Security, Funded is a weekly deep dive into cybersecurity funding and industry news captured and analyzed by Mike Privette. This week’s issue is presented together with Chainguard.

Hey there,

I hope you had a good and long weekend if you’re tuning in from the US!

Summer is officially over around the world now 😫 and that includes VC Summer™️. 😤 👊 With deal size and volume heating up and the US economy looking increasingly like an interest rate increase is coming in September, everything is really starting to get interesting in the latter half of this year.

Onward to this week's issue.

Table of Contents

😎 Vibe Check

Are you using an "AI SOC" or AI copilot to support your security operations work today?

Last issue’s vibe check:

When it comes to AI for Security or Security for AI, what kind of company are you more likely to go with?

🟩🟩🟩🟩🟩🟩 🏢 A more established company (17)

🟨🟨🟨⬜️⬜️⬜️ 🆕 A newer startup (11)

28 Votes

Last week’s vibe check was a bit closer than I expected, with 60% of people saying they were more likely to go with an established company regarding AI for Security / Security for AI. I imagine that if I had put a third option of “A bit of both,” I would have gotten the most votes there. I think the market is far too large with far too many problems to solve at this point to go all-in on one kind of company vs. another. I also suspect that many are doing the “wait for my existing large vendor to add this feature.”

Some of the top comments from last week:

“More established - Newer startups are more likely to have solutions that only work in modern environments or are largely cloud based. Many organizations span not only cloud, but on-prem cloud native, VMs, and in some cases physical servers. Making security work across all those, where you manage your fleet or where you plan to deploy your AI-enabled apps, typically requires expertise that established companies have - however it does come at the cost of sleek, easy to use, and without all the extra cruft inherent with heritage code and systems.”

💰 Market Summary

7 companies raised $335.4M across 6 unique product categories in 5 countries

5 companies were acquired or had a merger event across 3 unique product categories

71% of funding went to product-based cybersecurity companies

2 public cyber companies had an earnings report

📸 YoY Snapshot

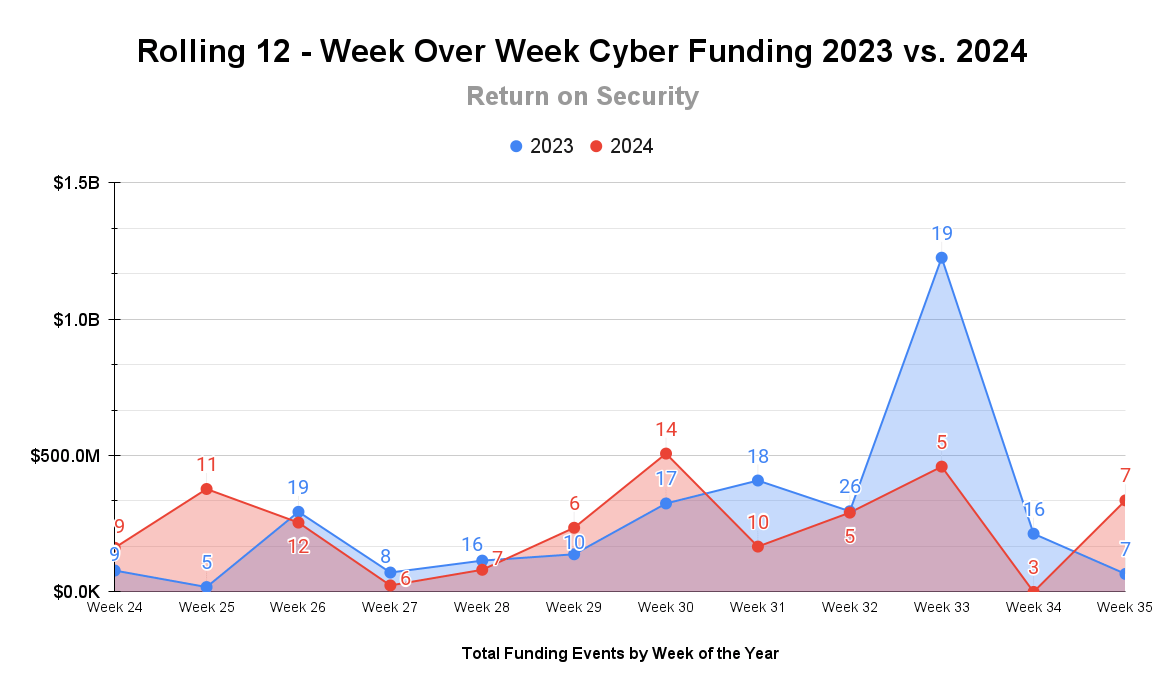

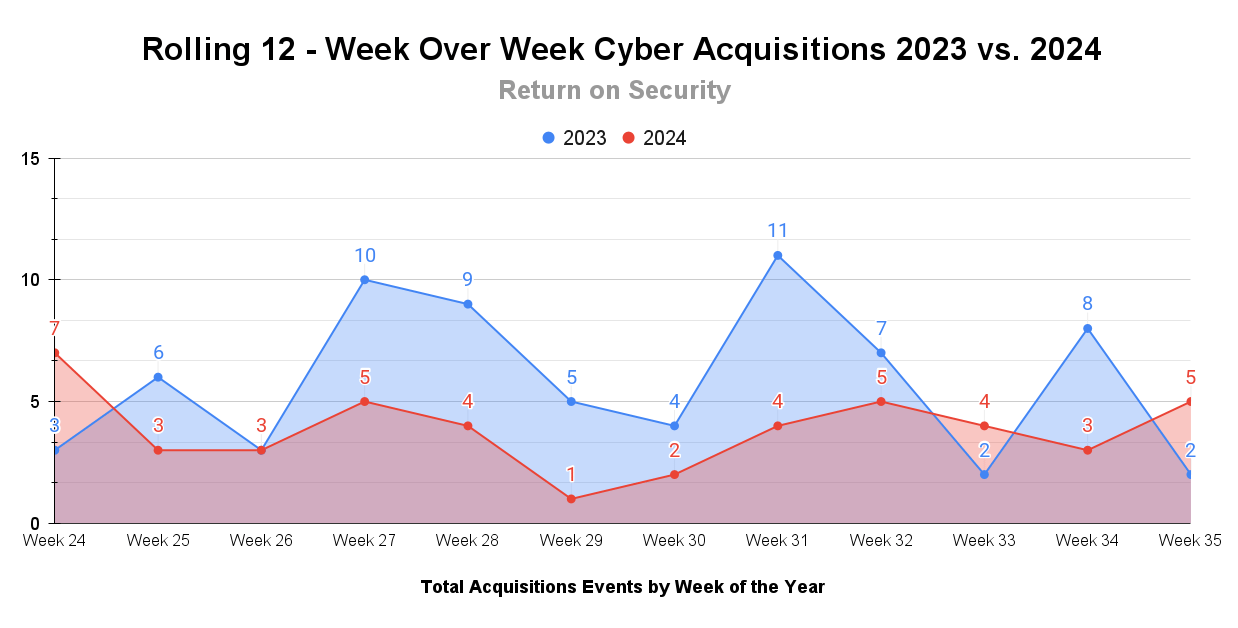

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between 2023 and 2024.

Funding is picking back up this week as VC Summer™ comes to an end. I think the latter half of this year is really going to pick up.

M&A again with a healthy week. Look for this area to pick up even more steam as the big dogs go through Q2 earnings season.

🤙 Earnings Reports

This section is Powered by Quartr, where I track all the latest earning reports.

Cyber Market Movers

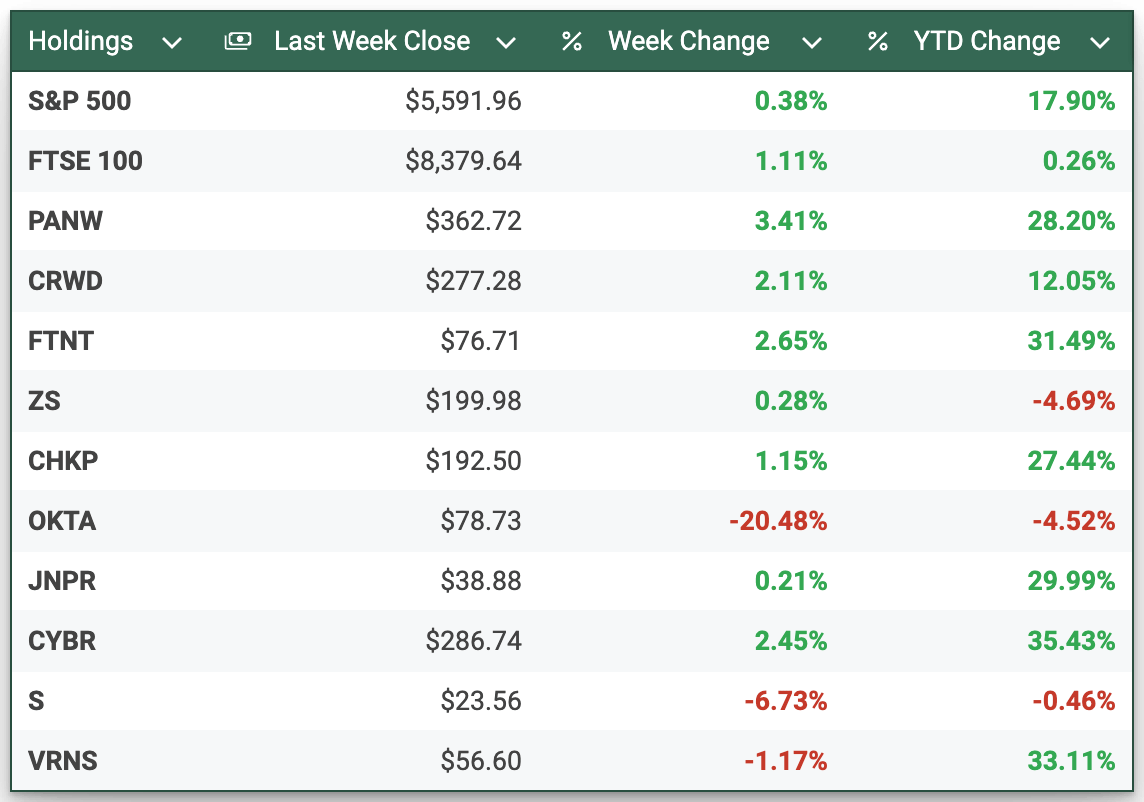

As of August 30th market close

If you joined the newsletter recently, I’m trying something new with this section. I’m taking the top 10 public cyber companies by market cap and tracking their change over time compared to the broader market.

The goal is to give you more data and situational awareness about the cyber industry as a whole with a bit of commentary.

Earnings reports from last week:

CrowdStrike (CRWD) - CrowdStrike beat its estimates this last quarter despite having the worst IT outage in history, but it revised its forward-looking guidance down for the rest of the year. Even with the mixed message, the stock is still up because it’s hard to replace the king. 👑

SentinelOne (S) - SentinelOne reported a strong quarter across all metrics, with revenue jumping 33% year-over-year (!!). Despite the very impressive numbers, the stock has been down ~7% since the earnings call. Like always, SentinelOne never shies away from taking shots at CrowdStrike, this time calling their architecture substandard in light of the major outage mentioned above.

Earning reports to watch this week:

Zscaler (ZS)

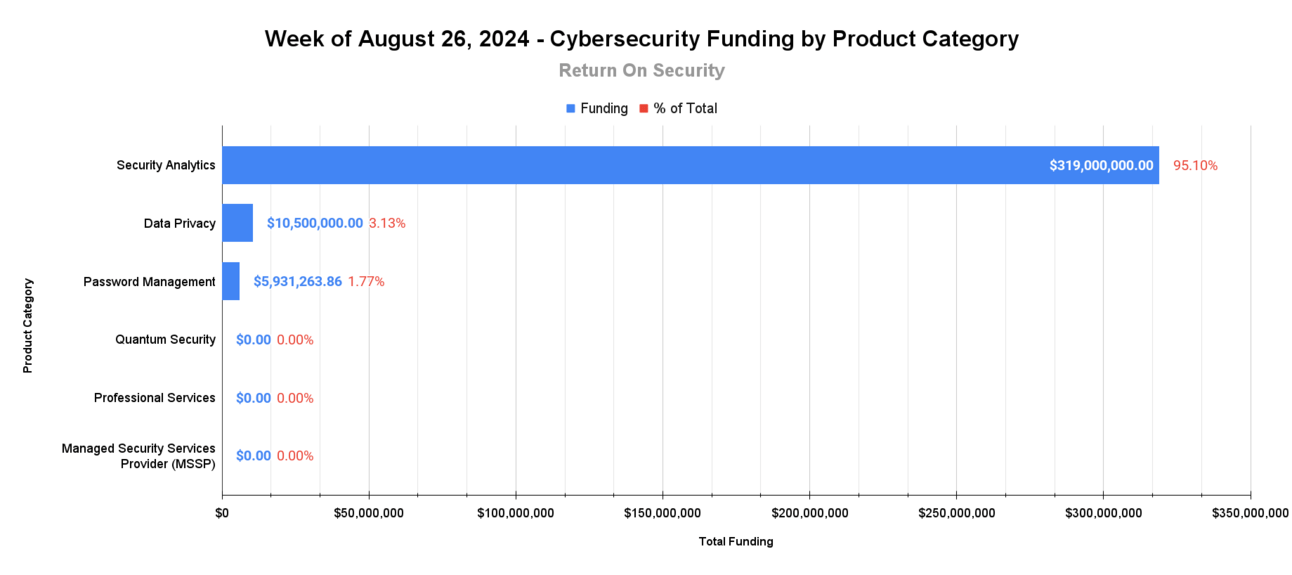

🧩 Funding By Product Category

$319.0M for Security Analytics across 1 deal

$10.5M for Data Privacy across 2 deals

$5.9M for Password Management across 1 deal

An undisclosed amount for Quantum Security across 1 deal

An undisclosed amount for Professional Services across 1 deal

An undisclosed amount for Managed Security Services Provider (MSSP) across 1 deal

🏢 Funding By Company

Uniqkey, a Denmark-based password management platform, raised a $5.9M Venture Round from BackingMinds. (more)

PrivacyHawk, a United States-based consumer and business data privacy management platform, raised a $3.0M Seed from K Street Capital. (more)

Cybanetix, a United Kingdom-based managed security services provider (MSSP), raised an undisclosed Venture Round from Phoenix Equity Partners. (more)

MOXFIVE, a United States-based professional services firm focused on digital forensics and incident response (DFIR), raised an undisclosed Private Equity Round from Falfurrias Management Partners. (more)

Quantum Bridge, a Canada-based quantum-resistant encryption key distribution platform, raised an undisclosed Corporate Round from Juniper Networks. (more)

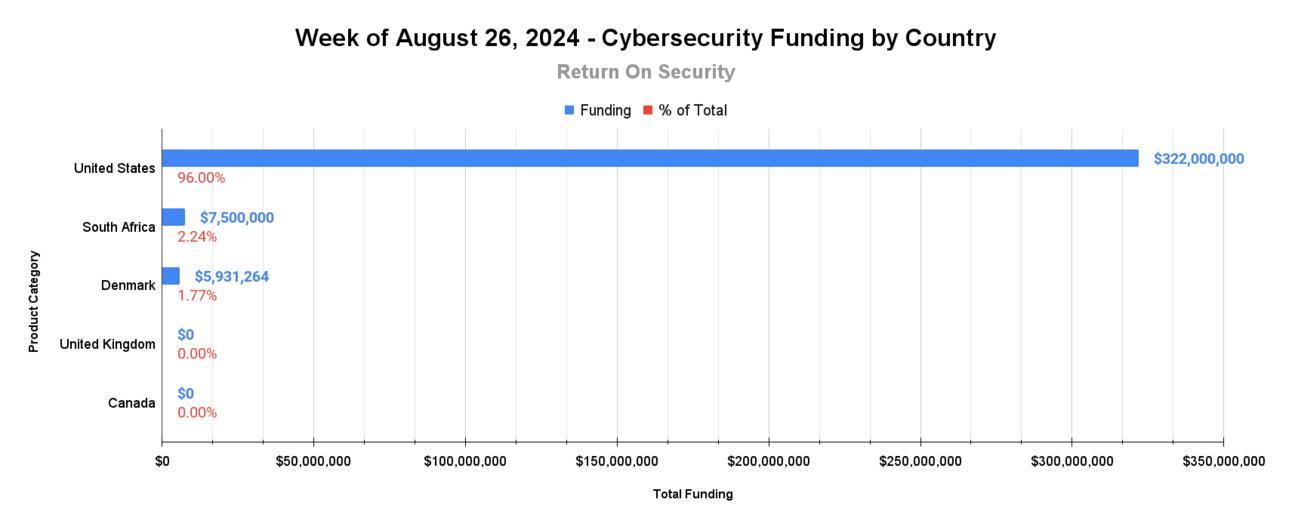

🌎 Funding By Country

$322.0M for the United States across 3 deals

$7.5M for South Africa across 1 deal

$5.9M for Denmark across 1 deal

An undisclosed amount for the United Kingdom across 1 deal

An undisclosed amount for Canada across 1 deal

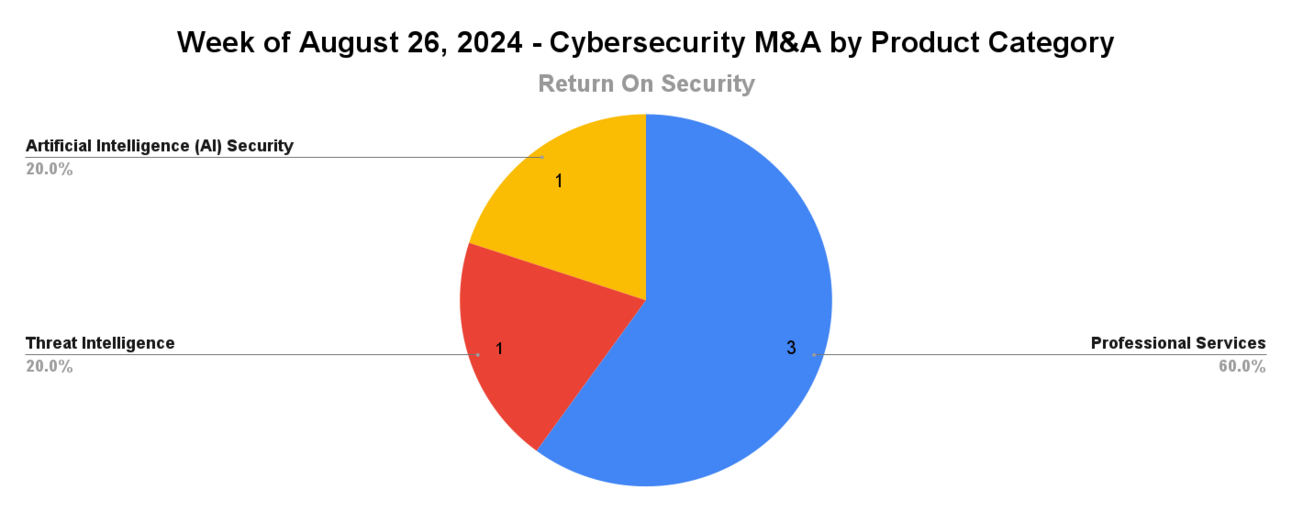

🤝 Mergers & Acquisitions

Cyber Sandia, a United States-based professional services firm focused on public sector cybersecurity assessments in the US state of New Mexico, was acquired by TAC Security for an undisclosed amount. (more)

Cyberint, an Israel-based cyber threat intelligence platform, was acquired by Check Point Software Technologies for an undisclosed amount. (more)

Forensic IT, an Australia-based professional services firm focused on digital forensics and incident response (DFIR), was acquired by Spirit Telecom for an undisclosed amount. (more)

Grove, a South Africa-based professional services firm focused on cloud security, was acquired by Integrity360 for an undisclosed amount. (more)

Robust Intelligence, a United States-based application security platform for securing AI applications and services, was acquired by Cisco for an undisclosed amount. (more)← This marks the 3rd AI Security acquisition this year

📚 Great Reads

Intel’s Immiseration - The long, seemingly inevitable decline of an icon. This is an interesting look into Intel's various missteps and slow decline.

*The State of Hardened Container Images - Hardened container images are critical to security and trust in open-source software. Chainguard Labs surveyed the field to learn how current offerings are living up to a “hardened” container image promise. Read the full research report to see how other images compare.

Cybersecurity Market Update: July 2024 - Check out July 2024's cybersecurity market trends, investments, major acquisitions, and global insights.

TL;DR: Every AI Talk from BSidesLV, Black Hat, and DEF CON 2024 - Clint Gibbler does it again with a meta-analysis of all the AI Security talks from the major security conferences this summer. Get up to speed on >60 AI talks in 15 minutes.

*A message from our sponsor

🧪 Labs

Relationship goals 😍

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.