Good morning,

I hope you had a great weekend, and Happy Memorial Day to all of those who are celebrating with loved ones and remembering those who served.

Another highly diversified week of funding and acquisitions in the cybersecurity space. Although it was a moderately low week for overall funding, huge acquisitions are still picking up the industry slack.

I’d be remiss if I didn’t mention the absolute unit of an acquisition of VMware by Broadcom for $61B, but you won't see it listed below.

It’s too big not to mention but it’s not included because neither company specifically and solely solve security problems, but rather just have business units that do. Including it in the overall totals wouldn't be true to the purpose of this newsletter.

Let's dive in.

Funding by product category

💰 Summary

14 companies raised $290.2M across 11 unique product categories

7 companies were acquired or had a merger event for $5.8B

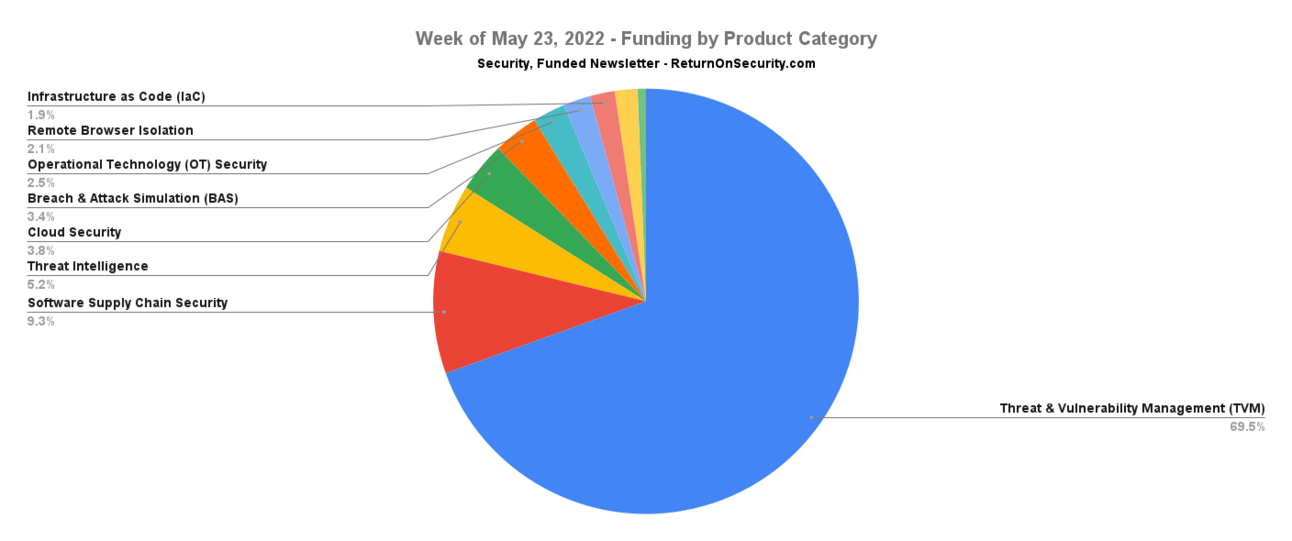

🧩 By Product Category

$201.7M for Threat & Vulnerability Management (TVM)

$27.0M for Software Supply Chain Security

$15.0M for Threat Intelligence

$11.0M for Cloud Security

$10.0M for Breach & Attack Simulation (BAS)

$7.2M for Operational Technology (OT) Security

$6.0M for Remote Browser Isolation

$5.5M for Infrastructure as Code (IaC)

$5.0M for Distributed Ledger Technology (DLT) Security

$1.9M for Secure Networking

An undisclosed amount for Connected and Autonomous Vehicle Security (CAVS)

💡

The Secure Ventures PodcastWant behind the scenes stories of how cybersecurity founders made their journeys? Check out Secure Ventures with Kyle McNulty wherever you listen to podcasts.I'm personally a fan of Kyle's podcast because you get to hear founders talk about how they came up with their ideas, how they raised funds, and how they scaled their businesses. It's an inside look into the minds of the best and the brightest carving new paths in the cybersecurity field today.Listen to it on Spotify or Apple Podcasts

🏢 By Company

Semperis, a threat and vulnerability management (TVM) for Active Directory resources, raised a $200.0M Series C from Kohlberg Kravis Roberts (KKR) and TenEleven Ventures.

Tidelift, a software supply chain security company that also pays the maintainers of Open Source Software (OSS), raised a $27.0M Series C from Dorilton Ventures.

Nisos, a managed threat intelligence service, raised a $15.0M Series B from Paladin Capital Group.

ShardSecure, a cloud security platform, raised a $11.0M Series A from Grotech Ventures and Gula Tech Adventures.

MazeBolt Technologies, a Distributed Denial of Service (DDoS) attack simulation platform, raised a $10.0M Venture Round.

XONA Systems, an operational technology (OT) security platform, raised a $7.2M Series A from DataTribe and Task Force X Capital.

Red Access, a secure remote browsing platform, raised a $6.0M from Elron Ventures and TenEleven Ventures.

LimaCharlie, a security infrastructure as a service, raised a $5.4M Seed from Susa Ventures.

Doppel, a distributed ledger technology (DLT) security platform for detecting non-fungible token (NFT) fraud, raised a $5.0M Seed from FTX Ventures.

Qunnect, a secure quantum network communications company, raised a $1.9M Grant from US Department of Energy.

Nanitor, a security risk prioritization and scoring platform, raised a $1.7M Venture Round from Brunnur Ventures.

BoundaryX, a cloud security platform, raised an undisclosed Seed from Chuxin Capital.

GuardStrike, a connected and autonomous vehicle security (CAVS) platform, raised an undisclosed Seed from Beidou Investment.

Picus Security, a continuous security validation platform, raised an undisclosed Corporate Round from Mastercard.

🤝 Mergers & Acquisitions

CynergisTek, a privacy and cybersecurity professional services firm, was acquired by Clearwater Compliance for $17.7M.

Business System Solutions, a managed security services provider (MSSP), was acquired by The Go2IT Group for an undisclosed amount.

IT-Seal, a security awareness training company, was acquired by Hornetsecurity for an undisclosed amount.

Lighthouse Technology Partners, a managed services provider (MSP), was acquired by Coretelligent for an undisclosed amount.

Safe Host, a data center hosting company, was acquired by IPI Partners for an undisclosed amount.

Security Journey, a security awareness company focused on building sustainable security cultures, was acquired by HackEDU for an undisclosed amount.

🔐 Secure The Job

If you're looking for new opportunities (actively or passively), I've got two ways to help:

Return on Security Job Board - Browse the jobs I curate each week and apply for what matches your interests.

Return on Security Talent Collective - Join the talent collective to get personally matched with high-growth, high-upside opportunities. This is invite-only, curated by me, and you can set your profile to be public or anonymous.

Search firms, recruiters, and hiring managers - hire the best talent from the Return on Security community by signing up here.

📚 Great Reads & Finds

12 steps to building a top-notch vulnerability management program - Security experts share their best advice for the essential ingredients of a solid vulnerability management program, including foundational elements to put in place, workflows to establish, who to involve, and metrics to track.

A Cyber Threat Intelligence Self-Study Plan: Part 1 - learn about the concepts of cyber threat intelligence (CTI) from an SANS instructor.

How to Think about Threat Detection in the Cloud - Anton Chuvakin's views on a foundational framework for thinking about threat detection in public cloud computing.

🧪 Labs

13 times out of 10, it's an expired certificate issue.

Never thought I’d say this: My window blinds won’t open because of an expired cert. 🤦♂️— Joey Piccola (@joeypiccola) May 10, 2022

🎉 Enjoying This Newsletter?

♥️

If you want to show your support you can:- Share the newsletter- Support independent publishing- Sponsor an issue

👋 Thanks

Have questions, comments, or feedback about this issue? I'd love to hear from you.

Reach out on Twitter or reply directly to the newsletter version of this issue.

Thanks for reading!

Cheers,

Mike P