Hey there,

I hope you had a great weekend!

In this week's issue:

Macro headwinds

Big cyber earnings

Cyber leaders are quitting

A lot happened last week.

The US jobs report came back with less people employed and more people on unemployment benefits, several large tech and cyber companies announced layoffs (with more expected to come this week), and a wave of public cyber companies posted their Q3 earnings reports.

On the public cyber companies earning side, Cloudflare, Cyberark, Fortinet, and Rapid7 all issued their reports with mixed responses from the market.

Cloudflare barely beat their earnings and the stock took a hit.

CyberArk is down year over year, but beat their estimates and their stock went up over 7% on news that they raised their full year revenue targets

Fortinet fell about 14% after it fell short of earnings estimates

Rapid7 fell over 20% after it cut it's own earning projections and Truist Securities changed their guidance to "hold" rather than "buy."

Mixed emotions all around.

What's interesting, however, is that many of these companies still had good growth in Q3 with revenue up quarter over quarter, but they weren't up as much as investors wanted. Growth was good, but not good enough. Investors want that consistent moonshot growth that cyber companies have enjoyed the past several years (likely to offset their portfolios that are down bad).

Even the best companies are seeing macroeconomic headwinds and many of them are reforecasting their Q4 earnings estimates and beyond and are rethinking how they price their products. Publicly, cyber is starting to feel the sentiment about there no longer being any "free lunch" anymore.

So what does this mean? I think this means we'll see even more seed stage deals in the cybersecurity space, as they have less momentum from the downward public market trends, and now is a great time to start a cybersecurity company if you've got product market fit. Lets get this bread 🥖

Onward to this week's issue.

Subscribe to Security, Funded

Know what and who is moving the cybersecurity.

🗣️ SPONSOR

🗣️

Live Q&A with the authors of Black Hat GraphQLGet answers to your questionsDolev Farhi & Nick Aleks, authors of Black Hat GraphQL are joining experts from ThreatX, API protection platform, for a 30-minute Q&A on Nov. 10th at 10 am PT / 1 pm ET. We will be interacting with our audience to answer questions related to:* Attack techniques on REST vs GraphQL* Building defense for modern attacks* Tactics to level up your appsec programRegister now to save your spot

🔮 Survey Time

Would you please help me out by filling out the Security, Funded Audience survey?

My goal is to generate a broad picture of the Security, Funded audience to write more engaging content and partner with relevant sponsors. This survey is completely anonymous and totally optional, but much appreciated!

📊 Industry News

💰 Funding Summary

11 companies raised $186.7M across 10 unique product categories

8 companies were acquired or had a merger event across 7 unique product categories

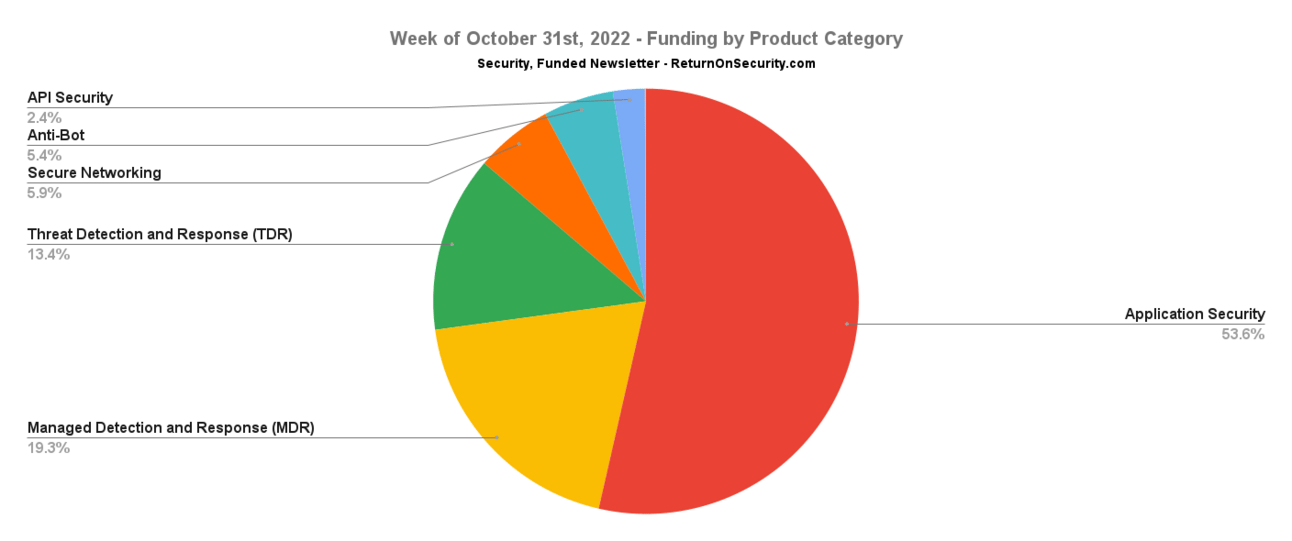

🧩 Funding by Product Category

$100.0M for Application Security

$36.0M for Managed Detection and Response (MDR)

$25.0M for Threat Detection and Response (TDR)

$11.0M for Secure Networking

$10.0M for Anti-Bot

$4.5M for API Security

$70.0K for Professional Services

$50.0K for Managed Security Services Provider (MSSP)

$45.0K for Secure Collaboration and Messaging

An undisclosed amount for Continuous Threat Exposure Management (CTEM)

🏢 Funding By Company

Apiiro, an application and supply chain security platform, raised a $100.0M Series B from General Catalyst. (more)

Binary Defense, a managed detection and response (MDR) platform, raised a $36.0M Private Equity Round from Invictus Growth Partners. (more)

MedCrypt, a medical device threat monitoring and data security platform, raised a $25.0M Series B from Intuitive Venturesand Johnson & Johnson Innovation. (more)

3NETS, a secure cloud networking platform, raised a $11.0M Seed from Taiwania Capital Management Corporation. (more)

Darwinium, a bot-detection and abuse prevention platform, raised a $10.0M Seed from Blackbird Ventures. (more)

Syccure, a professional services company focused on secure infrastructure automation, raised a $70.0K Pre-Seed from EXPERT DOJO.

Responsible Cyber Pte. Ltd., a managed security services provider (MSSP), raised a $50.0K Pre-Seed from EXPERT DOJO.

Telios, a decentralized and privacy-focused email platform, raised a $45.0K Seed.

3NUM, a privacy preserving and secure mobile messaging platform for Web3, raised an undisclosed Pre-Seed from BlueYard Capital. (more)

GlitchSecure, a continuous security testing and validation platform, raised an undisclosed Pre-Seed from TinySeed.

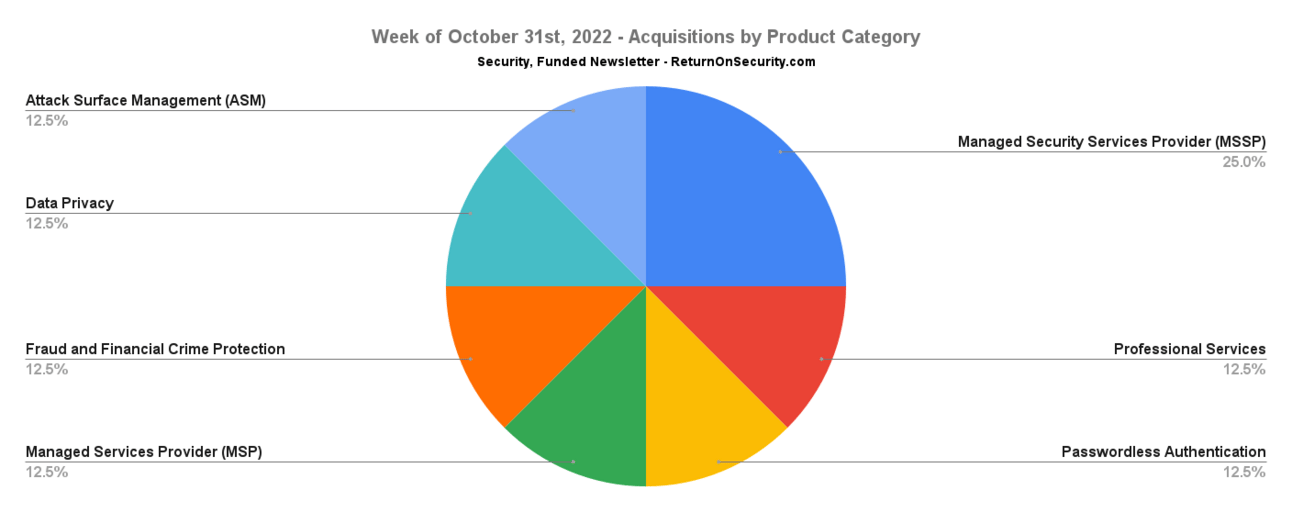

🤝 Mergers & Acquisitions

ArmorPoint, a managed security services provider (MSSP), was acquired by ServiceNow for an undisclosed amount. (more)

Reboot Networks, a professional IT and cybersecurity services firm , was acquired by Dataprise for an undisclosed amount. (more)

Sentant, a managed security services provider (MSSP), was acquired by Westwood Technology for an undisclosed amount. (more)

SpiderFoot, an attack surface management (ASM) platform, was acquired by Intel 471 for an undisclosed amount. (more)

Virtual Telecomm, a managed service provider (MSP), was acquired by Bluewave for an undisclosed amount. (more)

🔐 Secure The Job

If you're looking for new opportunities (actively or passively), I've got two ways to help:

Return on Security Job Board - Browse the jobs I curate each week and apply for what matches your interests.

Return on Security Talent Collective - Apply to my talent collective to get personally matched with high-growth, high-upside opportunities (if you refer one (1) person to this newsletter you get access automatically!)

Are you hiring? Post a role and request access to start meeting world class candidates open to new opportunities. Learn more or request access here.

📚 Great Reads

Nearly a Third of Cybersecurity Leaders Considering Quitting - Work life balance is most disliked part of the job for cybersecurity leaders.

Awesome Cybersecurity Conferences - A list of a number of security conferences around the world and a link to their videos and slides, by Tal Eliyahu.

The growing threat of cyber attacks on cryptocurrencies - While there are plenty of good crypto projects with good intentions, investors and businesses must tread extremely cautiously while dealing with virtual currencies.

You can see the full list of curated posts across all issues here, and you can submit an article, post, tweet, or video here and it can show up in the newsletter!

🧪 Labs

Is it working? #securityawareness pic.twitter.com/oGeuBN7Da9— Mike Privette (@mikepsecuritee) October 31, 2022

👋 Thanks

Have questions, comments, or feedback about this issue? I'd love to hear from you. Reach out on Twitter or reply directly to the newsletter version of this issue.

Thanks for reading and see you again next time!

Whenever you're ready, there are a few ways I can help you:

Cheers,

Mike P