Security, Funded is a weekly deep dive into cybersecurity funding and industry news captured and analyzed by Mike Privette. This week’s issue is presented together with Nudge Security and Tines.

Hey there,

I hope you had a great weekend!

If you were among the many unfortunate people who had to respond to the biggest global IT outage due to the CrowdStrike bug, my heart and support go out to you. Banks, transit systems, TV stations, and hospitals around the world were disrupted, showing our fragile global IT existence.

This is what everyone predicted would happen with Y2K when computer clocks around the world rolled over from the year 1999 to the year 2000, but it was a total non-event. The event last week, however, was larger than anyone could have predicted and created a perfect storm for businesses around the world. It wouldn’t surprise me if the collective revenue lost by businesses around the world was in the billions for that day.

CrowdStrike’s stock took an ~18% haircut on Friday. This comes on the heels of the great tech sector drawdown we’ve seen over the past few weeks (and the worst one this year), which this global outage only exacerbated. It’s not a good look for anyone right now, and will be interesting to see how the earnings calls for other public cyber companies go over the next few weeks (and I’ll be capturing it all here).

While the recovery may only last a few grueling days, the bigger issue is that conversations about arguments about what to do next will last for months. This kind of outage will also, unfortunately, dock the internal political capital of security teams, something that is not always at a surplus in many organizations.

While there have been good and bad takes on social media, this outage and the response from CrowdStrike really got me thinking about what can we learn about B2B Sales. 🤔

Onward to this week's issue.

TOGETHER WITH

Discover, secure and govern genAI use

Get an immediate inventory of who’s using what

Nudge Security has discovered over 500 unique genAI apps in customer environments to date, without the need for agents, browser plug-ins, network proxies, or any prior knowledge of an app’s existence.

Within minutes of starting a free trial, you’ll have a full inventory of all genAI apps (along with every other SaaS app ever introduced) and security profiles for each provider to quickly vet new or unfamiliar tools.

Table of Contents

😎 Vibe Check

Do you think the CrowdStrike outage will lead to the merging of more security and IT operations teams under one leader?

Last issue’s vibe check:

Do you think the potential acquisition of Wiz by Google will let Google compete against Microsoft Security?

🟩🟩🟩🟩🟩🟩 ✅ Yes (32)

🟨🟨🟨⬜️⬜️⬜️ 🙅♀️ Nope (20)

🟨🟨🟨⬜️⬜️⬜️ 🤷♂️ Different buyers (20)

72 Votes

55% of the people who voted in last week’s vibe check poll thought that the Google acquisition of Wiz would either not let Google compete against Microsoft Security or that they were still targeting different buyers. I’m personally in the “Different Buyers” camp on this one.

Some of the top comments from last week:

“Different buyers: Dinosaurs will remain Microsoft shops; new cool businesses will stay Google. Until they get bought by dinosaurs.”

“Nope: Microsoft security revenue comes from the fact that they own the underlying service/infrastructure and sell the security as a fully integrated add-on. In order to compete with MS in enterprise security, Google must first make more inroads as a cloud provider and productivity platforms in those same customers, something it hasn't managed to pull off with GCP or Google Workspace.”

“Yes: MSFT and PANW and Cisco. Before this they had a marginal SIEM- now they have the best CDR solution in the market.”

💰 Market Summary

6 companies raised $235.1M across 6 unique product categories in 2 countries

1 company was acquired or had a merger event across 1 unique product category

83% of funding went to product-based cybersecurity companies

No public cyber company had an earnings report

📸 YoY Snapshot

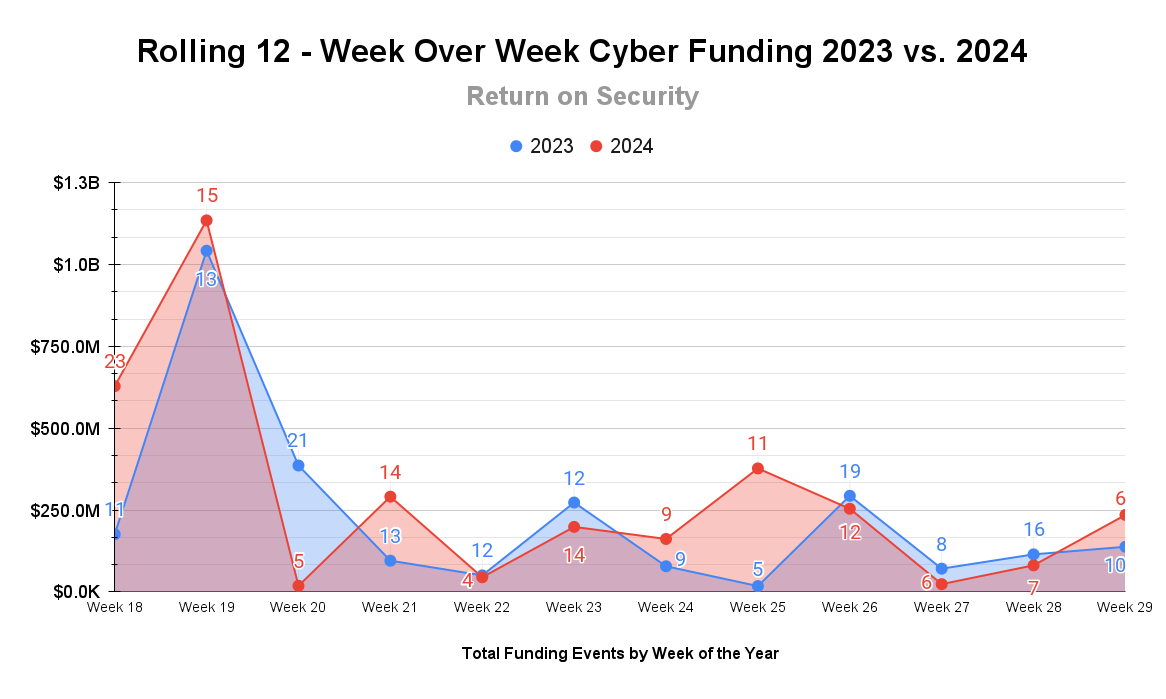

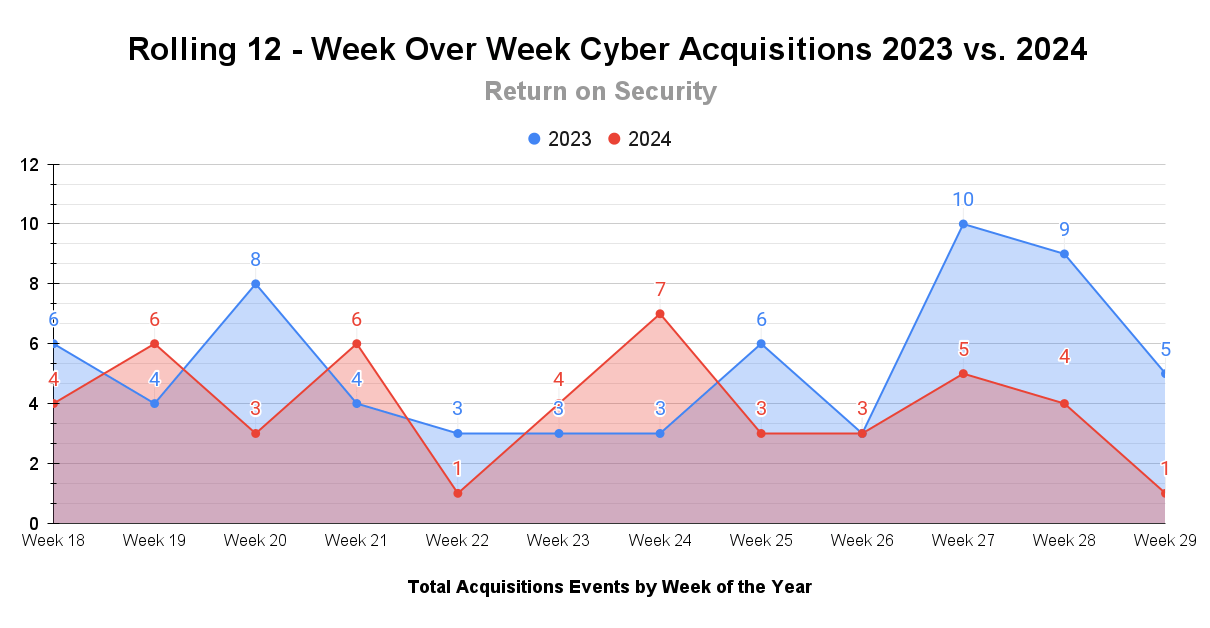

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between 2023 and 2024.

Small, but mighty is the theme of this week’s funding. While there were fewer transactions this week than normal, there were two huge, late-stage funding rounds that led the charge. This week’s funding is up 71% from this time last year.

A very quiet week on the M&A front, with only one transaction. Q3 2024 M&A is off to a much slower start than the previous quarters, but if the Wiz deal goes through, it won’t really matter.

🤙 Earnings Reports

Here are notable earnings reports from public cybersecurity companies. This section is Powered by Quartr, where I track all the latest earning reports.

Earnings reports this week: None

See the public cyber company tracker, which shows all public cybersecurity companies worldwide, along with market data, funding raised, product categories, and more.

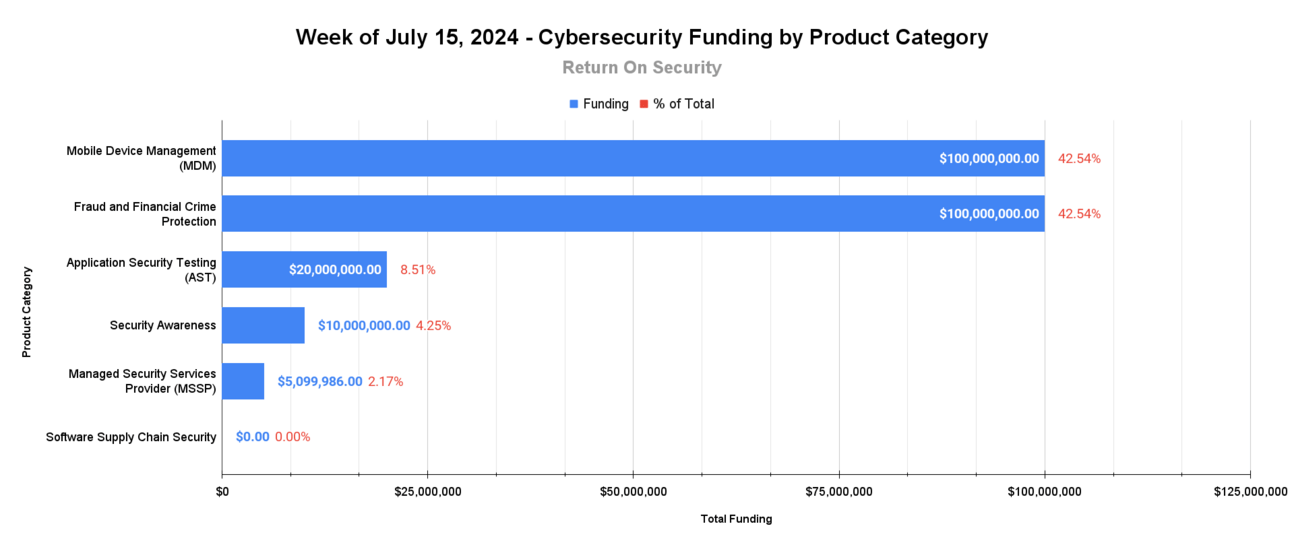

🧩 Funding By Product Category

$100.0M for Mobile Device Management (MDM) across 1 deal

$100.0M for Fraud and Financial Crime Protection across 1 deal

$20.0M for Application Security Testing (AST) across 1 deal

$10.0M for Security Awareness across 1 deal

$5.1M for Managed Security Services Provider (MSSP) across 1 deal

An undisclosed amount for Software Supply Chain Security across 1 deal

🏢 Funding By Company

Kandji, a United States-based Apple mobile device management (MDM) and security platform, raised a $100.0M Series D from General Catalyst. (more)

Pindrop, a United States-based voice authentication and biometric platform to prevent fraudulent and deepfake voices, raised a $100.0M Debt Financing from Hercules Capital. (more) 👈 What’s old is new again, thanks to AI

CultureAI, a United Kingdom-based security awareness and training platform, raised a $10.0M Series A from Mercia Ventures and Smedvig Ventures. (more)

Metabase Q, a United States-based managed security services provider (MSSP), raised a $5.1M Venture Round. (more)

Endor Labs, a United States-based software supply chain security platform, raised an undisclosed Venture Round from Citi Ventures. (more)

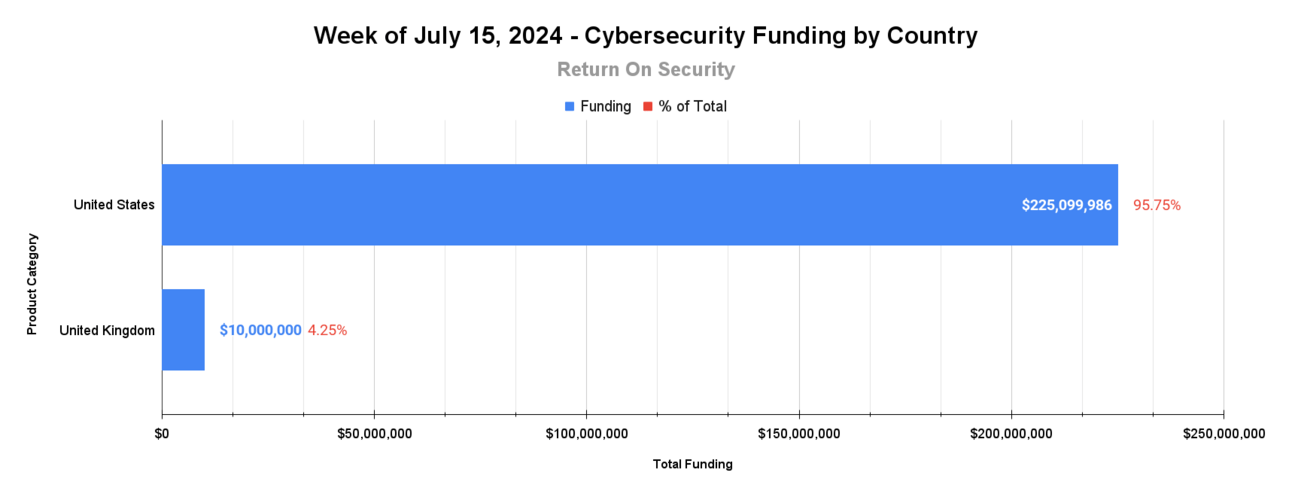

🌎 Funding By Country

$225.1M for the United States across 5 deals

$10.0M for the United Kingdom across 1 deal

🤝 Mergers & Acquisitions

Emagined Security, a United States-based professional services firm focused on incident response and penetration testing, was acquired by Neovera for an undisclosed amount. (more)

📚 Great Reads

Palo Alto isn’t going to buy everyone: the anatomy of cybersecurity startup exits - Ross Haleliuk and Mike Privette discuss the complexities of cybersecurity startup exits, debunk myths, and highlight the challenges in obtaining reliable M&A data.

*5 myths about workflow automation, debunked - Concerned that automation will replace team members or lead to rash decisions during remediation? Tines CEO and former security leader at eBay and DocuSign Eoin Hinchy dispels some common misconceptions.

8K and 10K Tracker - An automated tracker for SEC form 8K and 10K filings when companies have to report security breaches.

The AI Summer - While GenAI has received a huge amount of interest since ChatGPT was introduced to the world, the business use cases beyond chat agents have been very limited. AI is not out of the Product Market Fit (PMF) woods just yet.

*A message from our sponsor

🧪 Labs

This year’s album just hits different

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.