Security, Funded is a weekly deep dive into the financial transactions, industry news, and economic activity in the cybersecurity market. This week’s issue is presented together with Material Security, ThreatLocker, and Nudge Security.

Hey there,

Hope you had a great weekend!

To say it was an eventful close to Q3 last week would be an understatement. Increasing tensions and physical combat in the Middle East, an almost “own goal” (been catching up on my football lingo in the UK) on the U.S. Economy from a dockworker strike, and generally healthy economic data (for now), the season finale of 2024 is going to be a doozy!

Onward to this week's issue.

TOGETHER WITH

Detect & Respond to Account Takeovers with Material

Regain control of SaaS security and spend

Attackers have endless ways to breach email accounts, gaining access to vital systems. Detecting account takeovers is challenging, as savvy attackers often blend in.

Material Security enhances email protection by identifying suspicious behaviors, alerting on mail forwarding rules, failed data retrievals, and password resets. We monitor Microsoft 365 and Google Workspace for signs of compromise, like unusual logins and rule changes.

Table of Contents

😎 Vibe Check

Do you think security awareness training actuallys work?

Last issue’s vibe check:

Forget your zodiac sign, tell me your favorite cybersecurity acronym right now.

🟨🟨🟨🟨⬜️⬜️ 📈 SIEM (11)

🟨🟨🟨🟨⬜️⬜️ 🦅 SOAR (11)

🟨🟨🟨⬜️⬜️⬜️ 🧦 SOC (7)

🟨🟨🟨⬜️⬜️⬜️ 😴 CNAPP (7)

🟨⬜️⬜️⬜️⬜️⬜️ 💽 DLP (4)

🟩🟩🟩🟩🟩🟩 👾 CTEM (15)

🟨🟨🟨🟨⬜️⬜️ 🔮 Other (tell me!) (11)

66 Votes

The CTEM’s (Continuous Threat Exposure Management - which is a new terminology grouping of Attack Surface Management (ASM) + Breach and Attack Simulation (BAS) + Vulnerability Management) have it! SIEM and SOAR tied for second along with the “Other” category. You can really see where the current line of thinking (and advertising) is going with this clustering of AI-enabled Everything™ and *DR (Everything Detection and Response).

Some of the top comments from last week:

“Other - ADR - Application Detection and Response. Apps and APIs are a big gap in security operations. Every other layer of the stack has a *DR solution. ADR is filling that gap with new and innovative instrumentation techniques.”

“Other - CDR (Cloud Detection and Response)“

“Other - Wait! What happened to all the _SPM's that Gartner told everyone they needed? CSPM, ASPM, DSPM, SSPM.... Is it possible, those ideas have been left behind already? ;-) "Leave the gun. Take the cannoli."“

💰 Market Summary

8 companies raised $131.0M across 8 unique product categories in 4 countries

7 companies were acquired or had a merger event across 7 unique product categories

100% of funding went to product-based cybersecurity companies

No public cyber company had an earnings report

📸 YoY Snapshot

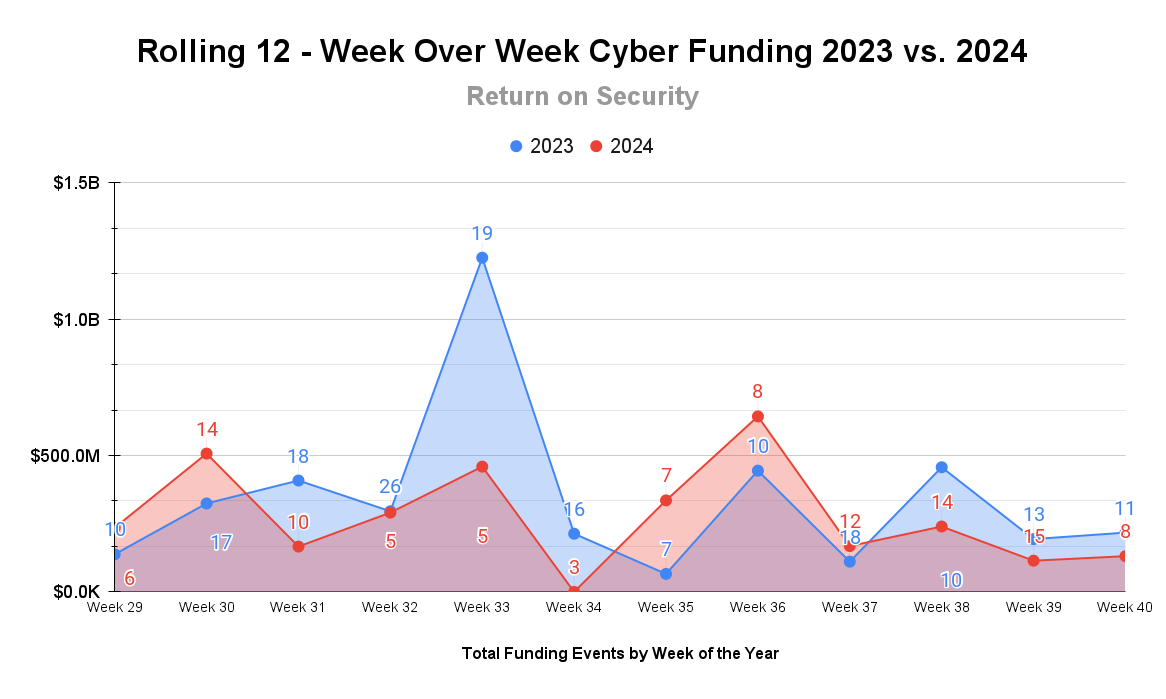

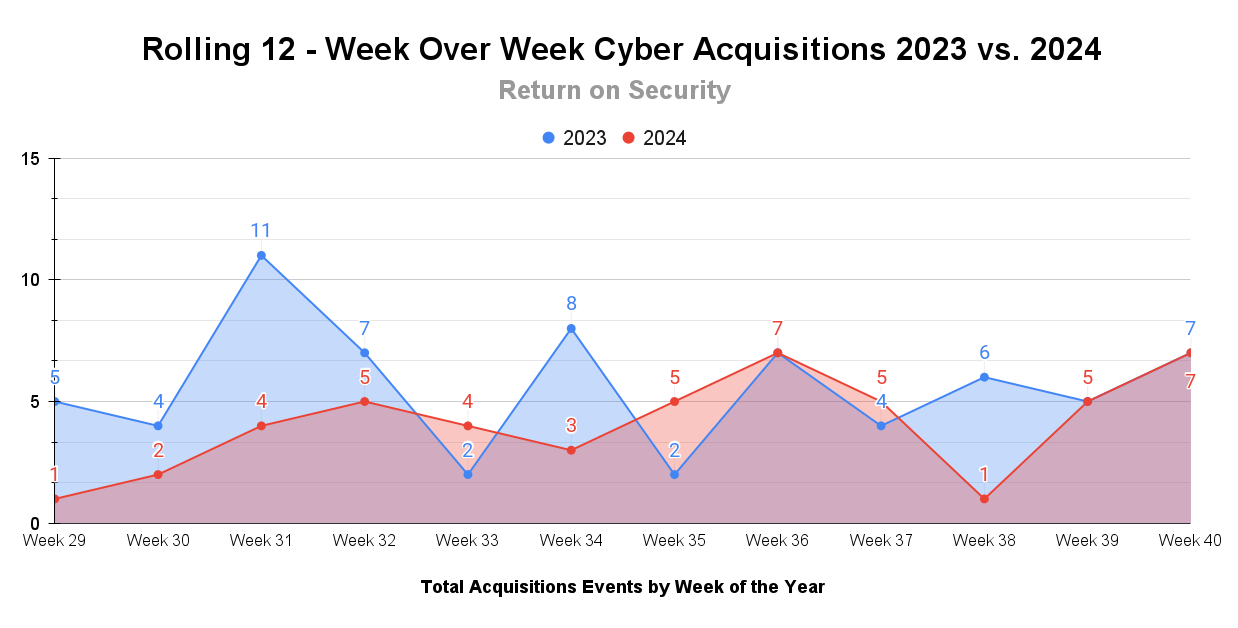

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between 2023 and 2024.

Funding to end Q3 was strong, with the quarter pulling in approximately $3.3 billion (the same as in 2022). Overall, 2024 is on a strong pace to meet and surpass 2023.

While M&A activity surged last week to wrap up Q3 and kick off Q4, it is still significantly behind 2023 in terms of transaction volume to the tune of 33%.

TOGETHER WITH

Remote Workforces are a Ticking Time Bomb!

How to Secure Remote Workforces

Hybrid and remote work expands your company's surface area of attack beyond corporate firewall boundaries. Employees’ personal computers introduce shadow IT, and home networks with default settings are easy targets, compounded by public Wi-Fi vulnerabilities.

You need to develop a strategy to stay secure while remote employees work across untrusted networks.

To learn more about how to secure your company's workforce, download the Remote Work: A Ticking Time Bomb eBook by ThreatLocker® today.

☎️ Earnings Reports

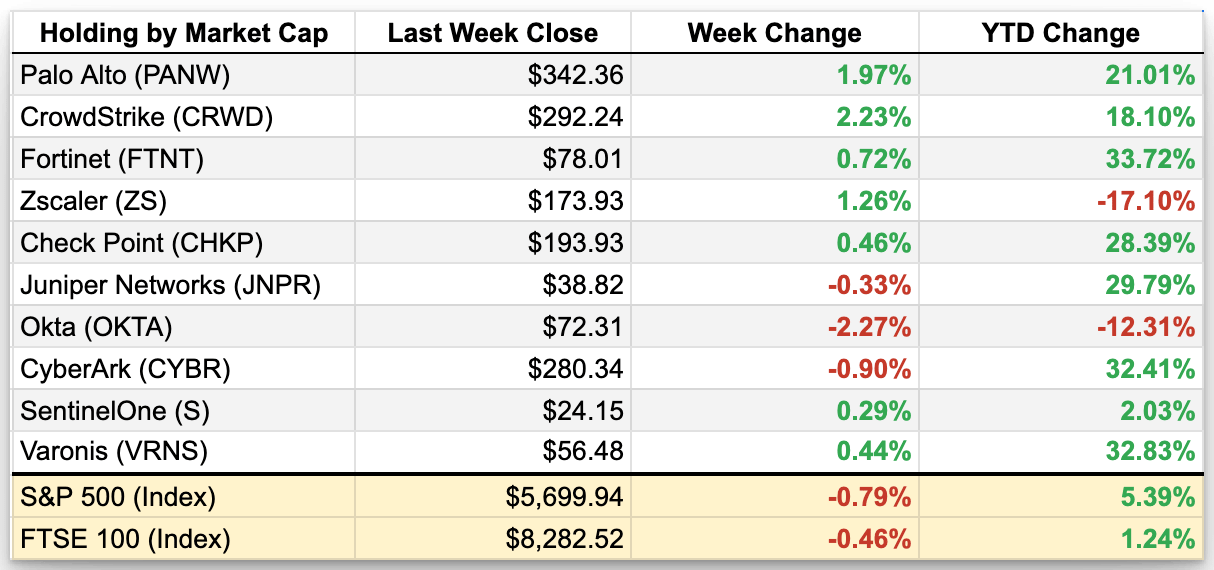

Cyber Market Movers

As of markets close on October 4, 2024

Earnings reports from last week: None

Macro Context:

A lot of tech stocks rebounded last week, including most of cyber.

Positive news from the September U.S. jobs report sent much of the global stock market heading up and to the right despite a bumpy week with the biggest dockworker strike in history and the escalating war between Israel and Iran.

October has always been historically full of surprises in the public markets, mostly bringing significant downturns for the year. Lower interest rates combined with stronger job reports and the looming election in the U.S., and you’ve got quite a recipe for excitement.

Earning reports to watch this coming week:

None

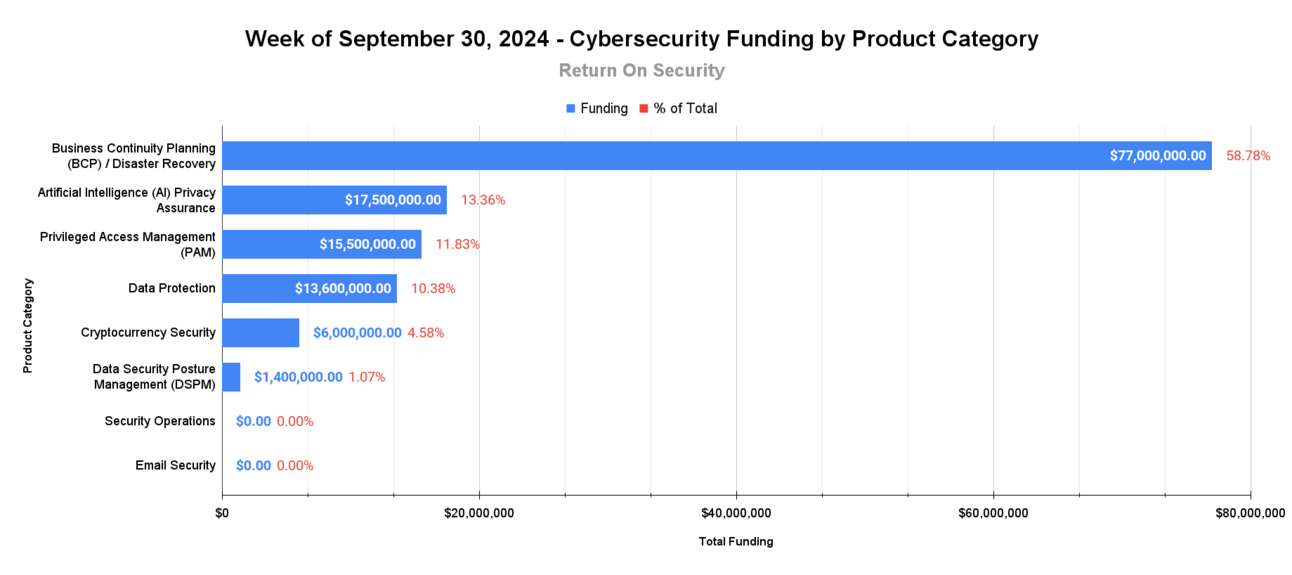

🧩 Funding By Product Category

$77.0M for Business Continuity Planning (BCP) / Disaster Recovery across 1 deal

$17.5M for Artificial Intelligence (AI) Privacy Assurance across 1 deal

$15.5M for Privileged Access Management (PAM) across 1 deal

$13.6M for Data Protection across 1 deal

$6.0M for Cryptocurrency Security across 1 deal

$1.4M for Data Security Posture Management (DSPM) across 1 deal

An undisclosed amount for Security Operations across 1 deal

An undisclosed amount for Email Security across 1 deal

🏢 Funding By Company

Harmonic Security, a United States-based platform to discover and control the usage of sensitive data in GenAI platforms and across the enterprise, raised a $17.5M Series A from Next47. (more)

Apono, a United States-based privileged access management (PAM) platform for cloud services, raised a $15.5M Series A from New Era Capital Partners. (more)

Arqit Limited, a United Kingdom-based data encryption platform, raised a $13.6M post-IPO equity from Notion Capital. (more)

Halon Security, a Sweden-based secure email hosting and delivery platform, raised an undisclosed Private Equity Round from Intera Partners. (more)

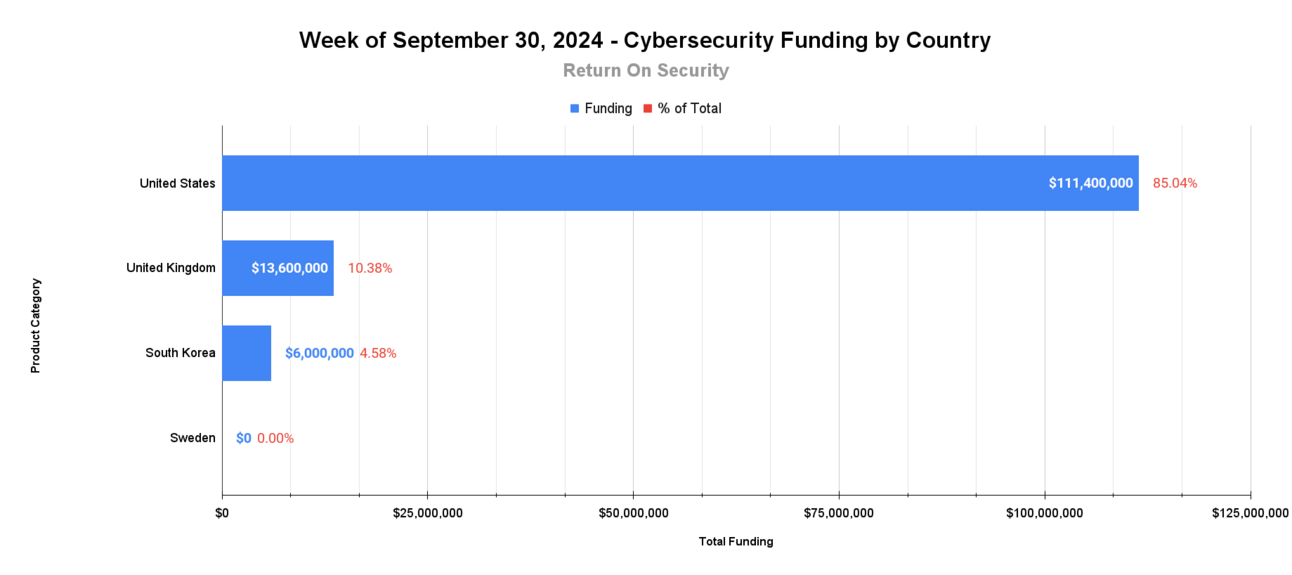

🌎 Funding By Country

$111.4M for the United States across 5 deals

$13.6M for the United Kingdom across 1 deal

$6.0M for South Korea across 1 deal

An undisclosed amount for Sweden across 1 deal

🤝 Mergers & Acquisitions

360IT Partners, a United States-based managed security services provider (MSSP), was acquired by Dataprise for an undisclosed amount. (more)

Applied Insight, a United States-based professional services firm focused on cybersecurity and data analytics, was acquired by CACI International Inc. for an undisclosed amount. (more)

Arrka, an India-based security and compliance automation platform, was acquired by Persistent Systems for an undisclosed amount. (more)

Network Perception, a United States-based secure networking and configuration management platform, was acquired by Dragos for an undisclosed amount. (more)

📚 Great Reads

The Myth of Security Market Consolidation - Oliver Rochford takes a look at why the cybersecurity market will never actually consolidate and the forces that are keeping it fragmented.

*The three-body problem of SaaS security - Why the classic physics challenge might feel familiar to those operating within the “shared security model” for SaaS applications.

The Intelligence Age - The path to the Intelligence Age is paved with compute, energy, and human will.

Daily AI: Quick Intel On Everything That Matters - Stay ahead of the AI curve with Prompts Daily's succinct overviews. This newsletter delivers the must-know tech trends directly to you, in just 3 minutes a day.

*A message from our sponsor

🧪 Labs

“This one weird trick…”

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.