Security, Funded provides a weekly analysis of economic activity in the cybersecurity market. This week’s issue is presented together with Harmonic Security.

Hey there,

I hope you had a great weekend!

Another big week in the industry with huge funding rounds, craziness on the threat intelligence front, and a whole lot of political tensions. Maybe grab another coffee to get locked in for this issue.

In brighter news, it’s that time of year already when party invites for big conferences like RSA are starting to roll out. This year, I’m happy to share that Return on Security will be cohosting a few after-party events at RSA, and here is the first one:

I’ll announce the second one as soon as the details get finalized, but I hope to see you there!

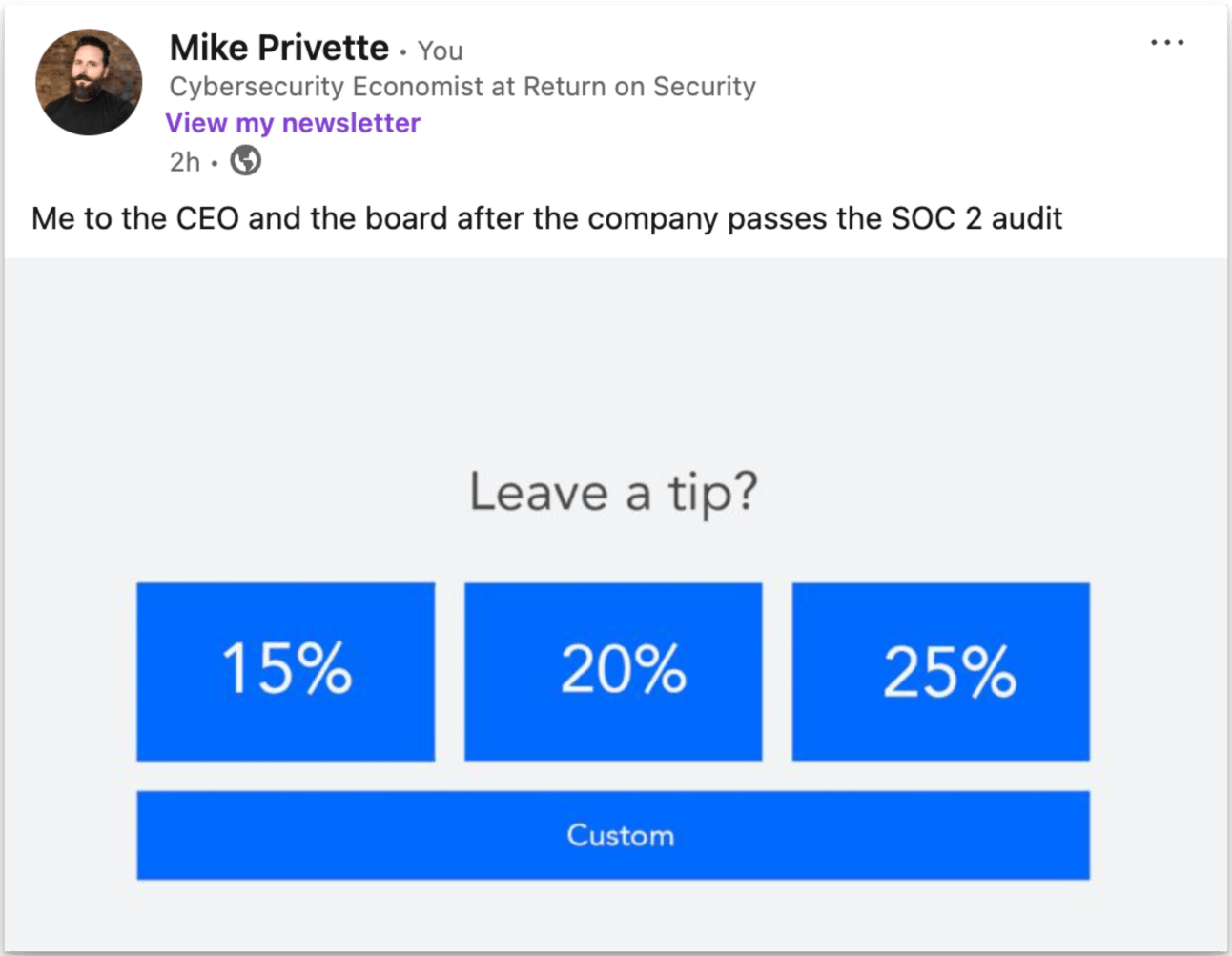

Also, this was the best response last week, with five bullet points showing what you accomplished that increased shareholder value:

This is the big-brain thinking we need 🧠

TOGETHER WITH

AI Is Already in Your Organization—Are You in Control?

AI adoption is happening whether you have a plan or not. Do you know what data is feeding AI models? Can you see how AI is being used across your business? Is your current data protection effective enough to prevent exposure?

Harmonic Security offers clear visibility into AI risks and gives you the controls you need to manage them—without slowing innovation.

Get started today by speaking with Harmonic.

Table of Contents

😎 Vibe Check

Whether you’re a security leader, product builder, or investor, what’s holding back AI in cybersecurity?

Last issue’s vibe check:

How is your team improving detection & response this year?

🟨🟨🟨⬜️⬜️⬜️ 🛠️ Consolidating tools (6)

🟩🟩🟩🟩🟩🟩 💼 Outsourcing to MSSPs (10)

🟨🟨🟨⬜️⬜️⬜️ 🧑💻 Upskilling internal teams (6)

🟨🟨🟨🟨⬜️⬜️ 🤖 Investing in automation & AI (8)

30 Votes

Last week, the top response for improving detection and response was outsourcing to MSSPs. This makes a lot of sense, as MSSPs and MDR providers have become more appealing due to budget constraints and hiring freezes over the past few years. The same sentiment can be seen in funding, as MSSPs and MDR providers have accounted for roughly $4 billion in funding over the last three years.

Investing in automation and AI was a close second, but it is likely not yet a significant game-changer for most teams. There’s still work to be done.

Some of the top comments from last week’s vibe check:

Outsource - “Just too hard to staff and retain a full 24/7 SOC with the budget they gave me.”

Consolidate - “Hopefully, it'll improve visibility, though a lot of the team will have to learn another SIEM language... again.”

💰 Market Summary

11 companies from 5 countries raised $407.1M across 11 unique product categories

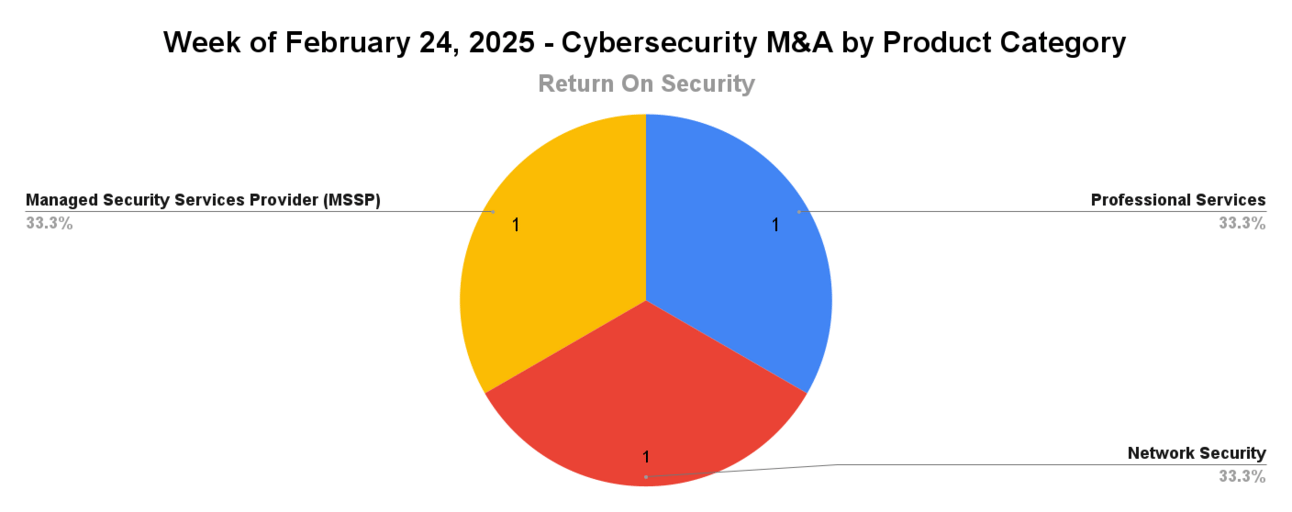

2 companies were acquired or had a merger event for $37.5M across 2 unique product categories

99% of funding went to product-based cybersecurity companies

No public cyber companies had an earnings report

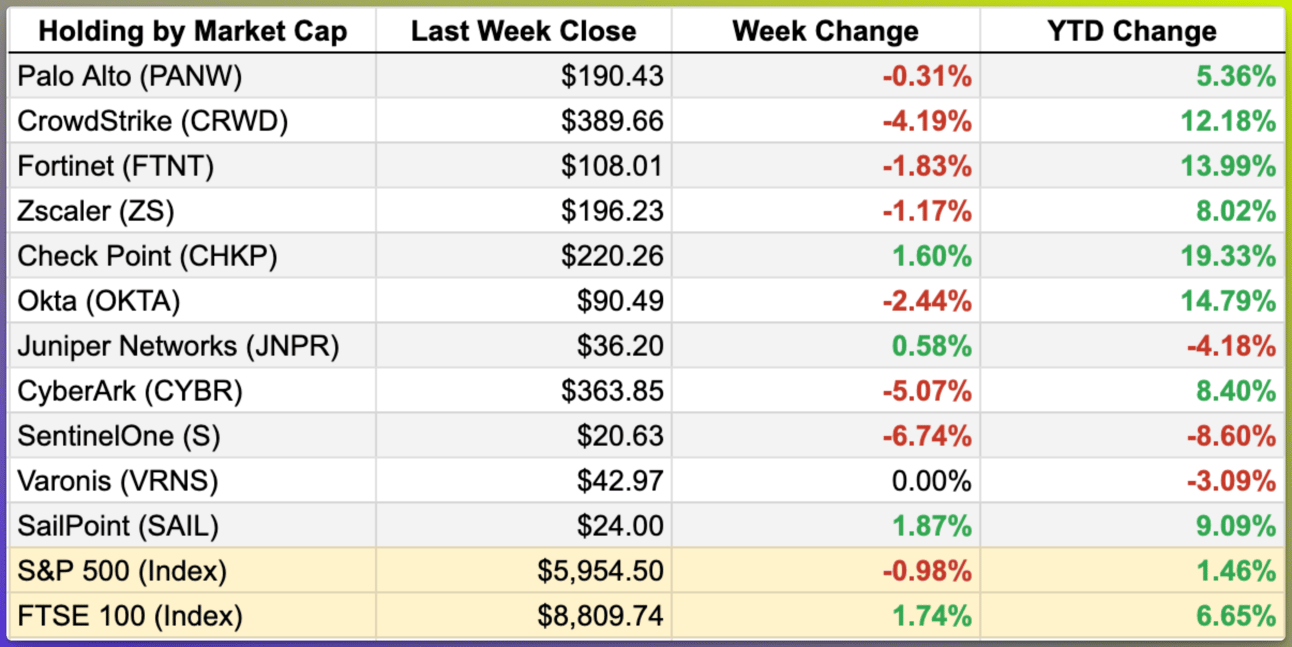

Public Market Moves

As of markets close February 28, 2025

📸 YoY Snapshot

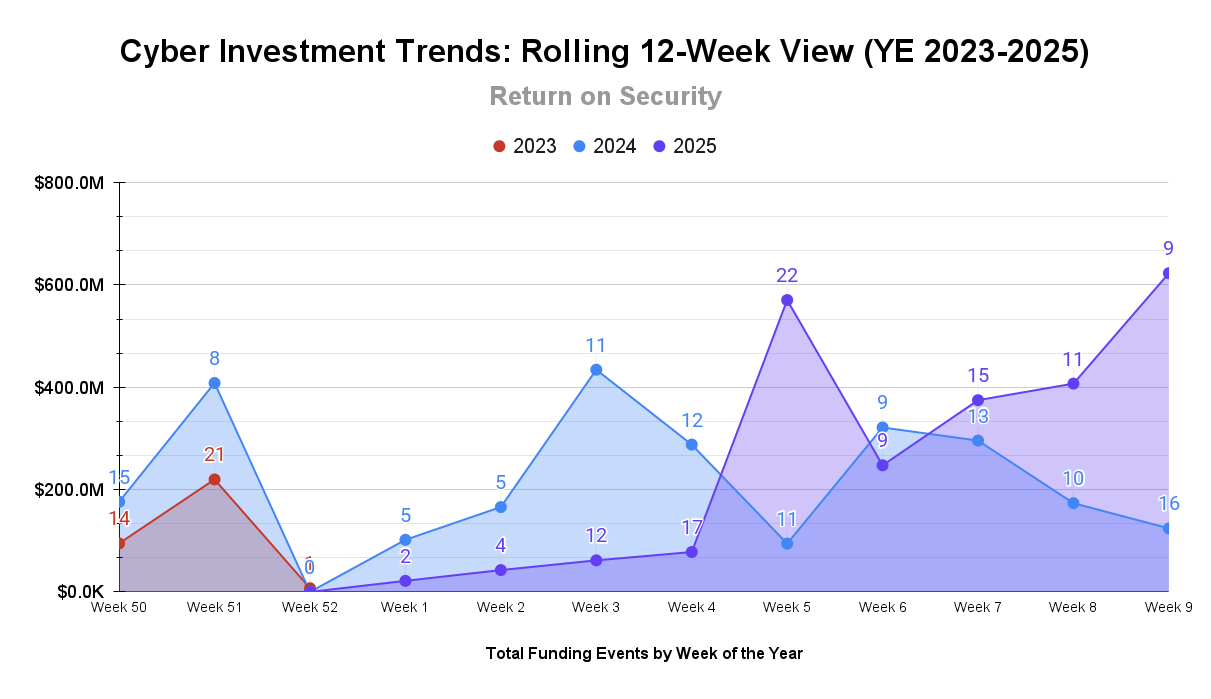

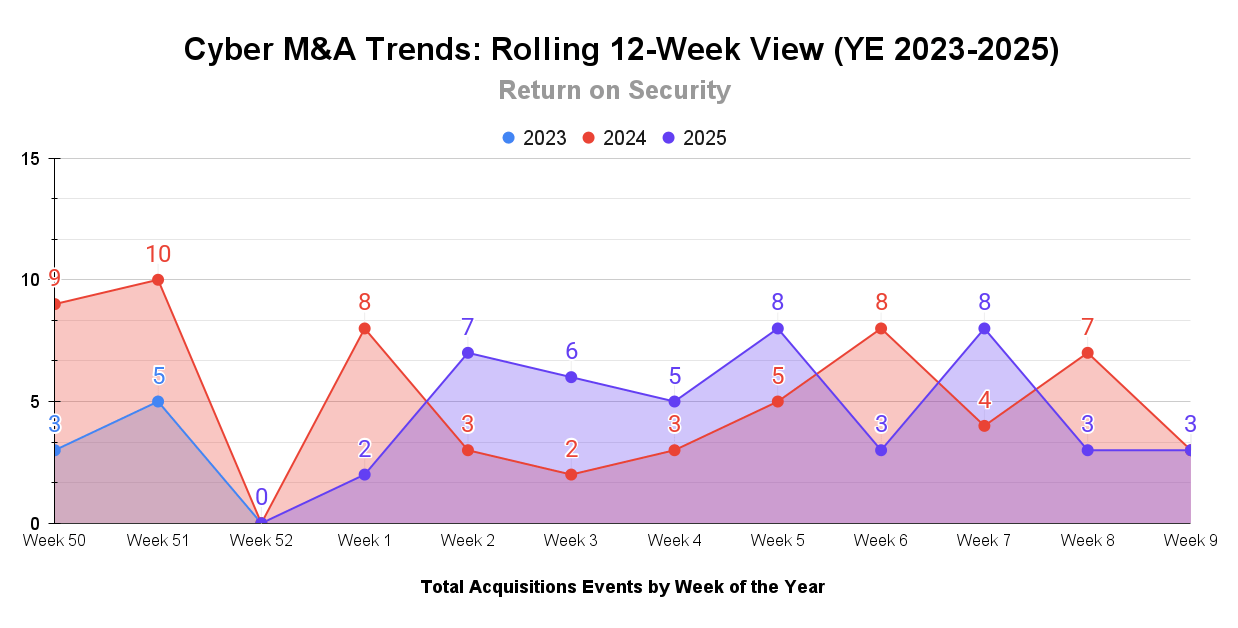

This is a rolling 12-week chart comparing funding and acquisitions each week in a year-over-year (YoY) view between the end of 2023 and the start of 2024 and 2025.

One huge funding round last week brought the total for the year to nearly $2.5 billion, which is up 20% from last year.

Steady consistency on the M&A front this year, still moving ahead at a stronger clip than 2024. One acquisition last week was quite different than the norm in the industry (see below).

☎️ Earnings Reports

Earnings reports from last week: None

Earning reports to watch this coming week: CrowdStrike, Okta, Zscaler

🪦 Stop, Drop, Shut’em Down…

Skybox Security, a United States-based network security posture management platform founded in 2002, abruptly shut down its operations last week after previously raising $334.8M in funding. (more)

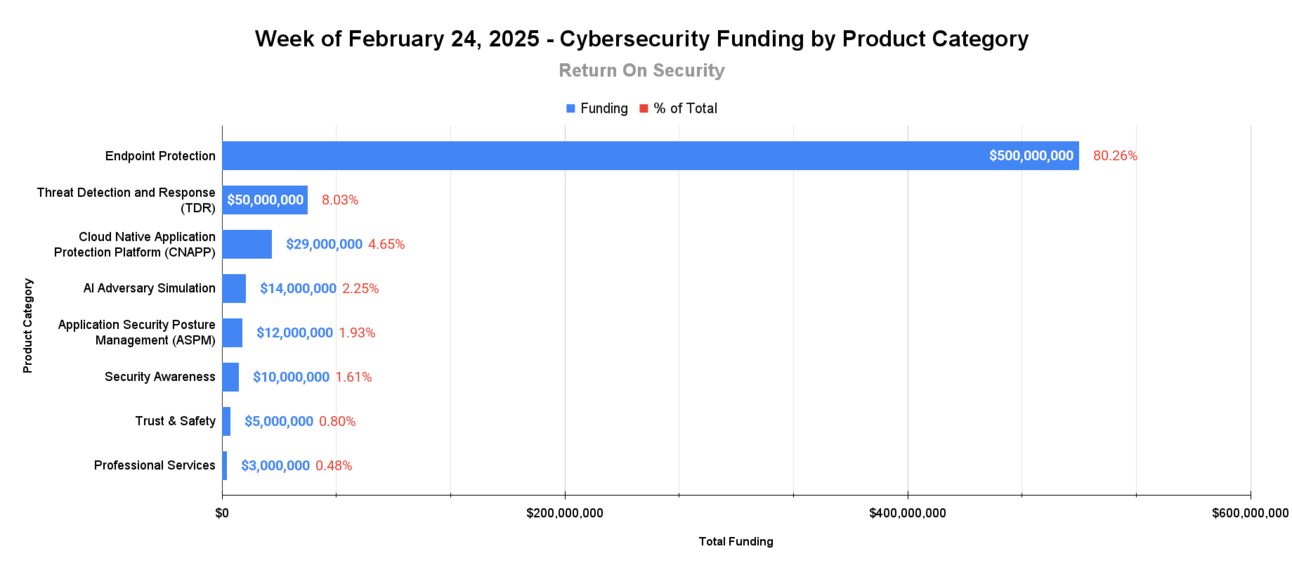

🧩 Funding By Product Category

$500.0M for Endpoint Protection across 1 deal

$50.0M for Threat Detection and Response (TDR) across 1 deal

$29.0M for Cloud Native Application Protection Platform (CNAPP) across 2 deals

$14.0M for AI Adversary Simulation across 1 deal

$12.0M for Application Security Posture Management (ASPM) across 1 deal

$10.0M for Security Awareness across 1 deal

$5.0M for Trust & Safety across 1 deal

$3.0M for Professional Services across 1 deal

🏢 Funding By Company

Product Companies:

NinjaOne, a United States-based endpoint management and protection platform, raised a $500.0M Series C from CapitalG and ICONIQ Growth. (more)

Mimic Networks, a United States-based threat detection and response platform focused on ransomware, raised a $50.0M Series A from Google Ventures and Menlo Ventures. (more)

Edera, a United States-based cloud threat detection and response platform for Kubernetes deployments, raised a $15.0M Series A from 645 Ventures. (more)

Dreadnode, a United States-based adversarial AI simulation and red teaming platform, raised a $14.0M Series A from Decibel Partners. (more)

RAD Security, a United States-based cloud threat detection and response platform for containers and Kubernetes deployments, raised a $14.0M Series A from Cheyenne Ventures. (more)

Archipelo, a United States-based DevOps-focused application security posture management platform, raised a $12.0M Seed from Dell Technologies Capital. (more)

Musubi, a United States-based content moderation platform from GenAI threats for trust and safety teams, raised a $5.0M Seed from J2 Ventures. (more)

Service Companies:

CQR, a Saudi Arabia-based professional services firm focused on operational technology (OT) security, raised a $3.0M Seed from Shorooq Partners. (more)

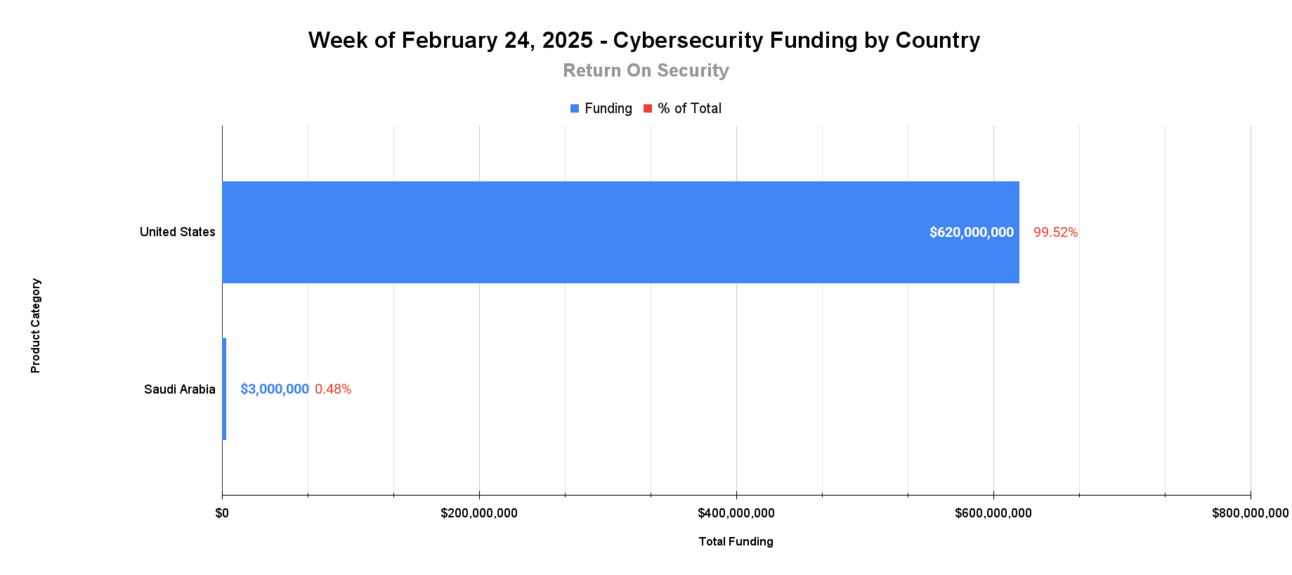

🌎 Funding By Country

$620.0M for the United States across 8 deals

$3.0M for Saudi Arabia across 1 deal

🤝 Mergers & Acquisitions

Product Companies:

Skybox Security, a United States-based network security posture management platform, was acquired by Tufin for an undisclosed amount. This was an asset sale that coincided with the company closing operations. Skybox Security closed its operations after having previously raised $334.8M in funding. (more)

Service Companies:

Globalnet Connect, a United States-based professional services firm focused on building cybersecurity programs, was acquired by Amplix for an undisclosed amount. Globalnet Connect has not publicly disclosed any funding events. (more)

Northeast MSP, a United States-based managed security services provider (MSSP), was acquired by AYCE Capital for an undisclosed amount. Northeast MSP has not publicly disclosed any funding events. (more)

📚 Great Reads

China’s GenAI Content Security Standard: An Explainer - Nicholas Welch explains China's GenAI Content Security Standard, focusing on political content control and censorship in AI development.

How Market Forces, Not Regulation, Are Creating Trustworthy AI - We don’t just need better AI governance — we need market incentives that make trustworthy tech the default. Here’s what works.

DOGE as a National Cyberattack - A security breach in the US government by DOGE highlights profound national security implications involving unauthorized access and system vulnerabilities.

*A message from our sponsor

🧪 Labs

How was this week's newsletter?

Data Methodology and Sources

All of the data is captured point-in-time from publicly available sources.

All financial figures are converted to U.S. dollars (USD) when collected.

Company country locations are pulled from publicly available sources.

Companies are categorized using our system at Return on Security, and we write all the company descriptions.

Sometimes, the details about deals, like who led the round, how much money was raised, or the deal stage, might get updated after the issue is first published.

Let us know if you spot any errors, and we’ll fix them.

About Return on Security

Return on Security is all about breaking down the cybersecurity industry for you with expert analysis, hard facts, and real-life stories. The goal? To keep security pros, entrepreneurs, and investors ahead in a fast-moving field. Read more about the “Why” here.

Feel free to borrow any data, charts, or advice you find here. Just make sure to give a shoutout to Return on Security when you do.

Thank you for reading. If you liked this analysis, please share it with your friends, colleagues, and anyone interested in the cybersecurity market.

Follow me on LinkedIn to never miss any updates!