Security, Funded is a weekly deep dive into cybersecurity funding and industry news captured and analyzed by Mike Privette. This week’s issue is presented together with Tines and iVerify.

Hey there,

I hope you had a great weekend! I spent part of last week in Marseille, France, for a conference and got to enjoy the Summer Solstice while writing this issue. That’s definitely not a sentence I ever imagined I would write, but it was super cool to be able to do it!

I always try to keep an eye and ear on economic trends as I travel to different parts of the world. Since I was at a conference mostly made up of cybersecurity practitioners, consulting companies, and vendors from around Europe, I was in the right place to observe my two favorite things: where cybersecurity and economics meet.

I’ve noticed that the major world economies are showing a divergent trend. The UK reported economic data that shows it had exited a recession and has the highest growth in the last three years and the European Central Bank cut rates. Meanwhile, in the US, people are still trying to figure out what JPow is saying and if there will be a rate cut at all. ¯\_(ツ)_/¯

On the cybersecurity front, I expect these shifting tides to also start creating more geographic expansion and increased sales opportunities for cyber companies outside of the US. Time to get your passports ready, folks. 🛂 🛫

And with that, we are at the halfway point of 2024. 😳

Onward to this week's issue.

TOGETHER WITH

AI in Tines: Work faster. Further reduce barriers to entry.

AI features that are private and secure by design.

Everyone is talking about AI right now, but not all AI products will work for your teams.

Introducing AI in Tines: two new AI-powered features making workflow automation even more accessible to any member of your team.

Build automated workflows faster, and optimize them more easily. Unlock new security use cases and quickly transform data to drive better decision-making.

And AI in Tines is designed with security and privacy in mind - you decide when and how your workflows interact with AI.

Table of Contents

😎 Vibe Check

How do you anticipate the economic climate will impact your cybersecurity strategy in the next 12 months?

Last issue’s vibe check:

Did you have it on your 2024 BINGO card that Lacework would be acquired by Fortinet?

⬜️⬜️⬜️⬜️⬜️⬜️ 🧠 Yep (3)

🟩🟩🟩🟩🟩🟩 🧐 Nope (36)

39 Votes

Most of us didn’t have the Big Brain Energy™ to manifest this kind of destiny with Fortinet buying Lacework. It shows that late-stage cyber companies still have moves to make and that strength can come from unexpected places on the M&A front. I’m looking forward to the next earnings call to see how this move is really perceived by the street.

💰 Market Summary

11 companies raised $377.2M across 8 unique product categories in 5 countries

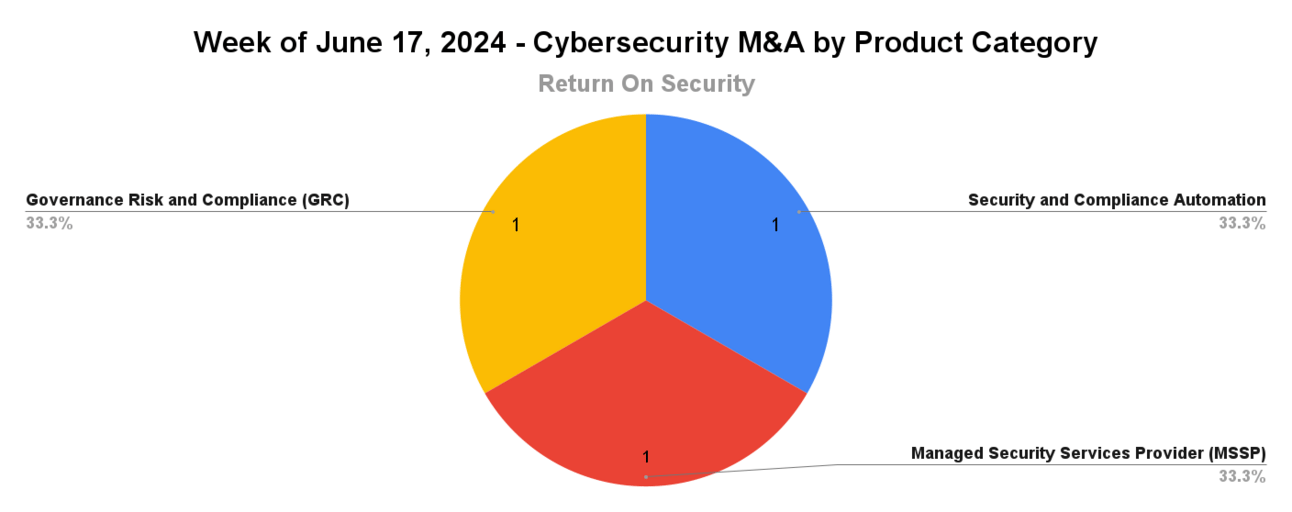

3 companies were acquired or had a merger event across 3 unique product categories

82% of funding went to product-based cybersecurity companies

No public cyber company had an earnings report

📸 YoY Snapshot

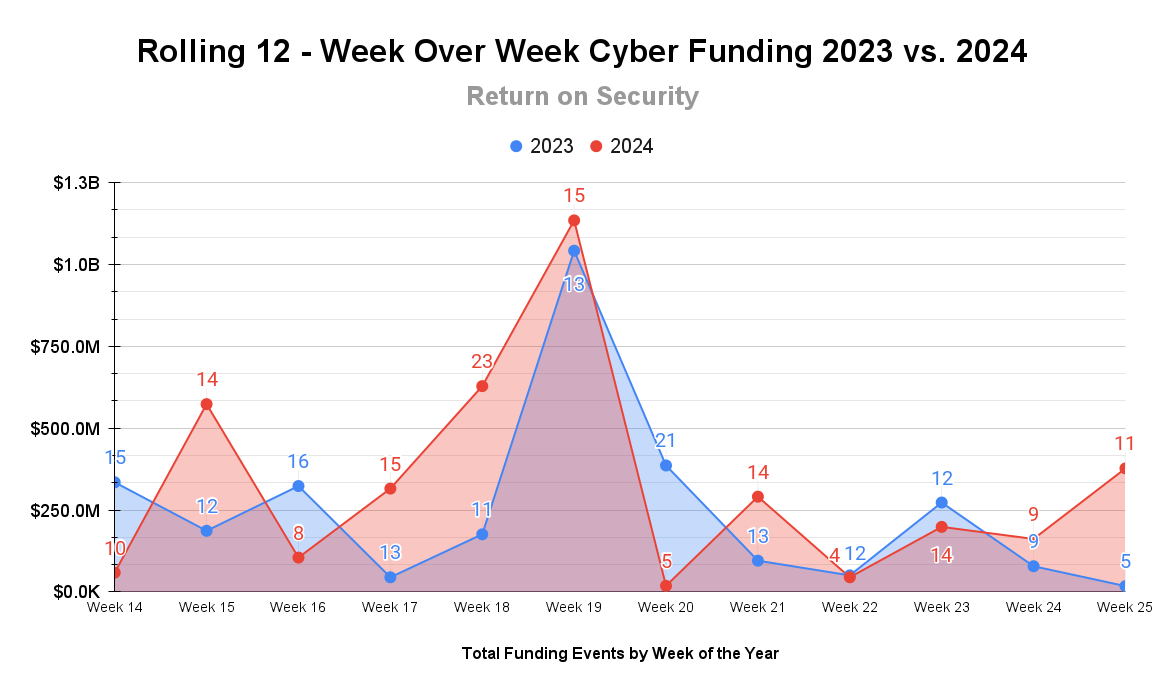

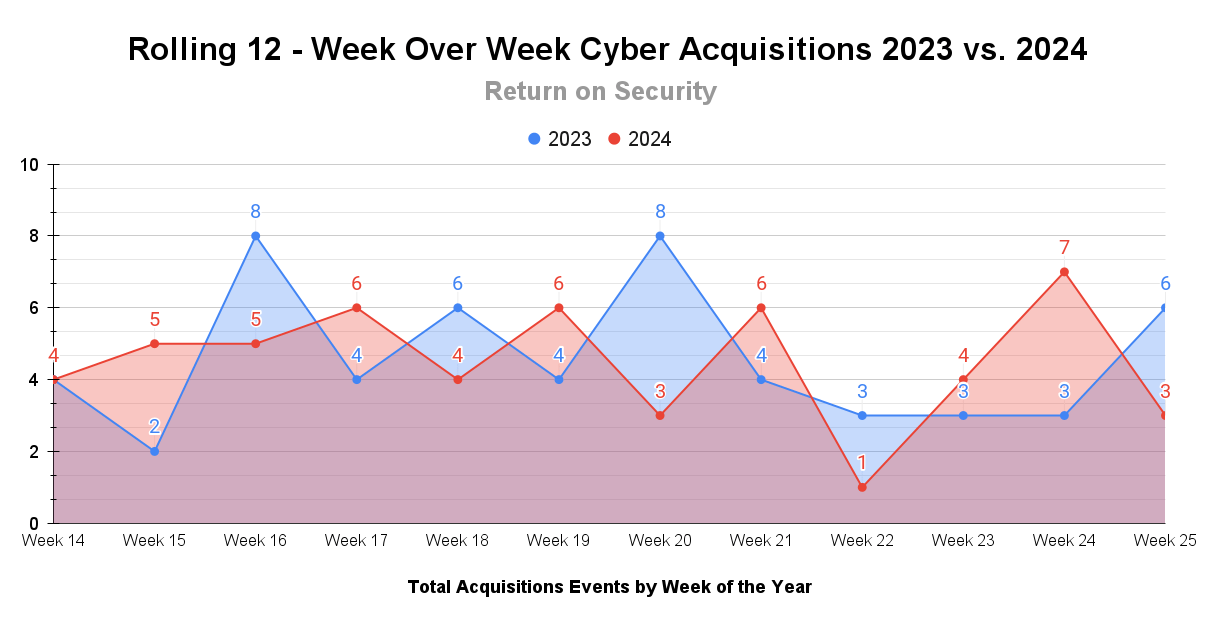

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between 2023 and 2024.

Funding continues at a healthy clip this year as late-stage rounds keep coming week over week. Last year's funding this week was one of the lowest weeks of 2023, at just $18 million when the industry was still coming to grips with the realities of continued high interest rate periods and layoffs all around.

A bit of a rollercoaster these past few weeks on M&A volume. With only one week left to go in Q2 2024, M&A activity will likely surpass Q2 2023.

🤙 Earnings Reports

Here are notable earnings reports from public cybersecurity companies. This section is Powered by Quartr, where I track all the latest earning reports.

Earnings reports this week: None

See the public cyber company tracker, which shows all public cybersecurity companies worldwide, along with market data, funding raised, product categories, and more.

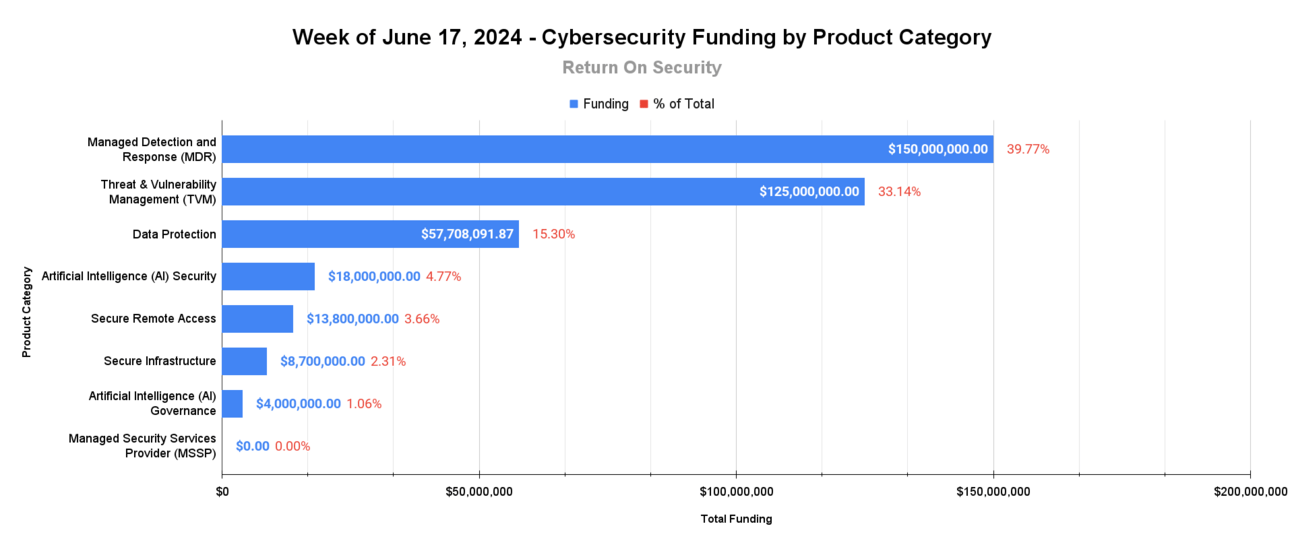

🧩 Funding By Product Category

$150.0M for Managed Detection and Response (MDR) across 2 deals

$125.0M for Threat & Vulnerability Management (TVM) across 1 deal

$57.7M for Data Protection across 2 deals

$18.0M for Artificial Intelligence (AI) Security across 1 deal

$13.8M for Secure Remote Access across 1 deal

$8.7M for Secure Infrastructure across 1 deal

$4.0M for Artificial Intelligence (AI) Governance across 1 deal

An undisclosed amount for Managed Security Services Provider (MSSP) across 2 deals

🏢 Funding By Company

Huntress, a United States-based managed detection and response (MDR) platform that stops hidden threats, raised a $150.0M Series D from Kleiner Perkins and Meritech Capital Partners. (more)

Semperis, a United States-based threat and vulnerability management platform for Active Directory resources, raised a $125.0M Venture Round from Hercules Capital and JP Morgan. (more)

PQShield, a United Kingdom-based platform helping companies meet quantum-safe cryptography standards, raised a $39.7M Series B from Addition and Chevron Technology Ventures. (more)

Aim Security, an Israel-based platform securing the usage of generative AI applications in enterprises, raised an $18.0M Series A from Canaan Partners. (more)

Entro, an Israel-based non-human identity access and secrets management platform, raised a $18.0M Series A from Dell Technologies Capital. (more)

Avaneidi, an Italy-based secure hosted storage platform, raised a $8.7M Series A from United Ventures. (more)

Trustwise AI, a United States-based AI governance, compliance, and safety platform, raised a $4.0M Seed from Hitachi Ventures. (more)

Communicate Technology, a United Kingdom-based managed security services provider (MSSP), raised an undisclosed Private Equity Round from Rockpool Investments LLP. (more)

Legato Security, a United States-based managed detection and response (MDR) platform, raised an undisclosed Series A from Level Equity Management and SageLink Capital. (more)

Virtual IT Group, an Australia-based managed security services provider (MSSP), raised an undisclosed Private Equity Round from Riverside Company. (more)

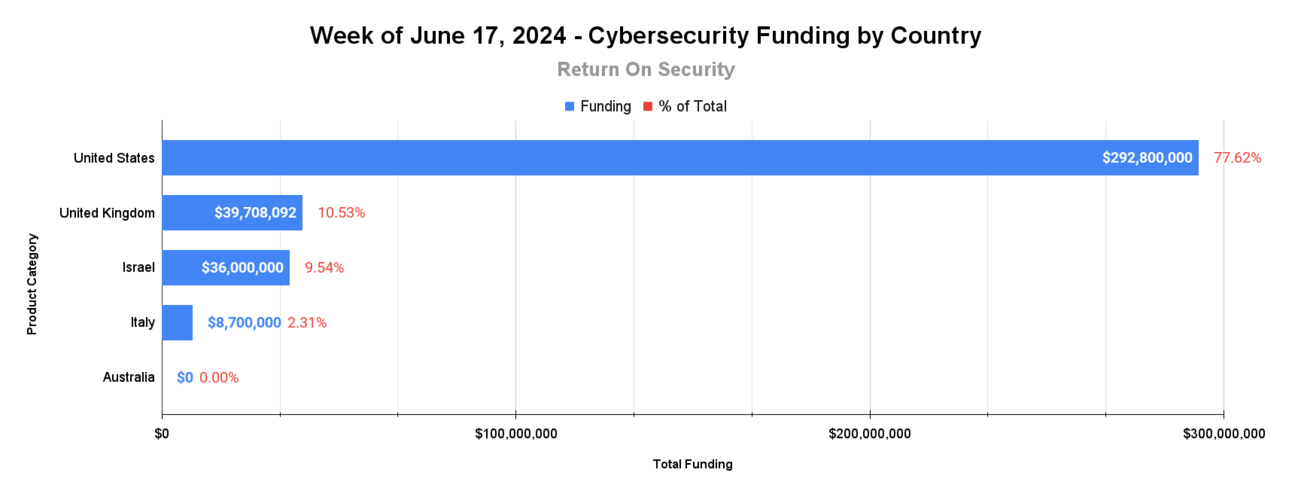

🌎 Funding By Country

$292.8M for the United States across 5 deals

$39.7M for the United Kingdom across 2 deals

$36.0M for Israel across 2 deals

$8.7M for Italy across 1 deal

An undisclosed amount for Australia across 1 deal

🤝 Mergers & Acquisitions

Camms, an Australia-based governance, risk, and compliance (GRC) platform, was acquired by Riskonnect for an undisclosed amount. (more)

Nuspire Networks, a United States-based managed security services provider (MSSP), was acquired by PDI Technologies for an undisclosed amount. (more)

Quod Orbis, a United Kingdom-based continuous controls and framework monitoring platform, was acquired by Deda Group for an undisclosed amount. (more)

📚 Great Reads

Sub-Venture Scale Security Problems - Rami McCarthy and Kane Narraway discuss the challenges small cybersecurity ventures face due to high risk and lack of funding and propose solutions for common security problems.

*Keep your iPhone super secure. This app shows you how - Running a BYOD program? Check out this review of iVerify’s new updates from ZDnet contributing editor Adrian Kingsley-Hughes!

How AI Will Change Democracy - Bruce Schneier discusses AI's influence on politics, lawmaking, administration, the legal system, and citizens, emphasizing both opportunities and challenges.

Cybersecurity Market Update: May 2024 - Check out May 2024's cybersecurity market trends, cybersecurity investments, major acquisitions, and global insights.

*A message from our sponsor

🧪 Labs

“sEcUrItY iS oUr tOp PrIoRiTy”

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.