Good morning,

I hope you had a great weekend!

The slowdown saga continues in cybersecurity funding this past week as we come off the wave of RSA announcements and see increased scrutiny in allocating capital for new investments.

Investors still see the cybersecurity industry as a bastion of hope for returns, so this downward trends in funding won't last forever (only Wu-Tang is forever).

Let's dive in.

💰 Summary

13 companies raised $100.4M across 11 unique product categories

6 companies were acquired or had a merger event for $670.0M

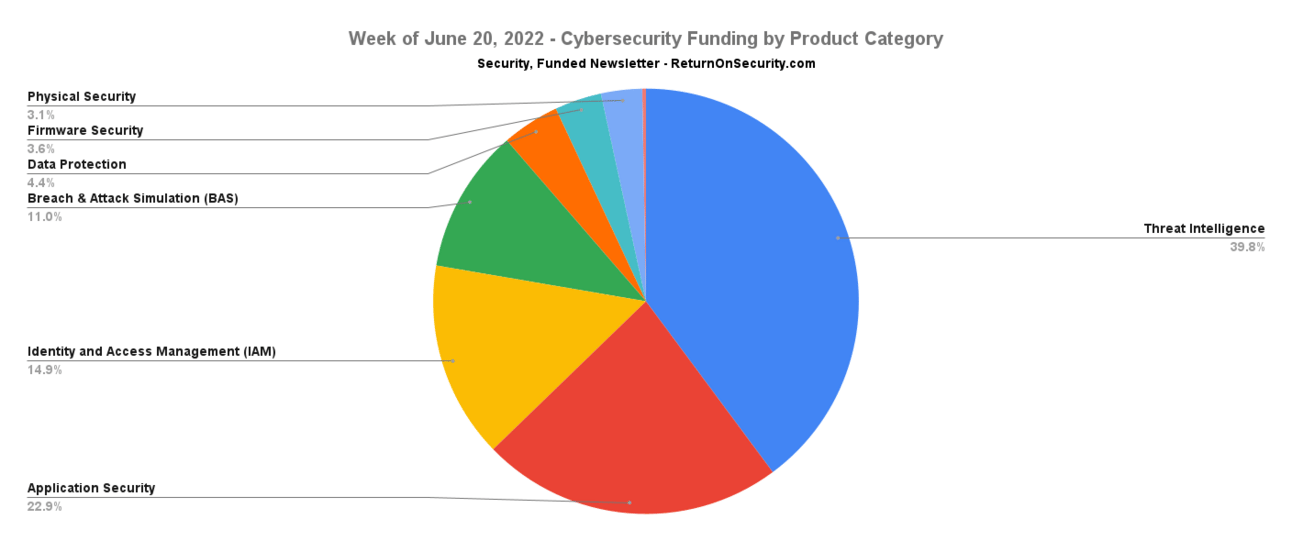

🧩 By Product Category

$40.0M for Threat Intelligence

$23.0M for Application Security

$15.0M for Identity and Access Management (IAM)

$11.0M for Breach & Attack Simulation (BAS)

$4.4M for Data Protection

$3.6M for Firmware Security

$3.1M for Physical Security

$286.1K for Threat & Vulnerability Management (TVM)

An undisclosed amount for Internet of Things (IoT) Security

An undisclosed amount for Hypervisor Security

An undisclosed amount for Digital Forensics and Incident Response (DFIR)

🗣️ SPONSOR

🗣️

How to Avoid Career Lateral MovementA short video course and Notion document to get out of your career advancement rut and start moving up to create the career and lifestyle you want.Your future self will thank you for learning this in 2022.

🏢 By Company

Cyberint, a cyber threat intelligence platform, raised a $40.0M Venture Round from StageOne Ventures, Viola Growth, and Neva SGR. (FinSMES)

RevealSecurity, an application security platform focused on insider threats and abuse, raised a $23.0M Series A from SYN Ventures. (RevealSecurity)

ConductorOne, an identity and access review and governance platform, raised a $15.0M Series A from Accel. (TechCrunch)

Hadrian, a breach and attack simulation (BAS) company, raised a $11.0M Seed from HV Capital. (Hadrian)

Cosmian, a data encryption platform for data lakes and confidential computing workloads, raised a $4.4M Venture Round from Elaia and La Banque Postale. (GlobalFinTechSeries)

BINARLY, a managed firmware security platform, raised a $3.6M Seed from Acrobator Venturesand WestWave Capital. (Security Week)

Allthenticate, a SaaS-based facilities access management software, raised a $3.1M Seed from Silverton Partners. (PRLog)

Eco IT, a threat and vulnerability management (TVM) platform, raised a $286.0K Seed from DOMO Invest. (TI INSIDE Online)

Asimily, a security analytics platform for Internet of Medical Things (IoMT) devices, raised a undisclosed Venture Round from MemorialCare Innovation FundandRidge Ventures. (Vator News)

Grayshift, a digital forensics and incident response (DFIR) company, raised an undisclosed Venture Round from Thoma Bravo. (PR Newswire)

Lynx Software Technologies, a hypervisor virtualization security platform for Real Time Operating Systems (RTOS) like air traffic control (ATC) systems, raised an undisclosed Private Equity Round from OceanSound Partners. (Lynx Software Technologies)

Rongka Technology, an Internet of Things (IoT) security company, raised an undisclosed Series B from Fortune Venture CapitalandArk Capital Management.

Veza, a data protection platform focused on identity and authorization, raised an undisclosed Series C from Blackstone Innovation Investments. (Veza)

🤝 Mergers & Acquisitions

Venustech, a managed security services provider (MSSP), was acquired by China Mobile for $620.0M. (LightReading)

LEVL Technologies, a wireless device authentication platform, was acquired by Comcast for $50.0M. (AFPKudos)

CyberDefenses, a managed security services provider (MSSP), was acquired by Apollo Information Systems for an undisclosed amount. (Channel Futures)

Moch, a security awareness and training company, was acquired by MetaCompliance for an undisclosed amount. (FinSMES)

Tempered, a secure remote access platform for building IT and OT devices, was acquired by Johnson Controls for an undisclosed amount. (Johnson Controls)

TrustTeam, a managed services provider (MSP), was acquired by Rivean Capital (formerly Glide Buy Out Partners) for an undisclosed amount. (Eubelius)

Vublo, a managed security services provider (MSSP), was acquired by Sky.One Solutions for an undisclosed amount.

🔐 Secure The Job

If you're looking for new opportunities (actively or passively), I've got two ways to help:

Return on Security Job Board - Browse the jobs I curate each week and apply for what matches your interests.

Return on Security Talent Collective - Join the talent collective to get personally matched with high-growth, high-upside opportunities. This is invite-only, curated by me, and you can set your profile to be public or anonymous.

Search firms, recruiters, and hiring managers - hire the best talent from the Return on Security community by signing up here.

📚 Great Reads & Finds

A Simple SOAR Adoption Maturity Model - As security orchestration, automation and response (SOAR) adoption continues at a rapid pace, security operations teams have a greater need for a structured planning approach

Unwanted Permissions that may impact security when using the ReadOnlyAccess policy in AWS - Tempest researchers identified at least 41 actions that can lead to improper data access.

Bill - The AWS Cost Optimization Bot - Bill enables AWS customers to proactively monitor their infrastructure costs and identify unforeseen expenses in a timely manner. Bill wants to prevent AWS customers from receiving bad surprises in their monthly bill.

You can see the full list of curated posts across all issues here, and you can submit an article, post, tweet, or video here and it can show up in the newsletter!

🧪 Labs

Not all threat models are created the same 🦫

ℹ️ Confirmed: Network data corroborate reports of a disruption to internet access in parts of British Columbia, #Canada, 7 June.

The incident is attributed to the activity of a single beaver, which gnawed through a tree that then fell on fiber cabling 🦫https://t.co/YVnuUAJotK pic.twitter.com/EWtBuUEpgC— NetBlocks (@netblocks) June 13, 2022

🎉 Enjoying This Newsletter?

♥️

If you want to show your support you can:- Share the newsletter- Support independent publishing- Shop the store- Sponsor an issue

👋 Thanks

Have questions, comments, or feedback about this issue? I'd love to hear from you.

Reach out on Twitter or reply directly to the newsletter version of this issue.

Thanks for reading!

Cheers,

Mike