Hey there,

Happy Monday! I hope you had a great weekend and welcome to the 100th issue of the Security, Funded newsletter! 🥳

🏃♂️ The Rundown

A meta roundup of all the important things affecting cybersecurity and the microenvironment:

🎯 Major cyber AI investments close Q2

💡 BlackBerry’s cybersecurity sales surge

🚀 Yet Another New Product Category (YANPC)

🧩 Challenges in pentesting LLMs and AI systems

🤔 AI privacy vs. personalized AI agent future conflict

🎉 Large volume of deals mark cybersecurity's comeback

Heads up - Today’s issue is going to be a long one based on how many transactions there were last week and your email provider might cut it short. I suggest reading this issue online here if you can.

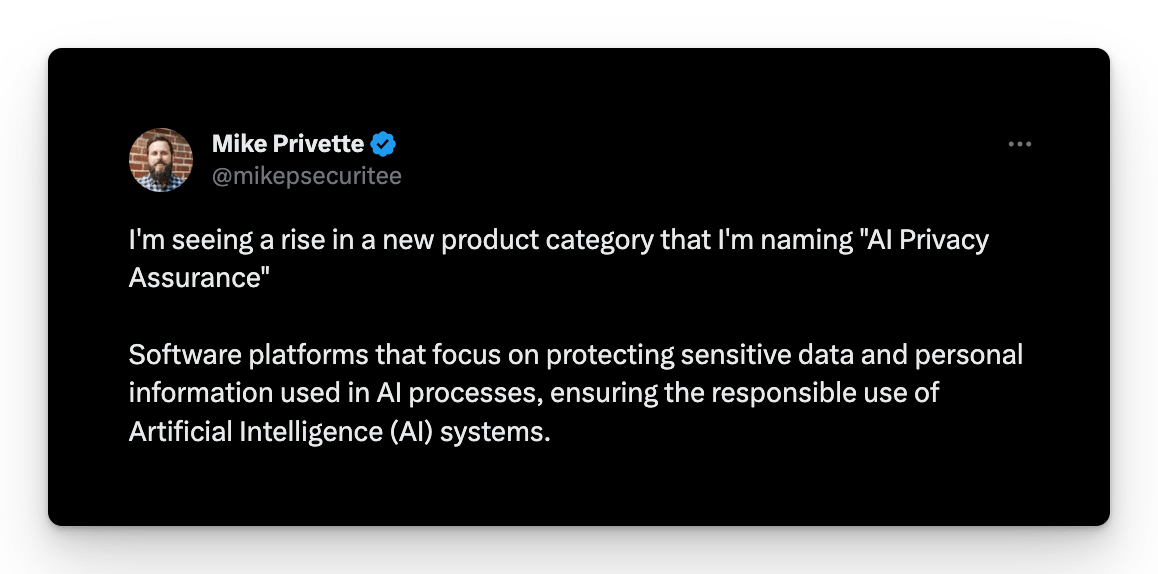

Yet Another New Product Category (YANPC) - this time with something I’m calling “AI Privacy Assurance.” You’ll see a few companies below falling into this new privacy-preserving and AI usage world, and I think this is a really important area for the world to be focusing on.

This effort, however, will be at direct odds with the personalized AI agent that does lots of work for you future that many people want to see come true.

I’ve loved keeping it 💯 with you all on this newsletter! Thank you for being here, and thank you for your kind words, support, feedback, and encouragement over these last two years. Here’s to the next 100!

Onward to this week's issue.

🗣Sponsor

Get compliant in weeks not months

What makes Secureframe different?

Get audit-ready and achieve compliance in weeks, not months with built-in remediation guidance and 100+ integrations.

Stay compliant with the latest regulations and requirements including ISO 27001, GDPR, HIPAA, PCI, and other standards.

Automate responses to RFPs and security questionnaires with AI.

Secureframe’s NEW Comply AI can help you remediate failing controls, generate fixes for IaC, or provide tailored guidance for meeting technical compliance requirements.

Thousands of companies already use Secureframe to achieve and maintain continuous security and privacy compliance

🔮 Earnings Reports

A section for notable earnings reports from public cybersecurity companies, be they “pure play” or hybrid companies:

BlackBerry ($BB) - I wouldn’t normally cover BlackBerry, as they are more of a hybrid player (meaning their primary business is not just cybersecurity), but I decided to include them this week because of their earnings report.

BlackBerry beat its earnings report off the back of increased cybersecurity sales, specifically to the US federal market. Every few years, BlackBerry seems to make some head scratching headway into the cybersecurity market, and this is one of those years.

If you’re looking for a great read about the meteoric rise and fall of BlackBerry, check out Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry

🛞 Industry News Roundup

📅 YTD Funding

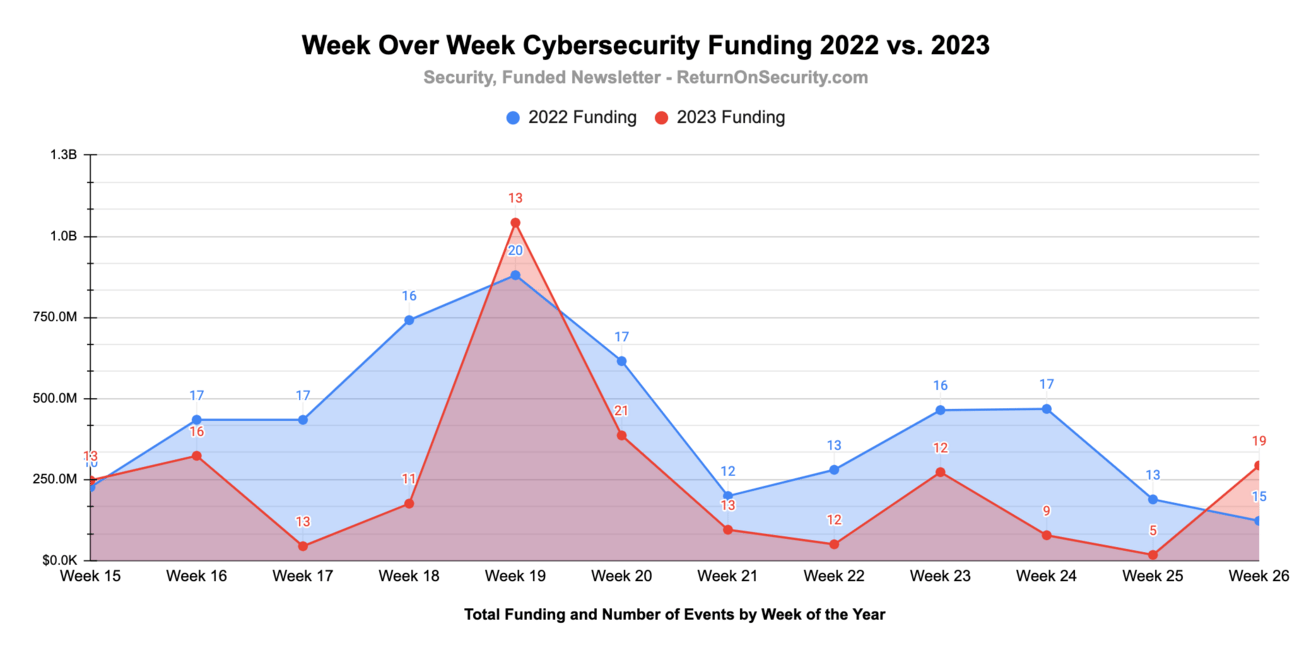

A rolling 12-week chart to compare funding each week between 2022 and 2023.

Remember last week when I said that I thought things were quiet so investors and founders could focus on generative AI applications for cybersecurity? And then this week, there was a big wave of cyber + AI investments to finish out Q2?

Even though cyber funding is down ~43% as compared to Q2 2022, I think we are just getting started with this new wave of AI-led cyber investments. Valuations are starting to go back up, growth rounds are starting to look like absolute units again, and marketing efforts are on overdrive. Oh man, we are so back 😤👊

I’m not keeping score or anything, but many of the 2023 predictions I made late last year are continuing to come true. 👀

💰 Funding Summary

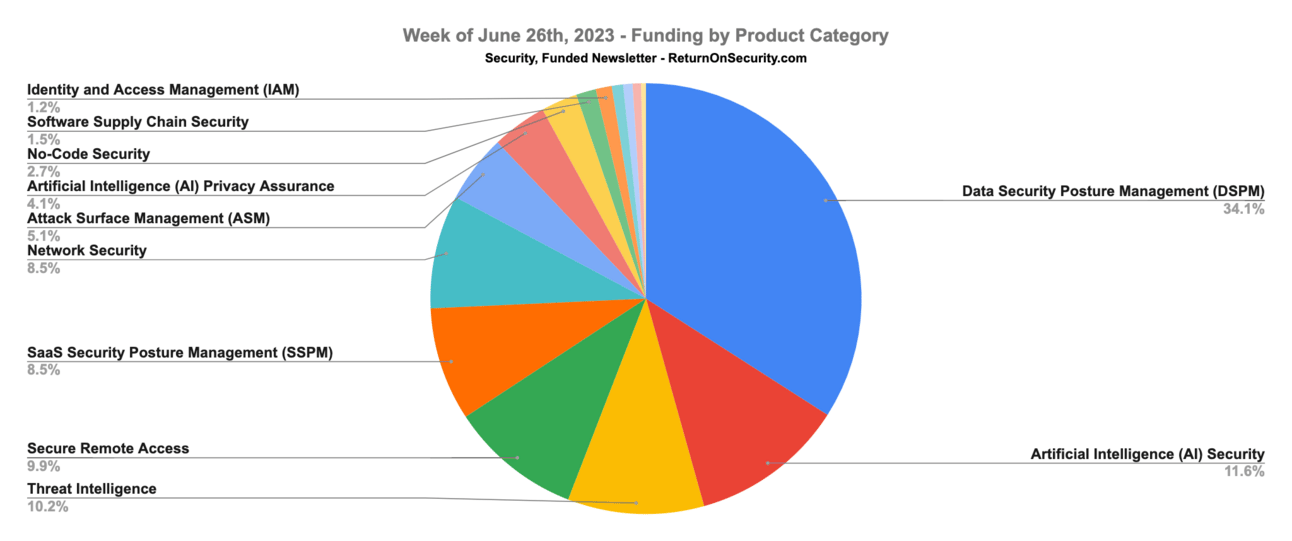

19 companies raised $293.5M across 17 unique product categories

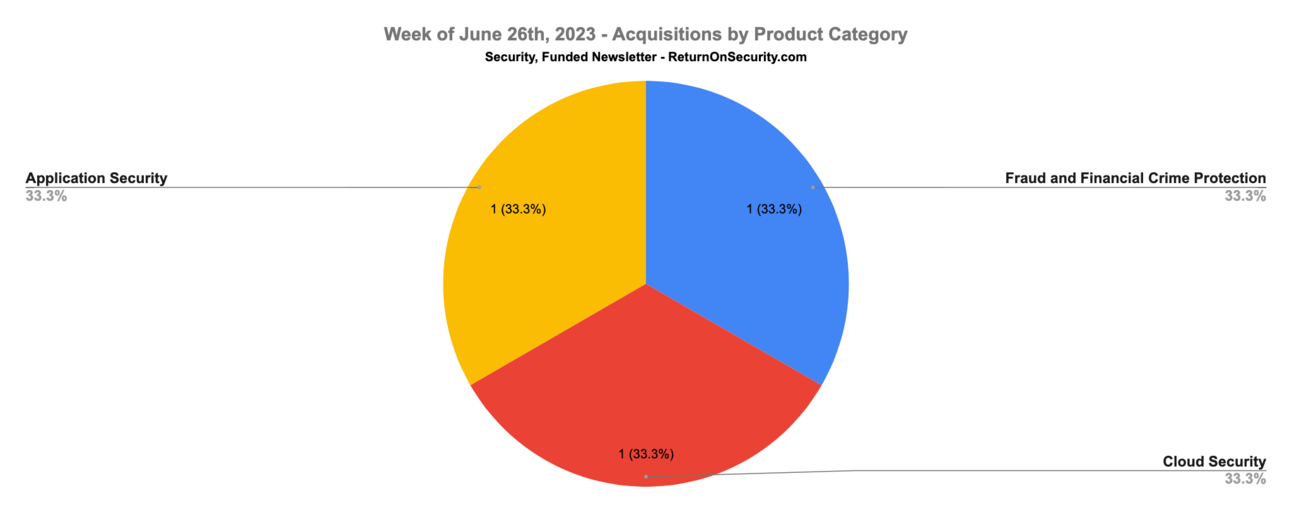

3 companies were acquired or had a merger event across 3 unique product categories for $70.0M

🧩 Funding By Product Category

$15.0M for Identity and Access Management (IAM) across 1 deal

$100.0M for Data Security Posture Management (DSPM) across 1 deal

$34.0M for Artificial Intelligence (AI) Security across 2 deals

$30.0M for Threat Intelligence across 1 deal

$29.0M for Secure Remote Access across 1 deal

$25.0M for SaaS Security Posture Management (SSPM) across 1 deal

$25.0M for Network Security across 1 deal

$15.0M for Attack Surface Management (ASM) across 1 deal

$12.1M for Artificial Intelligence (AI) Privacy Assurance across 2 deals

$8.0M for No-Code Security across 1 deal

$4.4M for Software Supply Chain Security across 1 deal

$3.5M for Identity and Access Management (IAM) across 1 deal

$2.5M for Fraud and Financial Crime Protection across 1 deal

$2.1M for Cyber Insurance

$1.9M for Application Security

$1.1M for Managed Security Services Provider (MSSP)

An undisclosed amount for Trust & Safety

An undisclosed amount for Data Access Governance

🏢 Funding By Company

Cyware, a United States-based cyber threat intelligence platform, raised a $30.0M Series C from Ten Eleven Ventures. (more)

Astrix Security, an Israel-based access management platform for third-party applications and integrations, raised a $25.0M Series A from CRV. (more)

Calypso AI, a United States-based platform for securing Large Language Model (LLM) usage, raised a $23.0M Series A from Paladin Capital Group. (more)

Sevco Security, a United States-based attack surface management (ASM), raised a $15.0M Venture Round.

BeeKeeperAI, a United States-based platform allowing AI workloads to work with privacy-protected data in a secure manner, raised a $12.1M Series A from Sante Ventures. (more)

Resistant AI, a Czechia-based platform to protect AI systems from adversarial machine learning attacks and advanced fraud, raised an $11.0M Series A from Notion Capital. (more)

Nokod Security, an Israel-based no-code and low-code application security platform, raised an $8.0M Seed from [Acrew Capital, Flint Capital, and Meron Capital. (more)

Xygeni, a Spain-based software supply chain security platform, raised a $4.4M Seed from Investing Profit Wisely.

0pass, a United States-based hardware-based authentication platform, raised a $3.5M Seed from Initialized Capital. (more)

Outdid, a United Kingdom-based identity verification platform, raised a $2.5M Seed from Jump Crypto and Superscrypt. (more)

1Fort, a United States-based cyber insurance and managed security company for SMBs, raised a $2.1M Pre-Seed from 8-Bit Capital, BrokerTech Ventures, Character, Company Ventures, Operator Partners, and Village Global. (more)

Invary, a United States-based runtime application security platform, raised a $1.9M Pre-Seed from Flyover Capital. (more)

BonjourCyber, a France-based managed security services provider (MSSP), raised a $1.1M Seed. (more)

Congruity360, a United States-based data access governance, raised an undisclosed Venture Round from G20 Ventures and Schooner Capital.

Reality Defender, a United States-based AI deepfake detection platform for media networks, raised an undisclosed Seed from Comcast NBCUniversal LIFT Labs.

Tibo, a Singapore-based platform for removing sensitive information when using AI and LLM systems, raised an undisclosed Seed from Oak Seed Ventures. (more)

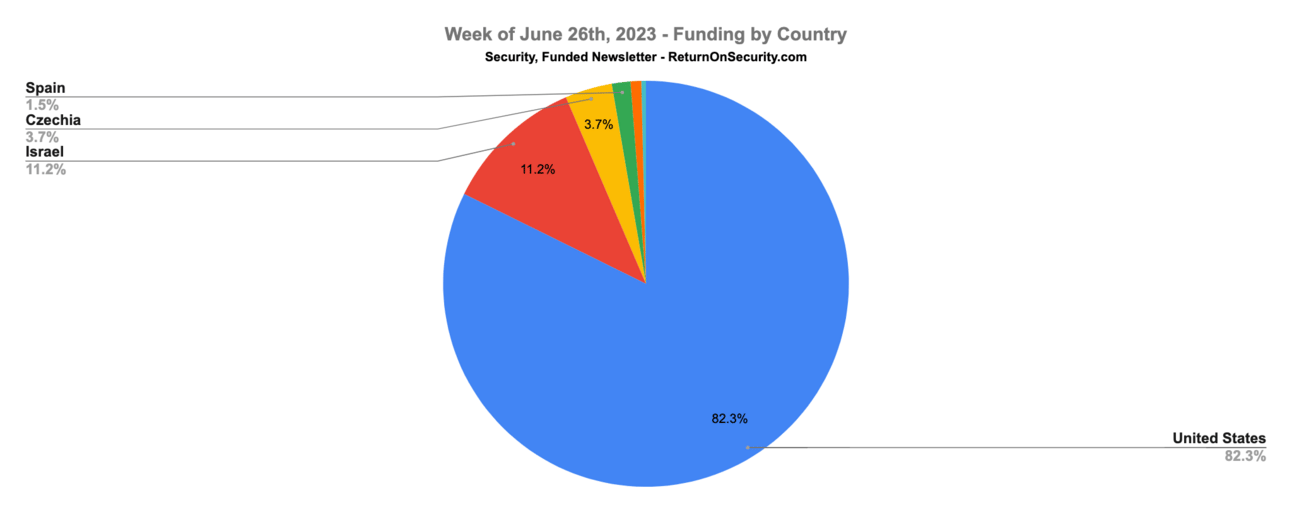

🌎 Funding By Country

$241.5M for United States across 12 deals 🇺🇸

$33.0M for Israel across 2 deals 🇮🇱

$11.0M for Czechia across 1 deal 🇨🇿

$4.4M for Spain across 1 deal 🇪🇸

$2.5M for United Kingdom across 1 deal 🇬🇧

$1.1M for France across 1 deal 🇫🇷

An undisclosed amount for Singapore across 1 deal 🇸🇬

🗣Sponsor

Gomboc is a Top 4 finalist in the 2023 Black Hat Startup Spotlight Competition. Come watch our talk at the Startup City or visit our exhibit in the Business Hall! We’ll also be throwing a Whiskey Tasting Experience on August 9th!

Gomboc uses a deterministic AI engine that continuously pushes secure, context-aware IaC remediations straight to your CI/CD pipeline as pull requests. With Gomboc, your DevOps engineers can remediate cloud security issues just by hitting Approve.

🤝 Mergers & Acquisitions

BluBracket, a United States-based code security platform that checks for security and integrity issues, was acquired by HashiCorp for an undisclosed amount. (more)

Horangi, a Singapore-based cloud security platform, was acquired by Bitdefender for an undisclosed amount. (more)

📚 Great Reads

The Challenges with LLM Pentesting - Garrett Galloway’s take on the multi-faceted complexities around penetration testing Large Language Models (LLMs) and generative AI systems.

Cybersecurity Interview Questions Collections - Security interview questions for different security skills with possible explanations. This GitHub repo is for security professionals who want to make themselves ready for various security roles from different skill sets like appsec, DevSecOps, and cloud security.

Building Security Tools is the Wrong Approach - If we want mass adoption of security technology and to have a truly meaningful impact on the state of software security, we have to stop building security tools and start building developer tools that have security features.

🧪 Labs

Plz think before you share sensitive data 😥

How was this week's newsletter?

✅ Here to Support

Whenever you’re ready, I’ve got a few ways I can help support you:

Promote your business to a hard-to-reach audience of cybersecurity and investment professionals by sponsoring this newsletter.

Schedule a 1:1 coaching call on newsletters, monetizing, cybersecurity trends, product strategy, or anything else.