Security, Funded provides a weekly analysis of economic activity in the cybersecurity market. This week’s issue is presented together with Nudge Security and Palo Alto Networks.

Hey there,

Hope you had a great weekend!

Well, that didn’t take long! The day he stepped into the White House, US President Trump threw out former President Biden's AI Security Executive Order (along with 77 other EOs!). It’s too early to tell what this will mean for the industry at large, but AI safety and governance professionals around the world are not fans of this outcome.

Also, a new AI model released by a hedge fund in China shakes the AI and security industry at large, with concerns around the advanced capabilities of the model and the troublesome privacy policy that came with it.

Last week had a ton of activity, so you might as well go ahead and hit that “Read Online” link at the top right so you can read the whole issue more easily. 🫡

TOGETHER WITH

How GLAAD protects SaaS identities and sensitive data with Nudge Security

When the team at GLAAD deployed Nudge Security, they were blown away by the immediate visibility it provided into shadow SaaS.

With this visibility, they were able to achieve quick wins, including:

50% less time required to discover and secure SaaS accounts

90% reduction in offboarding time, with more complete results

11 previously-unknown GenAI tools discovered

Continuous SaaS security monitoring and breach alerts

SaaS identity governance for a high-risk remote workforce

Table of Contents

😎 Vibe Check

If your cybersecurity program were a video game, how would you “win”?

Last issue’s vibe check:

Who has the most influence over cybersecurity budget decisions in your organization?🟩🟩🟩🟩🟩🟩 Security Leadership (e.g., CISO, Head of X) (27)

🟨🟨🟨⬜️⬜️⬜️ The CEO / Board of Directors (16)

🟨⬜️⬜️⬜️⬜️⬜️ The CFO / Finance Team (9)

🟨⬜️⬜️⬜️⬜️⬜️ Security Practitioners (6)

58 Votes

Thank you to everyone who voted last week! Looking at these results, I realize they are upside down from what I expected. I expected security practitioners to have the most or equal sway as the security leadership team, that the CFO would finish second, and the CEO / BOD would be dead last. 🤔

Some of the top comments from last week:

Security Leadership - “I take in a lot of guidance/advice/ideas from my practitioners and other business leaders (BoD, CFO, CIO, etc.) could heavily influence, too, but ultimately they leave us the autonomy to have budget, decisions, influence, etc. reside on me and my leaders.”

💰 Market Summary

17 companies raised $77.9M across 17 unique product categories in 8 countries

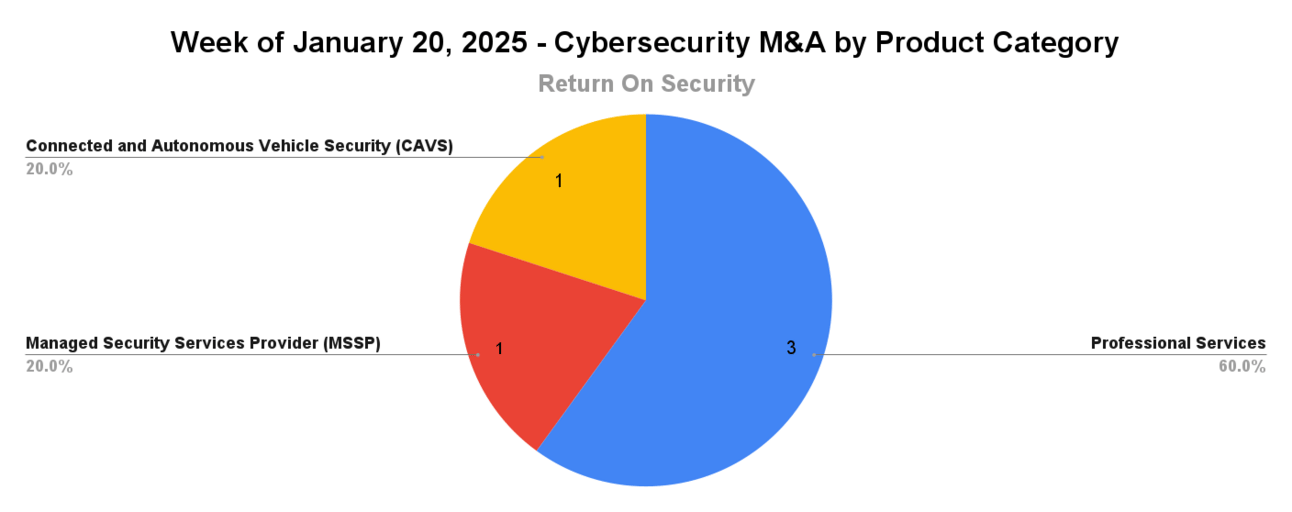

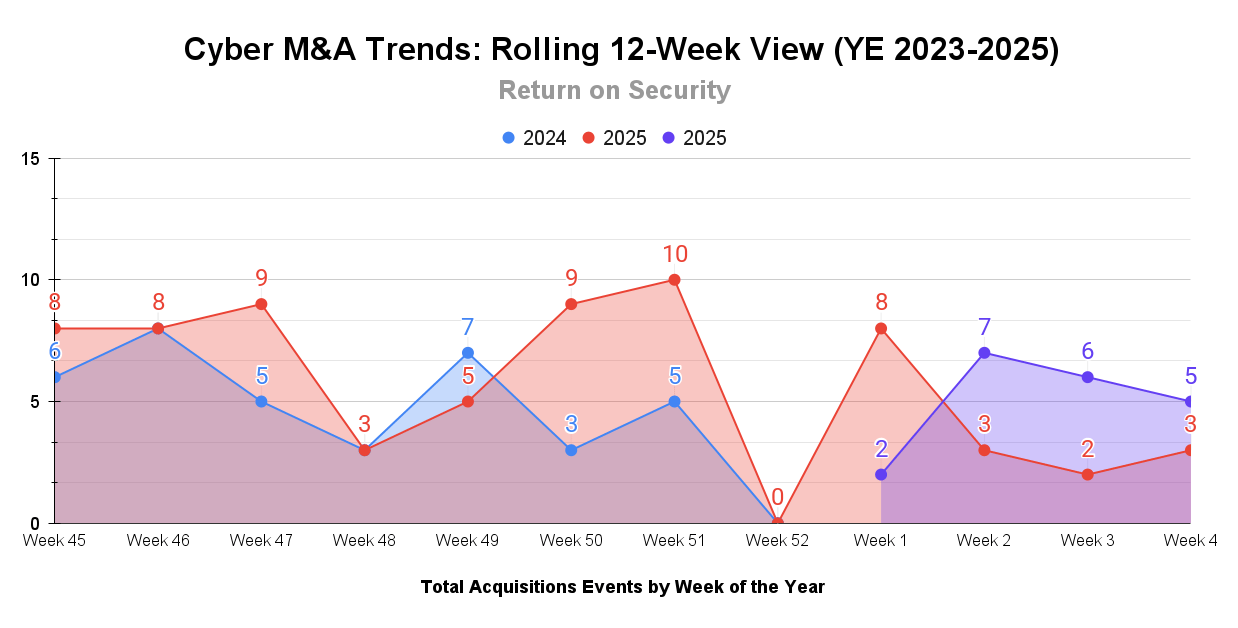

5 companies were acquired or had a merger event across 3 unique product categories

97.5% of funding went to product-based cybersecurity companies

No public cyber companies had an earnings report

📸 YoY Snapshot

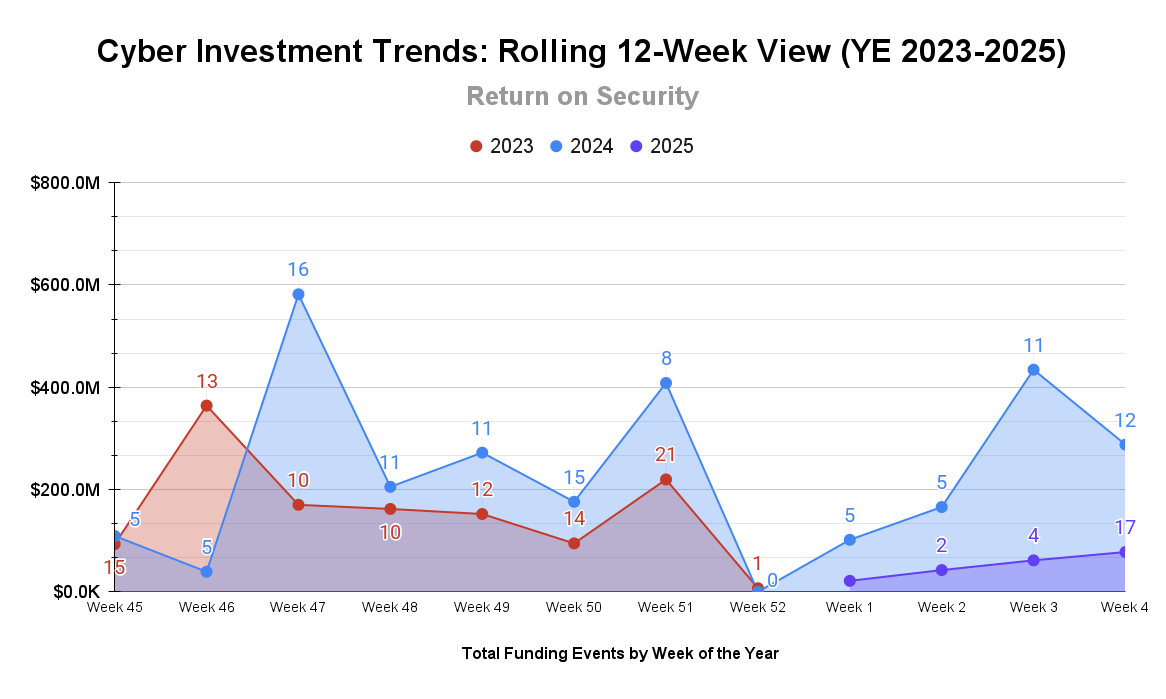

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between the end of 2023 and the start of 2024 and 2025.

There was a ramp-up in volume on the funding side last week, but dollar figures are still relatively low. This is just a timing issue, as the bigger rounds are starting to roll in.

M&A continues to progress strongly, with more professional services and MSSP businesses being acquired.

☎️ Earnings Reports

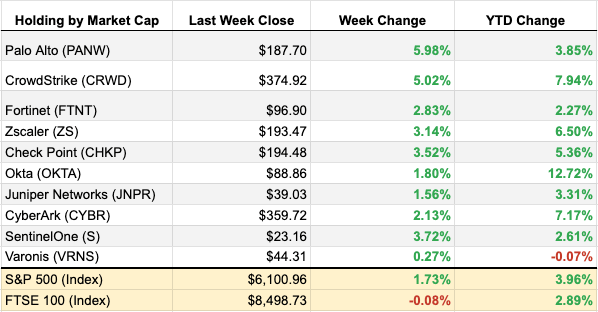

Cyber Market Movers

As of markets close on January 24, 2025

Earnings reports from last week: None

Macro Context:

The S&P 500 hit its first record of 2025 last week, bolstered by a strong start to earnings season and President Trump’s support for business tax cuts.

The tech-heavy US indexes took some hits after hours on Friday when a Chinese AI model named DeepSeek V3 was released from a prominent hedge fund in China. The model’s launch temporarily shook investor confidence in NVIDIA and similar companies.

Earning reports to watch this coming week:

None

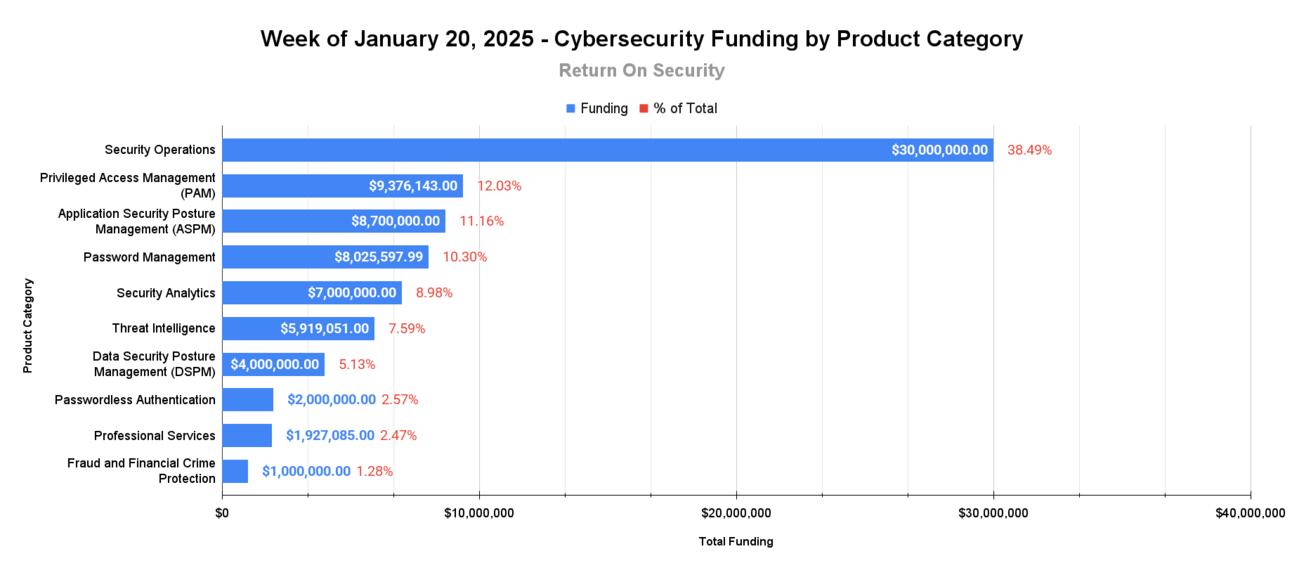

🧩 Funding By Product Category

$30.0M for Security Operations across 1 deal

$9.4M for Privileged Access Management (PAM) across 1 deal

$8.7M for Application Security Posture Management (ASPM) across 1 deal

$8.0M for Password Management across 1 deal

$7.0M for Security Analytics across 1 deal

$5.9M for Threat Intelligence across 1 deal

$4.0M for Data Security Posture Management (DSPM) across 1 deal

$2.0M for Passwordless Authentication across 1 deal

$1.9M for Professional Services across 1 deal

$1.0M for Fraud and Financial Crime Protection across 1 deal

An undisclosed amount for Software Supply Chain Security across 1 deal

An undisclosed amount for Secure File Sharing across 1 deal

An undisclosed amount for Quantum Security across 1 deal

An undisclosed amount for Network Security across 1 deal

An undisclosed amount for Managed Detection and Response (MDR) across 1 deal

An undisclosed amount for Attack Surface Management (ASM) across 1 deal

An undisclosed amount for Application Security Testing (AST) across 1 deal

🏢 Funding By Company

Products:

Mitiga, an Israel-based cloud-based incident response platform, raised a $30.0M Series B from SYN Ventures. (more)

Fudo Security, a United States-based privileged access management (PAM) platform, raised a $9.7M Venture Round from bValue Fund. (more)

DryRun Security, a United States-based application security posture management (ASPM) platform, raised a $8.7M Series A from LiveOak Venture Partners and Work Bench Ventures. (more)

Passbolt, a Luxembourg-based password management platform, raised a $8.0M Seed from Airbridge Equity Partners. (more)

Axoflow, a United States-based security and cloud data aggregation and analytics platform, raised a $7.0M Seed from EBRD Venture Capital. (more)

Zynap, a Spain-based threat intelligence platform, raised a $5.9M Seed from K Fund and Kibo Ventures. (more)

Safetica Technologies, a Czech Republic-based data security posture management (DSPM) platform, raised a $4.0M Series A from Impulse Ventures. (more)

Keyless, a United Kingdom-based passwordless authentication platform, raised a $2.0M Venture Round from Experian Ventures and Rialto Ventures. (more)

Almanax, a United States-based cryptocurrency and smart contract auditing and security platform, raised a $1.0M Venture Round from Blockchain Builders Fund and Eden Ventures. (more)

CYFIRMA, a Singapore-based external attack surface management platform, raised an undisclosed Venture Round from MDI Ventures. (more)

FileCloud, a United States-based secure file-sharing platform, raised an undisclosed Private Equity Round from Level Equity Management. (more)

Murphy Security, a China-based open-source software supply chain security platform, raised an undisclosed Seed from Hangzhou Fuzhuo Investment Management and Hundsun Technologies. (more)

QuSecure, a United States-based cloud network security platform using post-quantum cryptography, raised an undisclosed Venture Round from Accenture Ventures. (more)

SandboxAQ, a United States-based post-quantum cryptography (PQC) security platform, raised an undisclosed Venture Round from Arcapita Ventures and Parkway Venture Capital. (more)

TENEX.AI, a United States-based managed threat detection and response (MDR) platform, raised an undisclosed Seed from Andreessen Horowitz. (more)

ZeroPath, a United States-based code vulnerability scanning platform, raised an undisclosed Seed from SurgePoint Capital. (more)

Services:

🌎 Funding By Country

$30.0M for Israel across 1 deal

$26.1M for the United States across 9 deals

$8.0M for Luxembourg across 1 deal

$7.8M for Spain across 2 deals

$4.0M for Czech Republic across 1 deal

$2.0M for the United Kingdom across 1 deal

An undisclosed amount for Singapore across 1 deal

An undisclosed amount for China across 1 deal

🤝 Mergers & Acquisitions

Product

Service

Cybeta, a United States-based professional services company focused on threat intelligence and dark web monitoring, was acquired by HPN Holdings, Inc. (also known as “Master Glazier's Karate International,” which cracks me up 🥋 ) for an undisclosed amount. Cybeta has not publicly disclosed any prior funding rounds. (more)

MorganFranklin Cyber, a United States-based professional services firm focused on security operations and program strategy, was acquired by M/C Partners for an undisclosed amount. MorganFranklin Cyber has not publicly disclosed any prior funding rounds. (more)

U.S. Computer Connection, a United States-based managed security services provider (MSSP), was acquired by Netsurit for an undisclosed amount. U.S. Computer Connection has not publicly disclosed any prior funding rounds. (more)

The cybersecurity consulting arm of WithSecure, a Finland-based professional services firm focused on cybersecurity risk management, was acquired by Neqst for an undisclosed amount. WithSecure has not publicly disclosed any prior funding rounds. (more)

📚 Great Reads

Read More Books - A palette cleanser and a reminder for the overconsuming digital person (like me).

*GigaOm Radar for Software Supply Chain Security - Your guide to navigating software supply chain risks. Dive into the evolving threat landscape, discover top vendor solutions, and learn expert strategies to protect your systems.

By Default, Capital will Matter More Than Ever After AGI - Labour-replacing AI will shift the relative importance of human vs. non-human factors of production, which reduces the incentives for society to care about humans while making existing powers more effective and entrenched.

*A message from our sponsor

🧪 Labs

They say if you love something, let it go…

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.