Security, Funded is a weekly deep dive into the financial transactions, industry news, and economic activity in the cybersecurity market. This week’s issue is presented together with Harmonic Security, Chainguard, and Material Security.

Hey there,

Hope you had a great weekend!

Strong economic data from the US continues to roll in, and the European Central Bank (ECB) cut rates for a third consecutive time, hoping to keep the European economy out of a recession. Any way you slice it, the rising tides of the global economy, artificial intelligence, specifically Gen AI, has had a lot to do with it these last two years.

There’s been an interesting set of knock-on trends in cybersecurity, too. Two of the most prominent themes of 2024 have been the rebirth of the SOC/SIEM and an intense focus on data protection companies. AI has created an explosion of data and commensurate needs for data protection and more log and incident analysis.

We’ve not only seen a reemergence of growth and late-stage funding in those spaces but also in M&A activity. The acquisition of Trail Security last week (details below) marked the seventh acquisition of a Data Security Posture Management (DSPM) since 2023. As a point of reference, 2023 is about when the DSPM category was even created and started showing up in search results. This category is on fire 🔥

Speaking of being on fire, your boy got a new Beehiiv partner page last week, so smash that link if you want to get started with a newsletter and get a big discount.

Onward to this week's issue.

TOGETHER WITH

Prevent sensitive data from leaking into GenAI—without the DLP burden

Unlike other tools that block GenAI use entirely or rely on complex DLP setups, Harmonic Security provides pre-trained data protection models to prevent sensitive data loss and lighten the security team's workload.

Keep your sensitive data safe, while nudging, coaching, and educating users towards the safe use of GenAI.

If your company wants to embrace GenAI, Harmonic offers data protection guardrails. Check out our approach.

Table of Contents

😎 Vibe Check

Let's take the inverse of last week. In your experience, what's the easiest part about running a cyber program?

Last issue’s vibe check:

In your experience, what's the hardest part about running a cyber program?

🟨⬜️⬜️⬜️⬜️⬜️ 🤠 Tool and data wrangling (4)

🟨🟨🟨🟨🟨⬜️ 🗣️ Stakeholder communication (12)

🟩🟩🟩🟩🟩🟩 👀 Creating a supported vision (13)

🟨🟨🟨🟨🟨⬜️ 👯♀️ Talent recruiting/management (12)

🟨⬜️⬜️⬜️⬜️⬜️ 👹 The threats themselves (4)

🟨⬜️⬜️⬜️⬜️⬜️ 🔮 Other (tell me) (2)

47 Votes

It was interesting to see the results come in for last week’s vibe check, which has an almost three-way tie for the people and softer side of things over tech. It seems that creating and getting support from both a management and people aspect is what people see as the hardest part of the job.

Some of the top comments from last week:

“Creating a supported vision - Buy-in from management is key to getting the authority to do anything, and while framing things in terms of risk (even monetarily) can help, it can still come down to office politics”

“Creating a supported vision - It's challenge is less about the vision and more about getting the necessary support to action on it.”

💰 Market Summary

7 companies raised $82.9M across 7 unique product categories in 6 countries

5 companies were acquired or had a merger event across 5 unique product categories

86% of funding went to product-based cybersecurity companies

No public cyber company had an earnings report

📸 YoY Snapshot

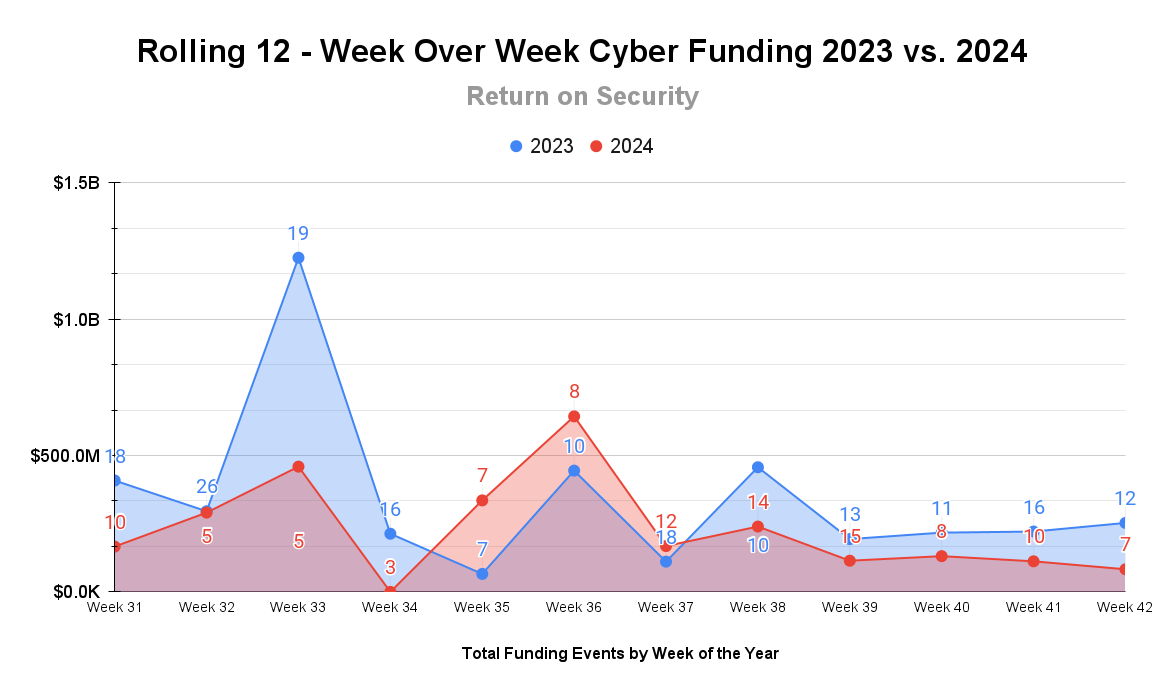

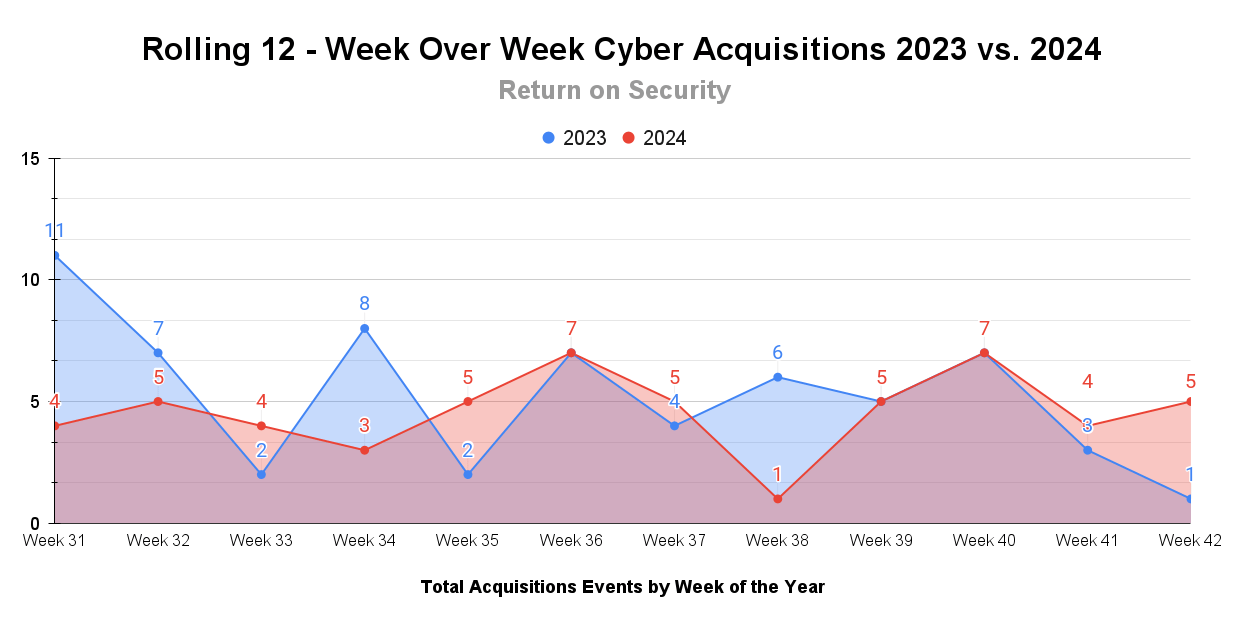

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between 2023 and 2024.

Funding is continuing on its mild start to Q4, but matching 2023 is still well within range. Don’t listen to the clickbait FUD headlines!

M&A activity had a slight blip back up these past few weeks, and even though the year has been substantially lower in terms of volume, the amount of money changing hands in 2024 is already even with 2023.

TOGETHER WITH

The Truth About Container Vulnerabilities

What Every Developer Needs to Know

Hardened container images play a major role in security, trust, and vulnerability management for open-source software. Chainguard Labs reviewed existing market offerings to find out whether they deliver on the “hardened” container image promise and how different providers compare.

☎️ Earnings Reports

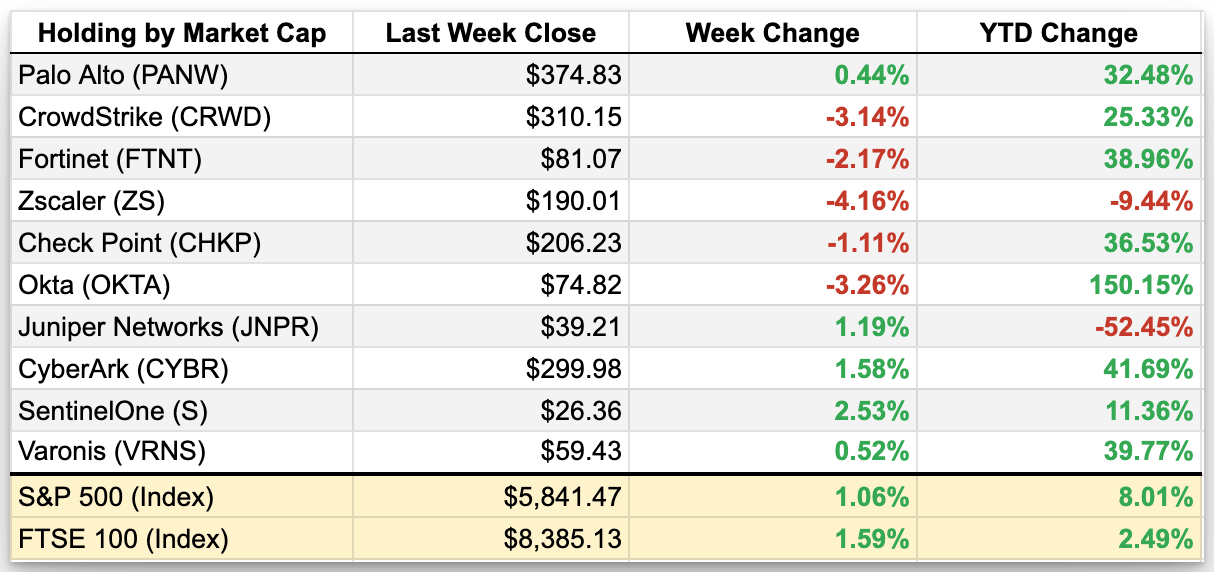

Cyber Market Movers

As of markets close on October 18, 2024

Earnings reports from last week: None

Macro Context:

The European Central Bank (ECB) cut interest rates again for the third consecutive time in six months.

The US market rallied hard in general, and a lot of big tech companies also rallied back up with solid news from AI chipmakers.

Expect markets to get more volatile up and down as we get closer to the US Presidential Election coming up on November 5th.

Earning reports to watch this coming week:

None, but Q3 earnings season is fast approaching!

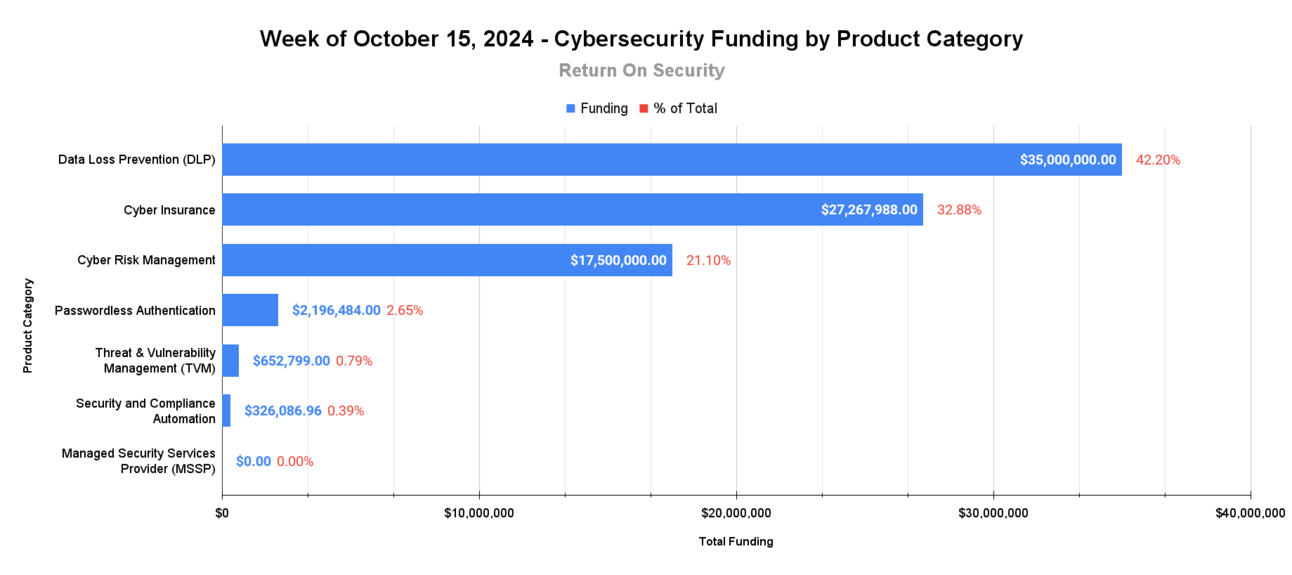

🧩 Funding By Product Category

$35.0M for Data Loss Prevention (DLP) across 1 deal

$27.3M for Cyber Insurance across 1 deal

$17.5M for Cyber Risk Management across 1 deal

$2.2M for Passwordless Authentication across 1 deal

$652.8K for Threat & Vulnerability Management (TVM) across 1 deal

$326.1K for Security and Compliance Automation across 1 deal

An undisclosed amount for Managed Security Services Provider (MSSP) across 1 deal

🏢 Funding By Company

Trail Security, an Israel-based company (that was still in stealth mode!) focused on data loss prevention (DLP), raised a $35.0M Series A from CRV, Cyberstarts, and Lightspeed Venture Partners. (more)

TraitWare, Inc., a United States-based passwordless authentication platform, raised a $2.2M Venture Round. (more)

Melius Cyber, a United Kingdom-based threat and vulnerability management (TVM) platform, raised a $652.8K Seed from Northeast Venture Fund ( NEVF ). (more)

Protostars, an Ireland-based security and compliance automation platform for the EU market, raised a $326.1K Pre-Seed from Growing Capital and Enterprise Ireland.

Seconia, a Switzerland-based managed security services provider (MSSP), raised an undisclosed Seed round.

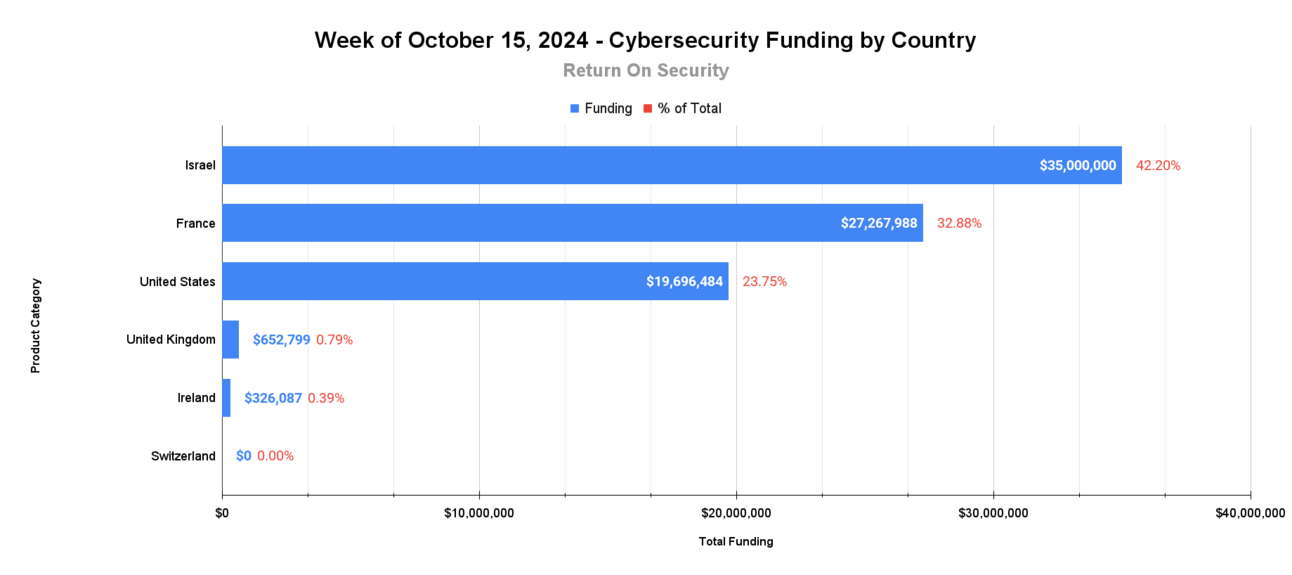

🌎 Funding By Country

$35.0M for Israel across 1 deal

$27.3M for France across 1 deal

$19.7M for the United States across 2 deals

$652.8K for the United Kingdom across 1 deal

$326.1K for Ireland across 1 deal

An undisclosed amount for Switzerland across 1 deal

🤝 Mergers & Acquisitions

Trail Security, an Israel-based company still in stealth mode (yes, the same one from above!) focused on data loss prevention (DLP), was acquired by Cyera for $162.0M. (more) This is some next-level stuff!

OffSec, a United States-based cybersecurity education and training platform focused on practical offensive and defensive security, was acquired by Leeds Equity Partners for an undisclosed amount. (more)

PlanNet 21, an Ireland-based managed security services pro, was acquired by Conscia A/S for an undisclosed amount. (more)

📚 Great Reads

Cybersecurity Models - A GitHub collection of models for organizing, prioritizing, and understanding cybersecurity and information risk management concepts.

*The Evolution of Email Security: Piecing Together a Fragmented Landscape - Why we need to move beyond traditional email security and how to modernize your solution.

Enterprise Governance Is Failing Cloud Security - Nearly every single cloud security issue and breach is the direct result of a governance failure, not a technology failure.

Accel Euroscape 2024 - Accel brings us a deep dive report that talks about how GenAI is fueling public and private market recovery and unlocking unprecedented opportunities and innovation.

*A message from our sponsor

🧪 Labs

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.