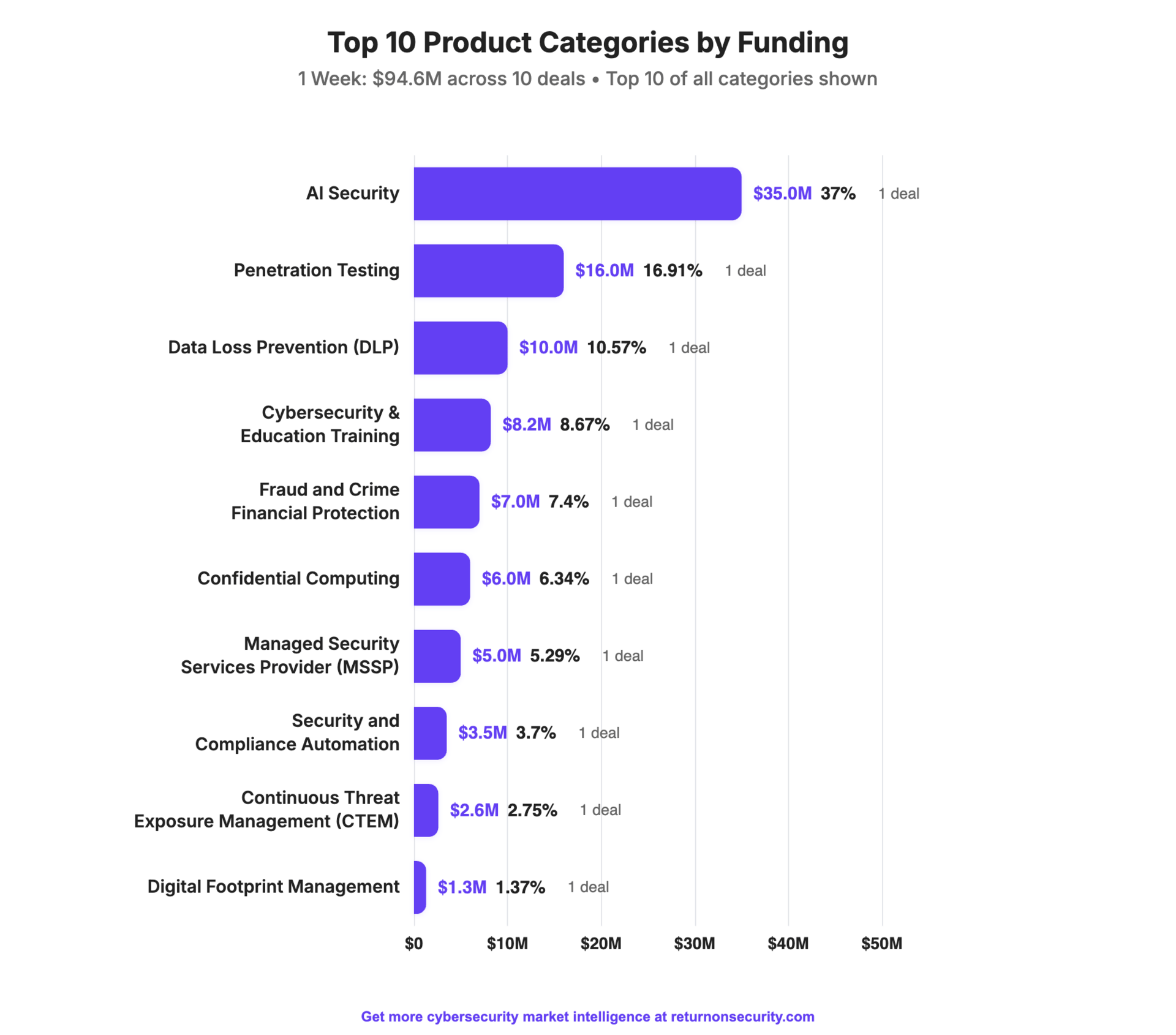

🧩 Funding By Product Category

$35.0M for AI Security across 1 deal

$16.0M for Penetration Testing across 1 deal

$10.0M for Data Loss Prevention (DLP) across 1 deal

$8.2M for Cybersecurity Education & Training across 1 deal

$7.0M for Fraud and Financial Crime Protection across 1 deal

$6.0M for Confidential Computing across 1 deal

$5.0M for Managed Security Services Provider (MSSP) across 1 deal

$3.5M for Security and Compliance Automation across 1 deal

$2.6M for Continuous Threat Exposure Management (CTEM) across 1 deal

$1.3M for Digital Footprint Management across 1 deal

🏢 Funding By Company

Product Companies:

Obot AI, a United States-based open-source control plane to manage and secure MCP servers, raised a $35.0M Seed from Mayfield Fund and Nexus Venture Partners. (more)

Prelude, a United States-based automated security testing platform, raised a $16.0M Venture Round from Brightmind Partners. (more)

InCountry, a United States-based data loss prevention platform for agentic AI workflows, raised a $10.0M Venture Round from Arbor Ventures. (more)

Cloudburst Technologies, a United States-based cyber threat intelligence and fraud detection for cryptocurrency transactions, raised a $7.0M Series A from Borderless Capital. (more)

Belfort, a United States-based encrypted confidential computing platform, raised a $6.0M Seed from Vsquared Ventures. (more)

Mycroft, a Canada-based agentic AI platform supporting security and compliance automation, raised a $3.5M Seed from Luge Capital. (more)

SafeHill, a United States-based continuous threat exposure management platform, raised a $2.6M Pre-Seed from Mucker Capital. (more)

Service Companies:

Unit 221b, a United States-based managed security services and penetration testing firm, raised a $5.0M Seed from J2 Ventures. (more)

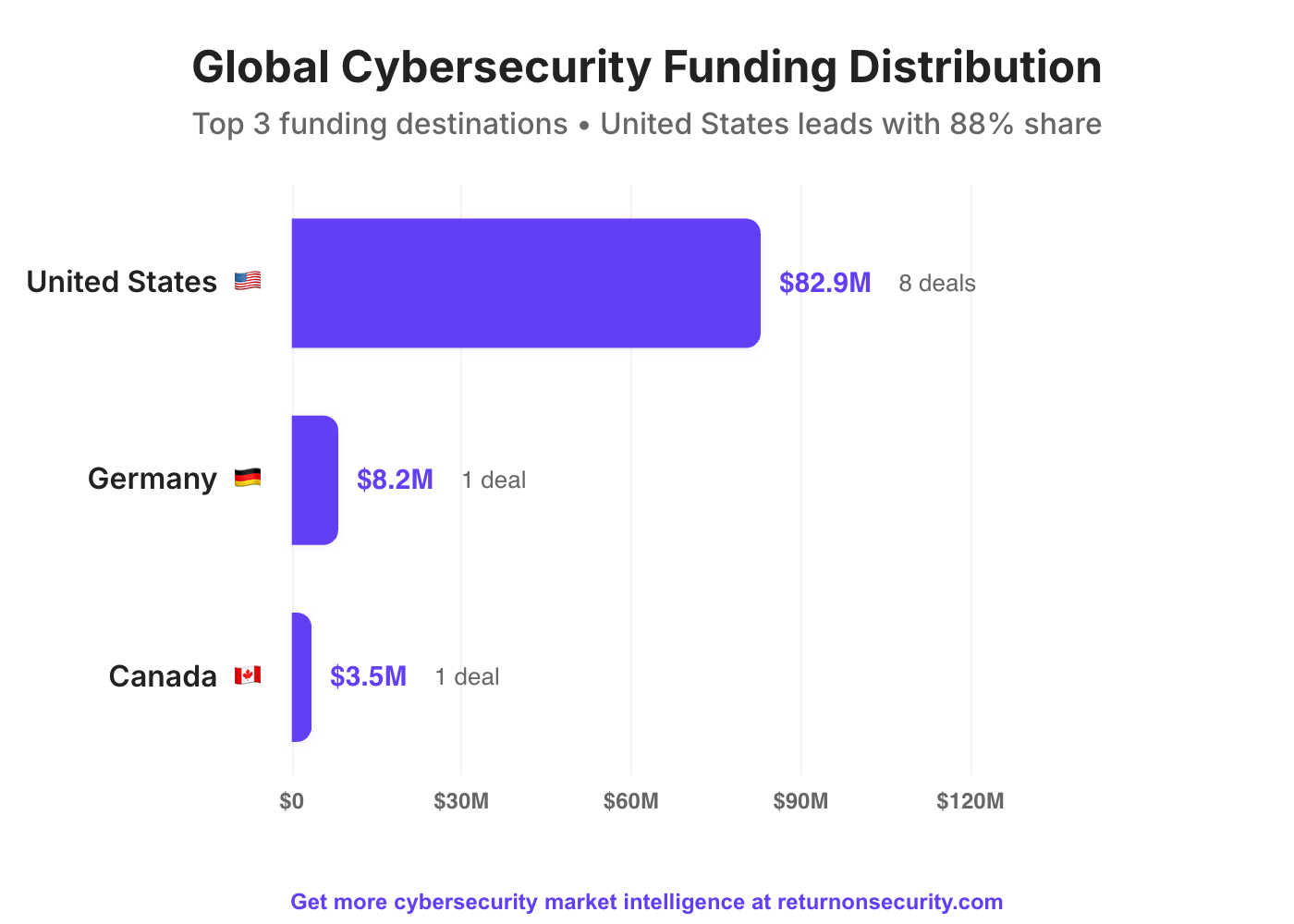

🌎 Funding By Country

$82.9M for the United States across 8 deals

$8.2M for Germany across 1 deal

$3.5M for Canada across 1 deal

🤝 Mergers & Acquisitions

Product Companies:

MarkMonitor, a United States-based brand fraud and abuse monitoring platform, was acquired by Com Laude for $450.0M. MarkMonitor had previously raised $45.4M in funding. (more)

Allseek, a Belgium-based continuous penetration testing platform, was acquired by Aikido Security for an undisclosed amount. Allseek has not previously disclosed any funding events. (more)

Haicker, a Switzerland-based continuous AI penetration testing platform, was acquired by Aikido Security for an undisclosed amount. Haicker had previously raised $260159 in funding. (more)

Service Companies:

RangeForce, a United States-based cyber defensive education and training platform, was acquired by Cyberbit for an undisclosed amount. RangeForce had previously raised $38.1M in funding. (more)

Security Compliance Associates, a United States-based professional services firm focused on security and compliance assessments, was acquired by 360 Advanced for an undisclosed amount. Security Compliance Associates has not previously disclosed any funding events. (more)

📚 Great Reads

Good CISO / Bad CISO - This post outlines the key differences between effective and ineffective CISOs, emphasizing that successful security leaders are business executives who manage technology risk rather than just IT managers who manage security tools.

That Secret Service SIM Farm Story is Bogus - A fascinating take on the recent "national security threat" that the US Secret Service took down. The secret ingredient is crime.

*A message from our partner

🧪 Labs

Well, that’s a relief! 😮💨

Security ROI > Coffee ROI

Get value every week? Back the mission.

Or send your smart friends a referral.

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. Dollars (USD) at the current spot rate at the time of collection.

Company country locations are pulled from publicly available sources.

Companies are categorized using the Return on Security system.

Sometimes the deal details, such as who led the round, how much was raised, or the deal stage, may be updated after publication.

Let us know if you spot any errors, and we’ll fix them.