Security, Funded is a weekly deep dive into cybersecurity funding and industry news captured and analyzed by Mike Privette. This week’s issue is presented together with iVerify, Tines, and Outpost24.

Hey there,

I hope you had a great weekend, and Happy Q3 to all those who celebrate.

Speaking of celebrations, this week’s issue marks THREE YEARS of writing this newsletter! 🤯

I could have never imagined this many people would be reading what I wrote every week, let alone for this long. A huge THANK YOU to everyone who encouraged and supported me along the way! You all are the reason that keeps me grinding, so let us continue to get this bread, fam. 😤 👊

If you want to go back in time, you can see the first issue here. It was just a guy and a spreadsheet living the dream. 🥹

Here’s to three more years and 150 more issues! 🍻

Onward to this week's issue.

TOGETHER WITH

Don’t just detect mobile threats, automatically remediate them with iVerify EDR

Detection and response backed by advanced mobile threat hunting

Credential theft is now the leading cause of data breaches, and attackers are focused on mobile devices where security is less stringent, and people often let their guard down. A staggering 71% of employees’ personal phones contain corporate credentials, and 50% of all employee phones will be successfully phished!

iVerify EDR empowers security teams to take immediate and automatic action against smishing attacks and compromised mobile phones with access to corporate data.

Table of Contents

😎 Vibe Check

Who do you think will "win" the AI Security game?

Last issue’s vibe check:

How do you anticipate the economic climate will impact your cybersecurity strategy in the next 12 months?

🟩🟩🟩🟩🟩🟩 💰 Increased investments in response capabilities (13)

🟨🟨⬜️⬜️⬜️⬜️ 👯♂️ Increase in hiring (5)

🟨⬜️⬜️⬜️⬜️⬜️ 3️⃣ More third-party services (4)

🟨🟨🟨🟨⬜️⬜️ ⏱️ Delay in planned projects or doing less (9)

🟨⬜️⬜️⬜️⬜️⬜️ 🔌 Other (tell me) (3)

34 Votes

Last week, it was all about responding and doing more with less, a recurring theme for many in the industry over the past few years. Getting breached is an inevitability (not only because cyber teams are getting leaner), so it’s all about how you respond.

Some of the top comments from last week:

"Do more with less!"

“Since my head cyber department got sack due to reduce budget, the current situation make everything is kept at minimum.”

💰 Market Summary

12 companies raised $254.1M across 9 unique product categories in 3 countries

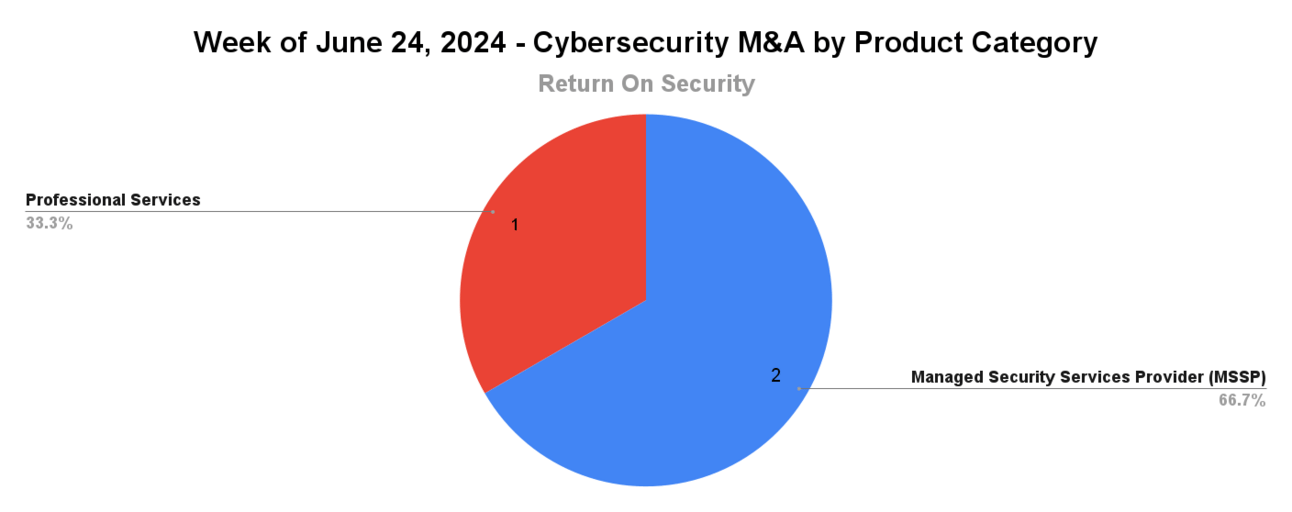

3 companies were acquired or had a merger event across 2 unique product categories

100% of funding went to product-based cybersecurity companies

No public cyber company had an earnings report

📸 YoY Snapshot

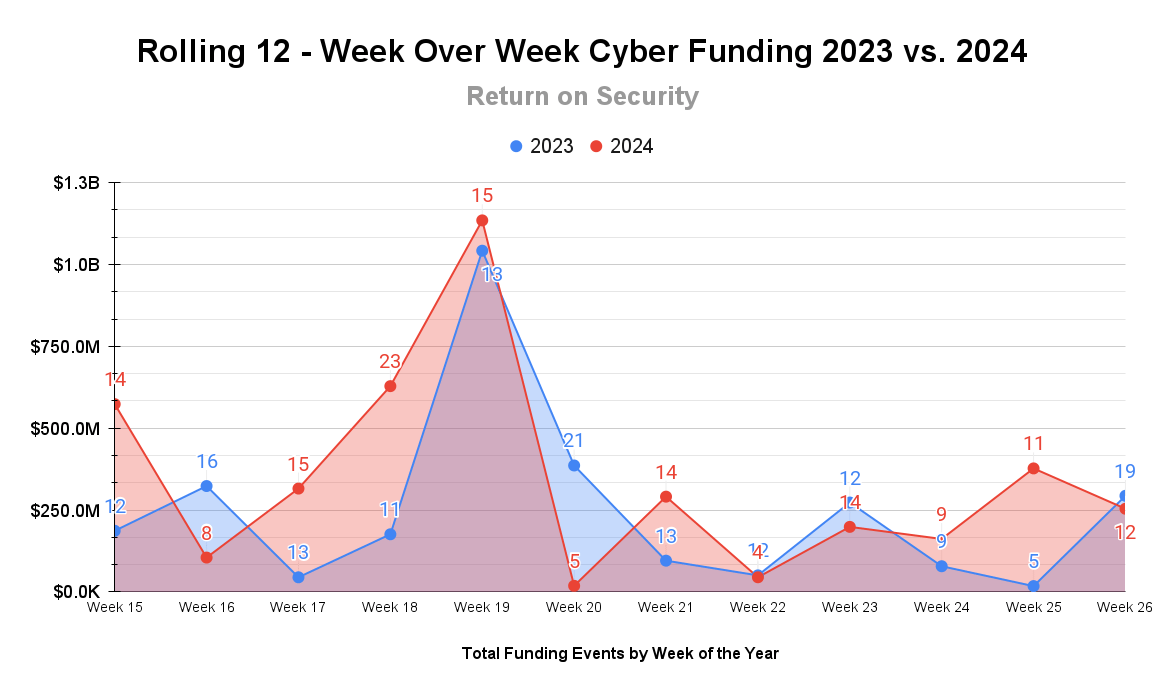

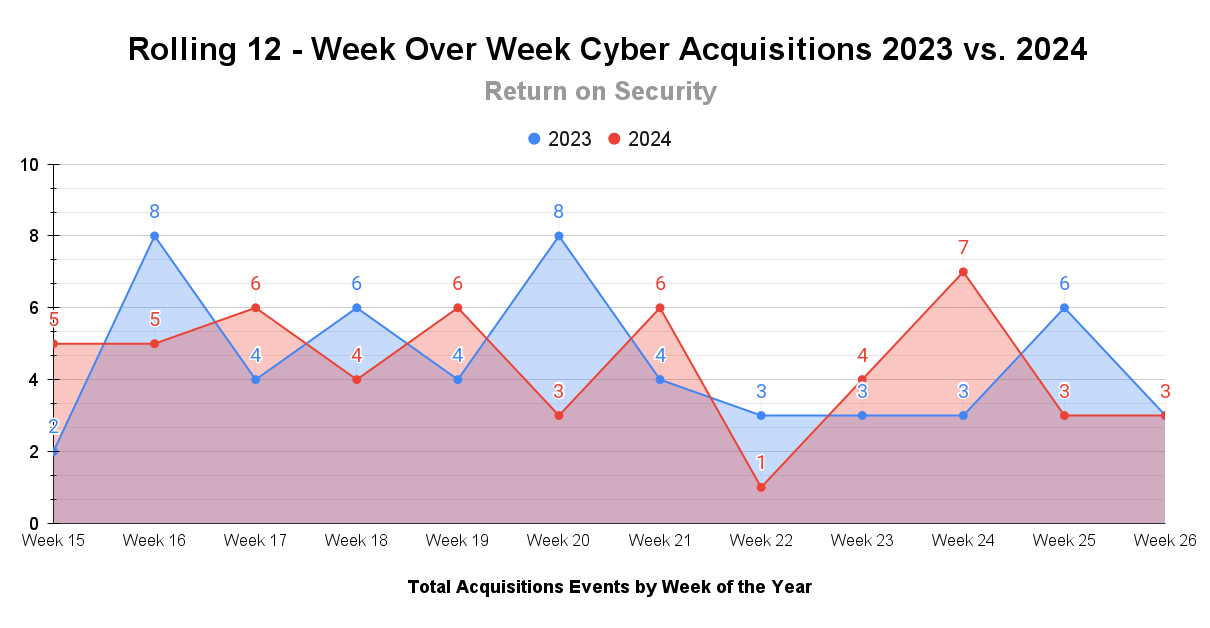

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between 2023 and 2024.

We are halfway through 2024 now and the cybersecurity industry, as well as the broader tech industry, is showing strong signals. All signs point up and to the right for the cyber industry with late-stage rounds still going on a tear and with valuations starting to head back up again.

M&A activity continues on a solid pace just slightly behind where we were this time last year. What’s different about this year is that the first half of 2024 is already at 85% of the total transaction value from 2023, so it’s already a record-breaking year!

🤙 Earnings Reports

Here are notable earnings reports from public cybersecurity companies. This section is Powered by Quartr, where I track all the latest earning reports.

Earnings reports this week: None

See the public cyber company tracker, which shows all public cybersecurity companies worldwide, along with market data, funding raised, product categories, and more.

TOGETHER WITH

Break away from traditional SOAR with Tines

Teams using legacy SOAR platforms are often challenged by long build times, reliance on engineers, and inflexible integrations. Enter Tines.

Tines is a vendor-agnostic SOAR platform that your whole team can use. And it connects with any tool, internal or external, that offers an API.

Implementation is fast and easy. One Tines customer, Mars, migrated 100% of their workflows from a legacy SOAR platform in a few months, and achieved coverage of 80-90% of sources for true positives in weeks.

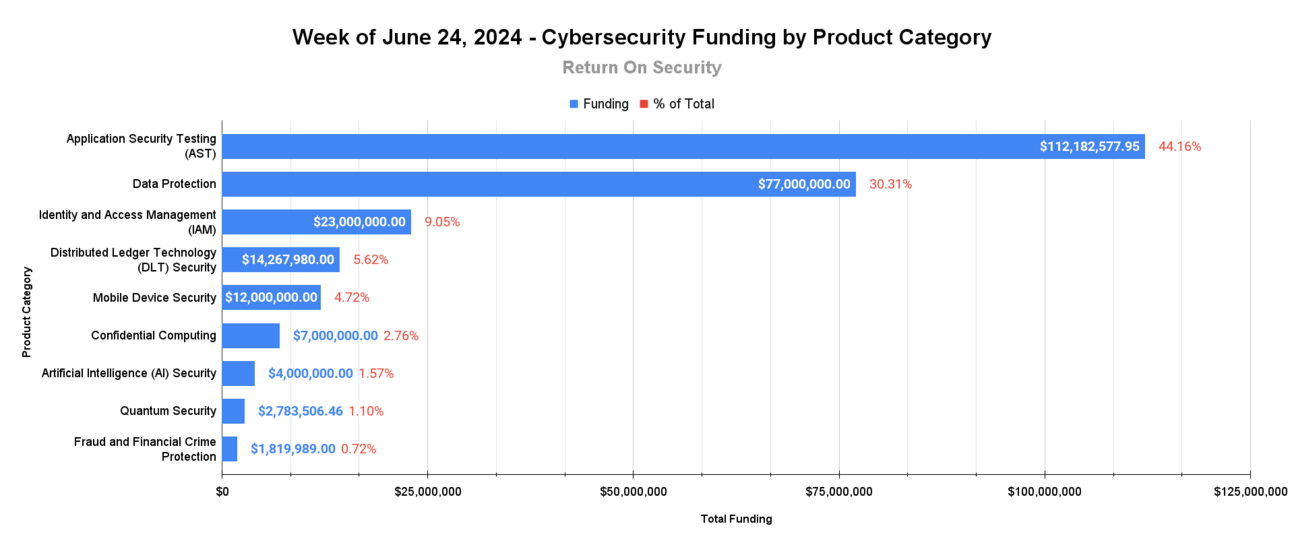

🧩 Funding By Product Category

$112.2M for Application Security Testing (AST) across 1 deal

$77.0M for Data Protection across 2 deals

$23.0M for Identity and Access Management (IAM) across 2 deals

$14.3M for Distributed Ledger Technology (DLT) Security across 1 deal

$12.0M for Mobile Device Security across 1 deal

$7.0M for Confidential Computing across 2 deals

$4.0M for Artificial Intelligence (AI) Security across 2 deals

$2.8M for Quantum Security across 1 deal

$1.8M for Fraud and Financial Crime Protection across 1 deal

🏢 Funding By Company

PortSwigger (the makers of BurpSuite), a United Kingdom-based web application security testing platform, raised a $112.2M Private Equity Round from Brighton Park Capital. (more)

Odaseva, a United States-based data protection platform for Salesforce applications, raised a $54.0M Series C from Silver Lake Waterman. (more)

Cloudian, a United States-based file and object data protection platform for S3 buckets, raised a $23.0M Private Equity Round from Morgan Stanley Expansion Capital. (more)

AuthZed, a United States-based application authorization and authentication platform, raised a $12.0M Series A from General Catalyst. (more)

iVerify, a United States-based mobile threat hunting platform, raised a $12.0M Series A from Shine Capital. (more)

authID, a United States-based identity and authentication as a service platform, raised an $11.0M post-IPO equity round.

HUB Security, an Israel-based confidential computing platform, raised a $5.0M post-IPO equity round and a $2.0M post-IPO debt round. (more)

HydroX AI, a United States-based artificial intelligence (AI) security and safety platform, raised a $4.0M Angel from Vitalbridge Capital. (more)

Cavero Quantum, a United Kingdom-based quantum-resistant encryption key distribution platform, raised a $2.8M Seed from Foresight Group. (more)

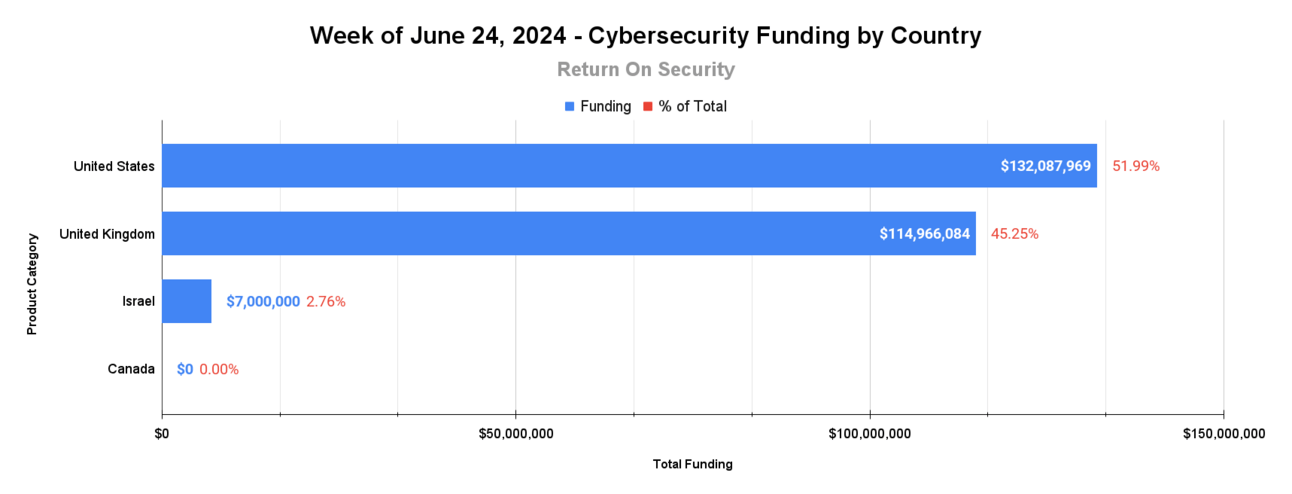

🌎 Funding By Country

$132.1M for the United States across 8 deals

$115.0M for the United Kingdom across 2 deals

$7.0M for Israel across 2 deals

An undisclosed amount for Canada across 1 deal

🤝 Mergers & Acquisitions

Glasshouse Turkey, a Turkey-based managed security services provider (MSSP), was acquired by e& enterprise for $1.8M. (more)

Cybolt, a United States-based professional services firm focused on cyber threat assessments, was acquired by Cyber Guards for an undisclosed amount. (more)

Practice Protect, an Australia-based managed security services provider (MSSP), was acquired by Rightworks for an undisclosed amount. (more)

📚 Great Reads

Resilient Cyber Newsletter #1 - My friend Chris Hughes, who already does a lot of great deep-dive posts and video interviews on various vulnerability management topics, is now doing a newsletter, so you should check it out.

*{New Analysis} In 2023, an average uReset customer saved $65K on password resets - Learn about the uncovered data showing significant costs associated with password resets.

Companies are Moving Slowly to Adopt AI - Vendors would have you believe that we are in the midst of an AI revolution, one that is changing the very nature of how we work. But the truth, according to several recent studies, suggests that it’s much more nuanced than that.

The Security Data Fabric Shift Explained - From my fried Darwin Salazar on why Zscaler paid $350M for Avalor and what it means for the security industry.

*A message from our sponsor

🧪 Labs

The journey is the destination.

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.