Security, Funded is a weekly deep dive into cybersecurity funding and industry news captured and analyzed by Mike Privette. This week’s issue is presented together with Tines.

Hey there,

I hope you had a great weekend and a nice US July 4th holiday or celebrating/crying over election day in the UK and France. 😱

While it was an eventful week on the political front in many countries, it was predictably quieter on the investment and M&A front.

So what did I do? As an American living in the UK, I did the only logical thing to celebrate: I went to Spain and drank vermouth.

10/10 would recommend doing. 🇪🇸 🍹

At Cala del Vermut in Barcelona

In other news, Return on Security crossed 10,000 subscribers last week after sending the 150th issue! I’m beyond excited to hit these milestones and super motivated to keep on growing for you all, and thank you again for being here.

Onward to this week's issue.

TOGETHER WITH

AI in Tines: Work faster. Further reduce barriers to entry.

AI features that are private and secure by design.

Everyone is talking about AI right now, but not all AI products will work for your teams.

Introducing AI in Tines: two new AI-powered features making workflow automation even more accessible to any member of your team.

Build automated workflows faster, and optimize them more easily. Unlock new security use cases and quickly transform data to drive better decision-making.

And AI in Tines is designed with security and privacy in mind - you decide when and how your workflows interact with AI.

Table of Contents

😎 Vibe Check

What influences your cybersecurity vendor selection the most?

Last issue’s vibe check:

Who do you think will "win" the AI Security game?

🟨⬜️⬜️⬜️⬜️⬜️ 🅾️ OpenAI (7)

🟩🟩🟩🟩🟩🟩 Ⓜ️ Microsoft (21)

🟨⬜️⬜️⬜️⬜️⬜️ 🧠 Google (7)

🟨⬜️⬜️⬜️⬜️⬜️ 🍎 Apple (7)

🟨⬜️⬜️⬜️⬜️⬜️ 🔮 Other (tell me) (6)

48 Votes

This was a fun vibe check from last week that generated a ton of comments. While most people believed that Microsoft would “win” the AI game, I was really surprised to see the rest so evenly split. This is a fast-moving topic, and right now, I’m in the Microsoft camp as well.

Also, shoutout to all the AI Security startups that wrote their company name into the “Other” comment response. Shooters shoot their shots. 😂 👏

Some of the top comments from last week:

“[Google has] the data to train the LLMs- will most likely be the first to achieve AGI as well.”

“[Microsoft] Copilot seems to be making lots of inroads into helping customers ramp up quickly and seems like the MSSPs are utilizing it as well.”

“There is no winning in the AI security game.”

💰 Market Summary

6 companies raised $23.7M across 6 unique product categories in 5 countries

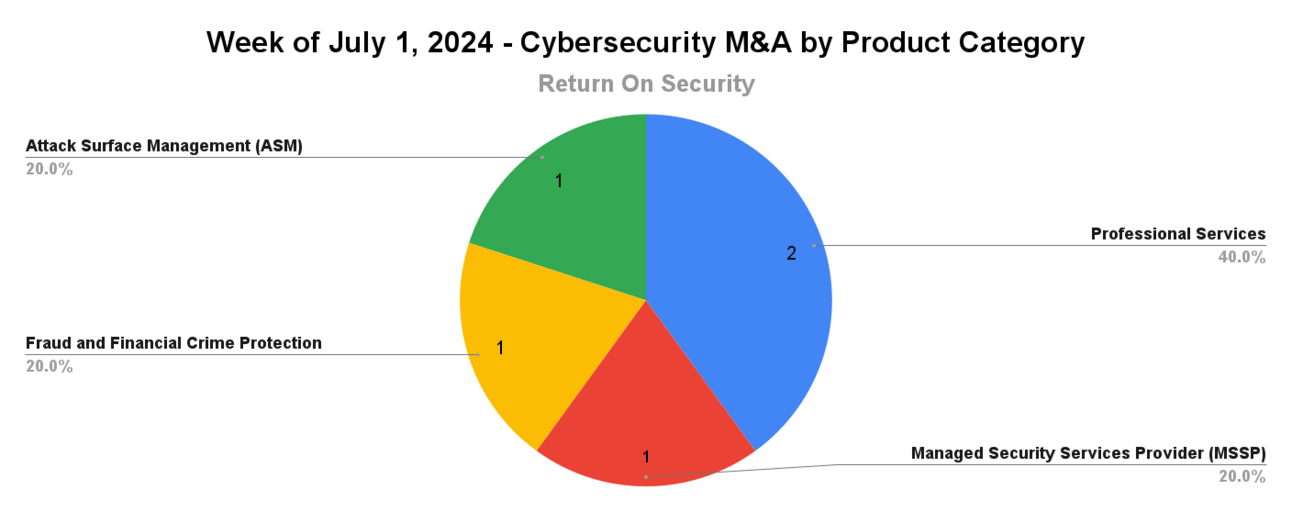

5 companies were acquired or had a merger event across 4 unique product categories

100% of funding went to product-based cybersecurity companies

No public cyber company had an earnings report

📸 YoY Snapshot

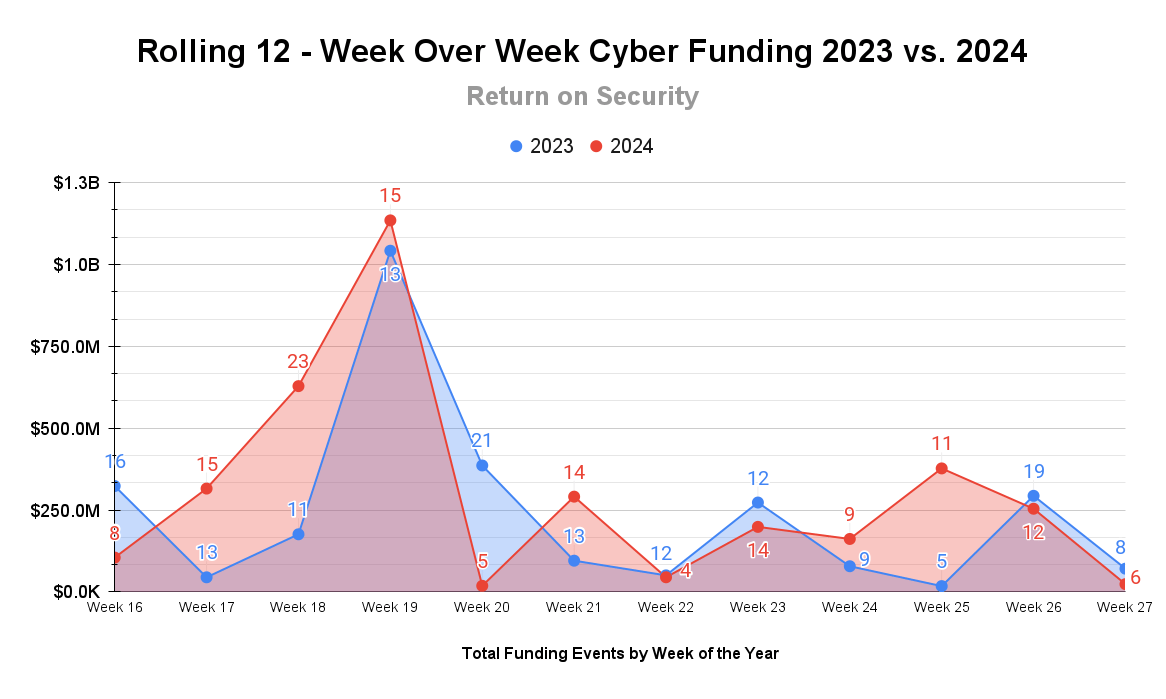

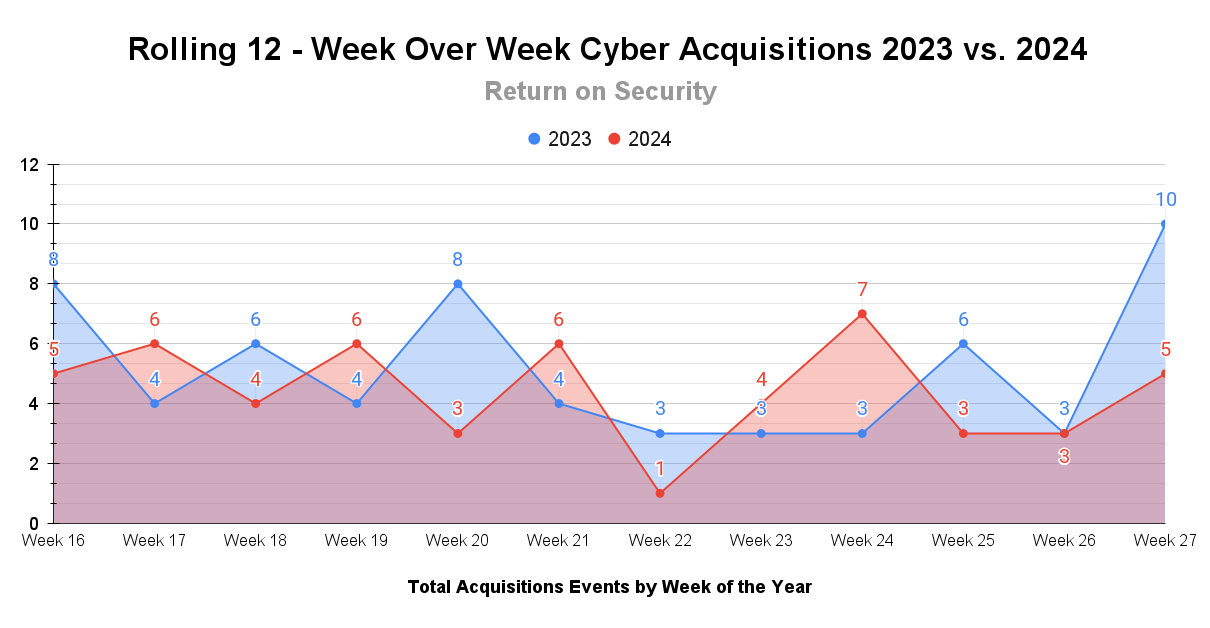

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between 2023 and 2024.

Last week was a very quiet and predictable week on the funding front. We saw the same thing happen last year (and the year before). Now is when the industry begins to push, leading up to Black Hat USA in August.

Still an eventful week on the M&A front, even with the holidays and elections. There is still a strong desire for late-stage companies to acquire the talent and capabilities of proven startups, and services businesses still dominate.

🤙 Earnings Reports

Here are notable earnings reports from public cybersecurity companies. This section is Powered by Quartr, where I track all the latest earning reports.

Earnings reports this week: None

See the public cyber company tracker, which shows all public cybersecurity companies worldwide, along with market data, funding raised, product categories, and more.

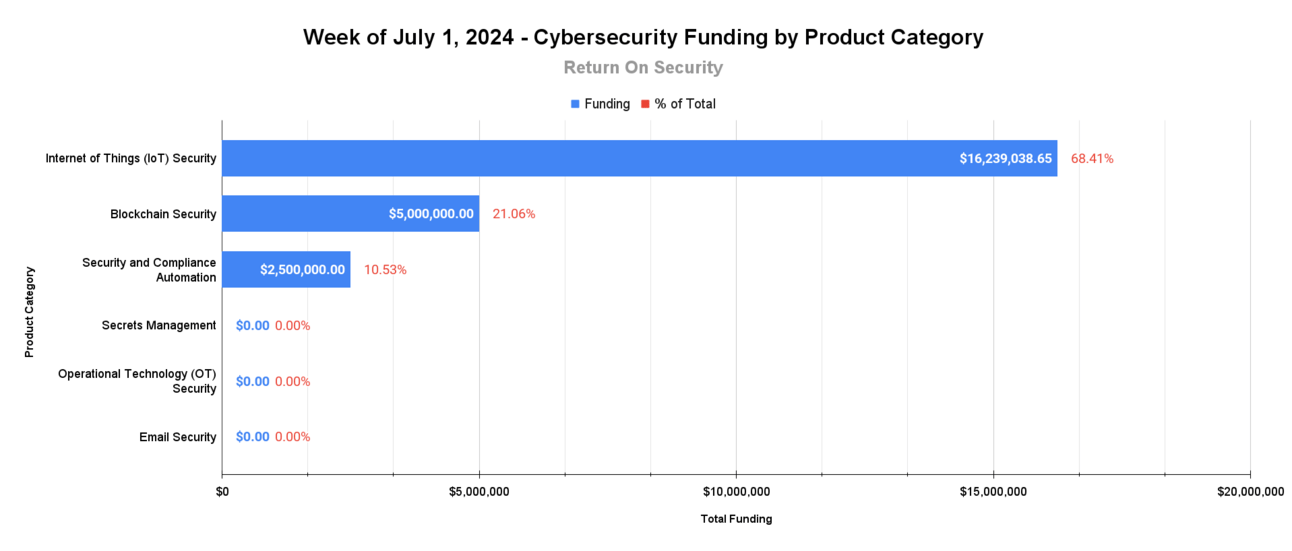

🧩 Funding By Product Category

$16.2M for Internet of Things (IoT) Security across 1 deal

$5.0M for Blockchain Security across 1 deal

$2.5M for Security and Compliance Automation across 1 deal

An undisclosed amount for Secrets Management across 1 deal

An undisclosed amount for Operational Technology (OT) Security across 1 deal

An undisclosed amount for Email Security across 1 deal

🏢 Funding By Company

Exein, an Italy-based firmware and Internet of Things (IoT) security platform, raised a $16.2M Series B from 33N Ventures.

Mamori, a Taiwan-based vulnerability detection platform for Web3 applications, raised a $5.0M Seed from Blockchain Capital. (more)

GovSky, a United States-based security and compliance automation for US government frameworks like CMMC and NIST, raised a $2.5M Seed from Peterson Ventures, Revolution’s Rise of the Rest Seed Fund, and SaaS Ventures. (more)

Abnormal Security, a United States-based email security company, raised an undisclosed Venture Round at a $5 billion valuation from Insight Partners. (more)

MicroSec, a Singapore-based operational technology (OT) security platform, raised an undisclosed Non-Equity Assistance from AcceliCITY powered by Leading Cities.

Tide Foundation, an Australia-based data sharding and secrets management platform, raised an undisclosed Non-Equity Assistance from AcceliCITY powered by Leading Cities.

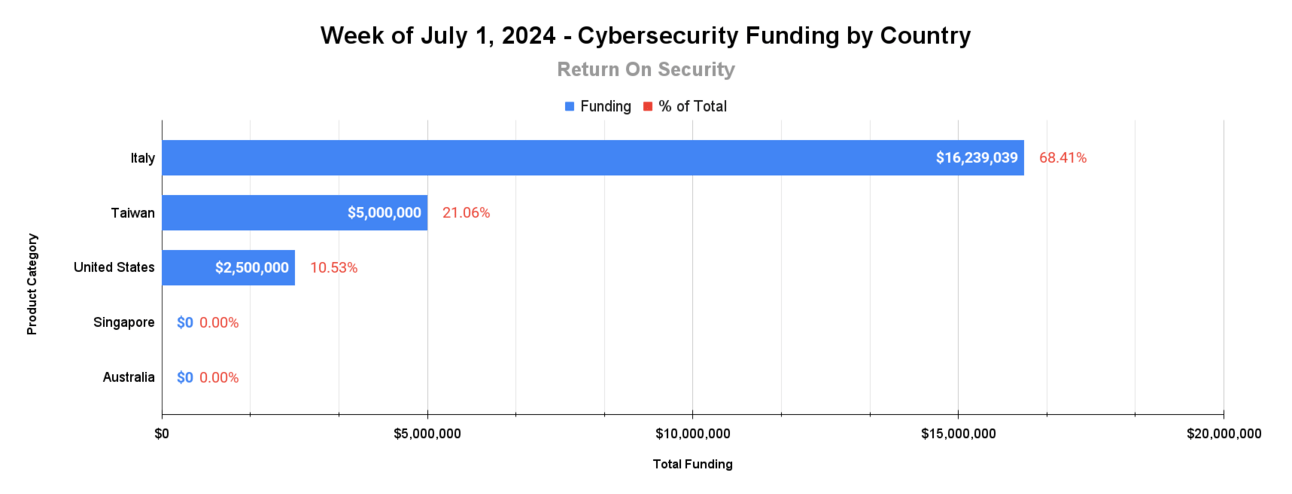

🌎 Funding By Country

$16.2M for Italy across 1 deal

$5.0M for Taiwan across 1 deal

$2.5M for United States across 2 deal

An undisclosed amount for Singapore across 1 deal

An undisclosed amount for Australia across 1 deal

🤝 Mergers & Acquisitions

Combitech Norway, a Norway-based professional services firm focused on cloud security and penetration testing, was acquired by Telenor Cyberdefence for an undisclosed amount. (more)

Noetic Cyber, a United States-based cyber asset management and controls platform, was acquired by Rapid7 for an undisclosed amount. (more)

Secure Enterprise Engineering, a United States-based professional services firm focused on security engineering, was acquired by SIXGEN for an undisclosed amount. (more)

Wallet Guard, a United States-based Web3 transaction fraud protection browser extension, was acquired by Consensys for an undisclosed amount. (more)

📚 Great Reads

Lazy Work, Good Work - The importance of strategic decisions and work has never been higher in these AI-fueled times.

The Global AI Arms Race - This post explores the dynamics of AI development, the role of government regulations, and the ethical considerations that must guide this rapidly evolving field.

You could learn a lot from a CIO with a $17B IT budget - A conversation about planning, resiliency, AI, and strategy with the CIO from one of the world’s largest banks.

*A message from our sponsor

🧪 Labs

It’s all about framing things up

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.