Security, Funded is a weekly deep dive into cybersecurity funding and industry news, captured and analyzed by Mike Privette. This week’s report is sponsored by Semgrep & SafeBase.

Hey there,

Happy Monday, and I hope you had a great weekend! In this issue, we’ve got:

😓 Dry January

⬆️ Quantum Leaps

🔒Trust is Trending

🤠 We Might Be So Back

Speaking of trust, I wanted to give a quick shoutout to my friend Ross Haleliuk from Venture in Security and congratulate him on launching his new book:

Which has already become a best-seller in just a few weeks! This book has commentary and insights from 50+ people from the cybersecurity and investing community (myself included) and is a must-read for anyone in the startup, entrepreneur, and investing spaces. Thanks to Ross for including me!

Onward to this week's issue.

Submit a deal for the newsletter here: [email protected]

🗣Sponsor

Boost Your Brand With Cybersecurity Leaders

Showcase your brand to cybersecurity’s elite

If you would like to get your company seen by over 7,500 of the smartest and most influential people in cybersecurity, tech, and investing, you should reach out and get on the calendar.

Learn more about sponsoring | Learn more about upgrading

What will cybersecurity acquisitions in 2024 look like?

Last issue’s vibe check:

What will cybersecurity funding in 2024 look like?

🟨⬜️⬜️⬜️⬜️⬜️ 😳 It will decrease again (9)

🟩🟩🟩🟩🟩🟩 😬 It will stay flat (30)

🟨🟨🟨🟨⬜️⬜️ 😎 We will be so back (25)

64 Votes

While most people feel like cybersecurity funding is going to stay flat for 2024, there is a strong contingent who believes we will be so back! There is momentum in the cybersecurity industry, and it’s something people can feel. I am personally in the we will be so back camp 😎

Some of the top comments from those saying funding will stay flat were:

“Folks are going to continue to be somewhat conservative until they feel we are on the other side of this downturn.”

“The IPO pipeline is frozen, there's still a ton of uncertainty in the broader market, and rates are going to remain restrictive for at least the first half of the year.”

One comment that made me lol about decreasing again:

“It's normal, we are used to it.”

🔮 Earnings Reports

A section for notable earnings reports from public cybersecurity companies, be they “pure play” or hybrid companies.

None to report on from last week. 🫡

📸 YoY Snapshot

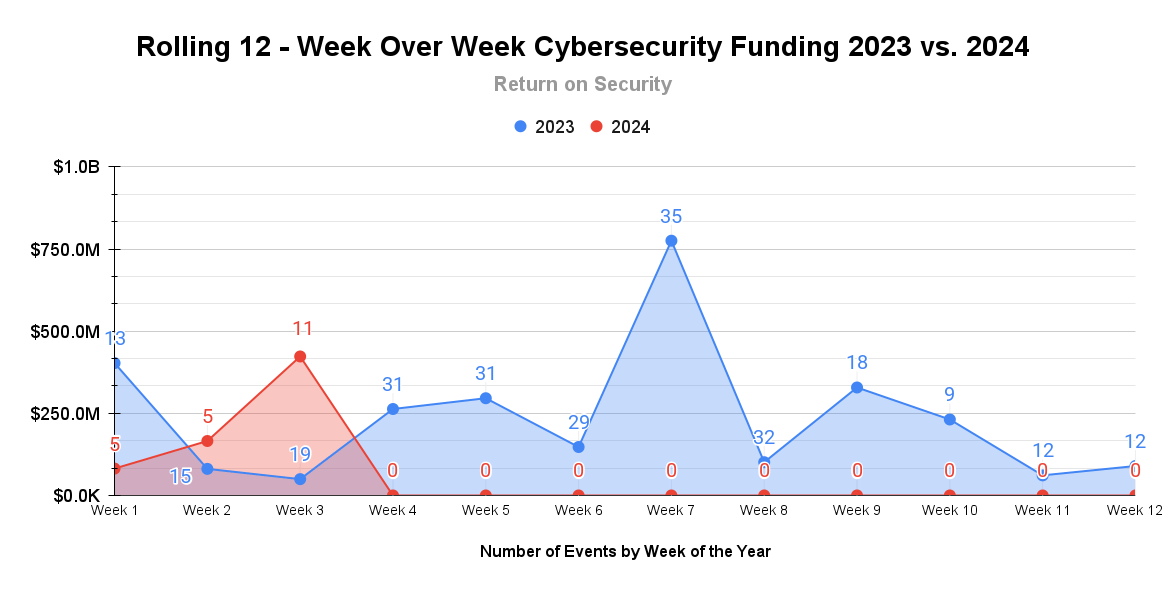

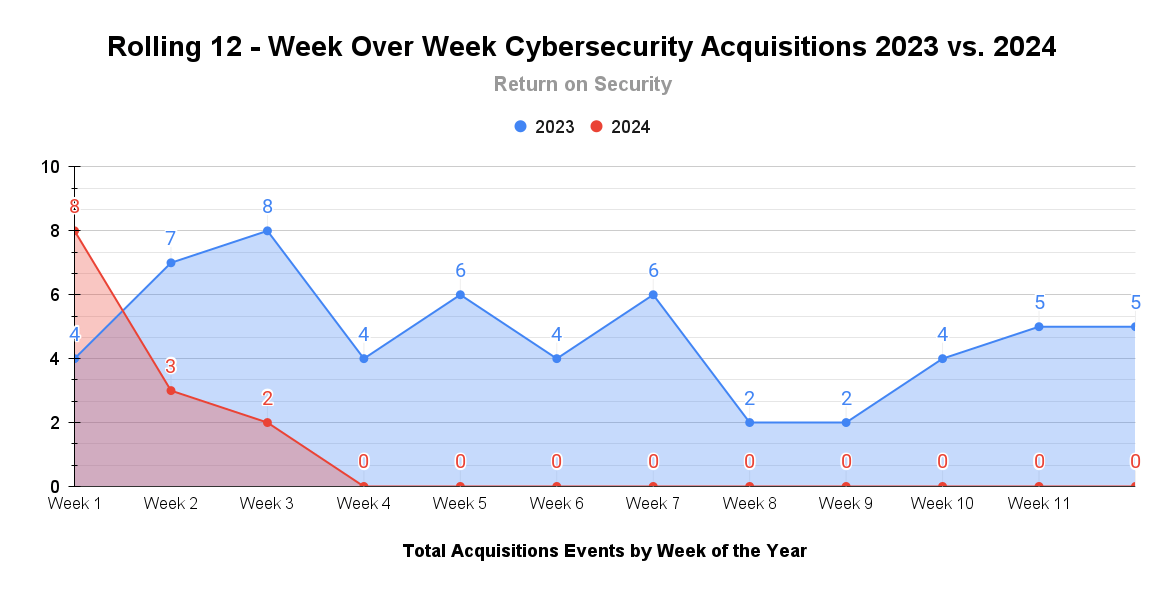

A rolling 12-week chart to compare funding and acquisitions each week in a year-over-year (YoY) view between 2023 and 2024.

As this is a new year, this chart will be building over the next 12 weeks and then roll forward.

A big surge in funding last week was driven mostly by quantum computing and security, a capital-hungry and emerging field in cyber. A significant drop in transaction volume is starting to emerge at the start of the year with far fewer transactions than in 2023 at this time.

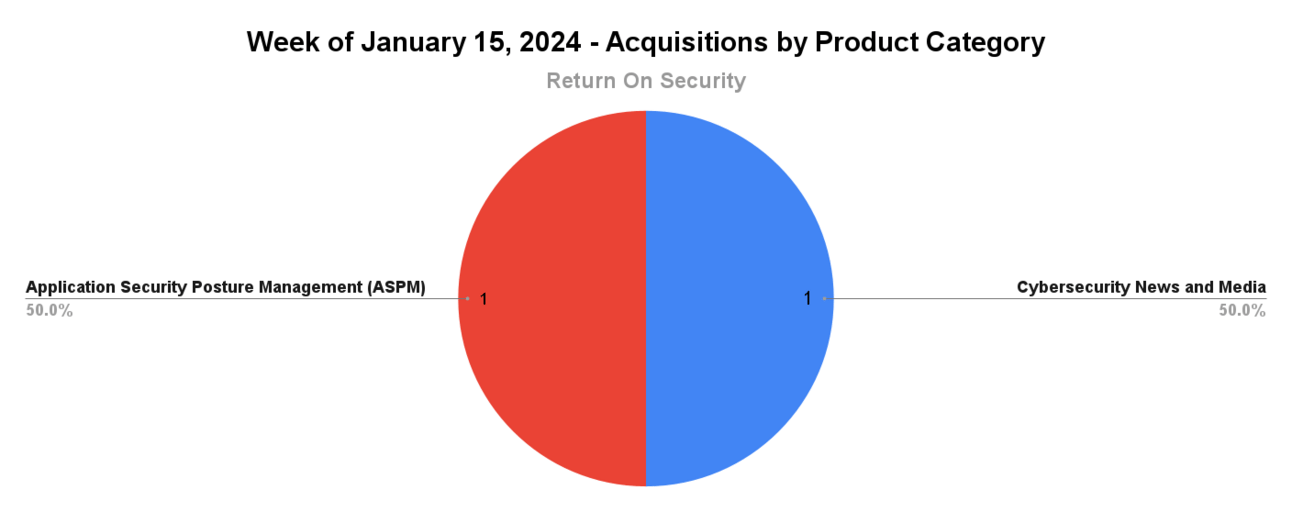

Acquisitions have shown a similar trend to funding with a lower volume of transactions, but don’t let the slow roll to the year fool you. Big Things™ are happening in this space even without everybody buying everybody.

💰 Market Summary

11 companies raised $423.1M across 9 unique product categories

2 companies were acquired or had a merger event across 2 unique product categories

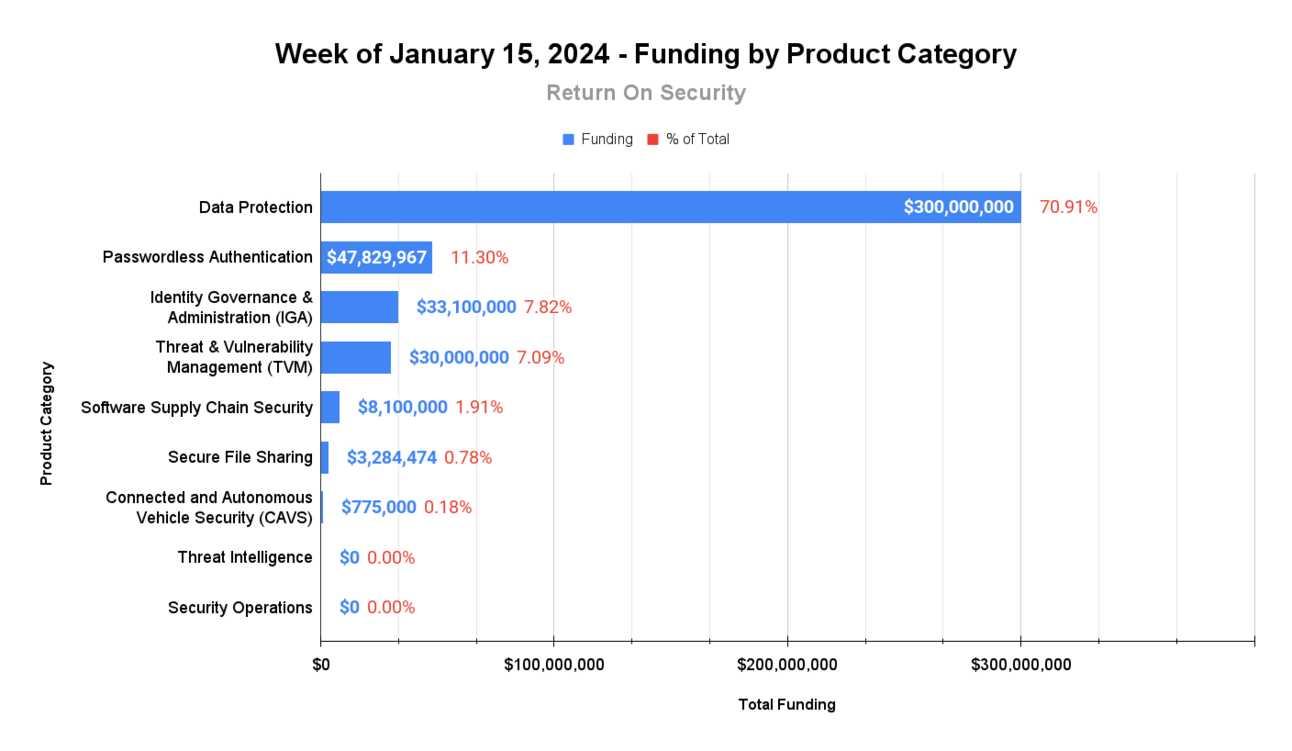

🧩 Funding By Product Category

$300.0M for Data Protection across 1 deal

$47.8M for Passwordless Authentication across 3 deals

$33.1M for Identity Governance & Administration (IGA) across 1 deal

$30.0M for Threat & Vulnerability Management (TVM) across 1 deal

$8.1M for Software Supply Chain Security across 1 deal

$3.3M for Secure File Sharing across 1 deal

$775.0K for Connected and Autonomous Vehicle Security (CAVS) across 1 deal

An undisclosed amount for Threat Intelligence across 1 deal

An undisclosed amount for Security Operations across 1 deal

🏢 Funding By Company

Quantinuum, a United States-based quantum computing cryptographic key generation platform, raised a $300.0M Venture Round from JP Morgan Chase. (more)

Oleria, a United States-based identity governance and administration (IGA) platform, raised a $33.1M Series A from Evolution Equity Partners. (more)

Vicarius, a United States-based vulnerability prioritization and remediation platform, raised a $30.0M Series B from Bright Pixel. (more)

Secret Double Octopus (officially my favorite cybersecurity company name), an Israel-based passwordless authentication platform, raised a $15.0M Series C from Benhamou Global Ventures. (more)

Internxt, a Spain-based secure file storage and sharing platform, raised a $3.3M Seed from Angels Capital, Crowdcube, Extension Fund, Notion Capital, and Telefonica.

Dapple Security, a United States-based passwordless authentication platform, raised a $1.8M Pre-Seed from First In.

Fleet Defender, a United States-based connected vehicle security platform, raised a $775.0K Seed. (more)

PRE Security, a United States-based AI-agent-enabled security operations monitoring platform, raised an undisclosed Pre-Seed from Nessar Technologies. (more)

Searchlight Cyber, a United States-based dark web threat intelligence platform, raised an undisclosed Private Equity Round from Charlesbank Capital Partners. (more)

🗣Sponsor

Doyensec’s SCA Benchmark Report

Nearly all SCA tools produce false positives that the security teams must then review and triage. But how do the top 3 SCA tools perform against each other?

Read this report by Doyensec, an independent security research and development firm, to see how Semgrep, Snyk, and Dependabot match up.

Learn more about sponsoring | Learn more about upgrading

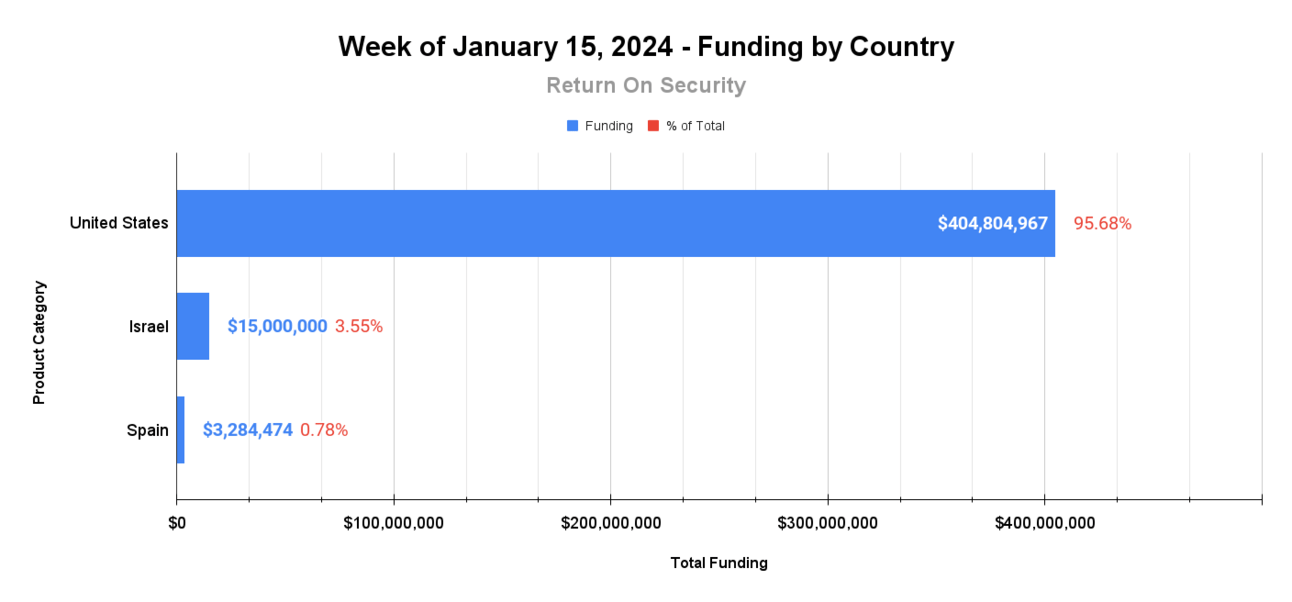

🌎 Funding By Country

$404.8M for the United States across 9 deals

$15.0M for Israel across 1 deal

$3.3Mfor Spain across 1 deal

🤝 Mergers & Acquisitions

QG Media, a United Kingdom-based cybersecurity media company focused on the IoT Security industry, was acquired by Information Security Media Group (ISMG) for an undisclosed amount. (more)

📚 Great Reads

*Trends in Enterprise Trust 2024 - explore five areas today's security leaders are focused on to build and maintain customer trust into the new year.

Google Search (and Spam) Really Has Gotten Worse - German researchers found that Google Search has gotten worse and has been taken over by dynamic adversarial spam in the form of low-quality, mass-produced commercial content thanks to the explosion of generative AI content.

Dry January: The Sobering State of Public Markets for Cybersecurity Companies - Being a cybersecurity unicorn feels like a never-ending Dry January right now. It's not as bad as it sounds, I promise.

Real-Time Cybersecurity Company Market Tracker - I published a live view of companies mapped to product categories and publicly available funding totals, and it's connected to some finance APIs to pull stock and market data every day where available

*Sponsored content and/or affiliate link.

🧪 Labs

New year, new training 💡